Nell Minow is the Vice Chair of ValueEdge Advisors. This post is based on her testimony in a hearing of the Subcommittee on Capital Markets of the House Committee on Financial Services.

I am very grateful for the opportunity to share my thoughts on proxy advisory firms. I welcome your questions and will submit supplemental materials as necessary following this session.

My connection to this field is that I was the fourth person hired at ISS when it began 40 years ago. I left as President of ISS in 1990 and remained on its board of directors until 1992. While I have stayed in the field of corporate governance ever since, always on behalf of shareholders, I have no connection to any company providing proxy advisory services, and am appearing today on my own behalf, and not representing or being paid by anyone.

I worked in the Justice Department’s Antitrust Division during the Reagan Administration, as a special assistant to now-Judge Douglas Ginsburg, long enough to know that the definition of “cartel” means either conspiring to fix prices or conspiring to keep out competition by imposing barriers to entry, or both. Neither is the case here. There are three major players in the field of proxy advisory services and they compete vigorously. Each has unique attributes that they emphasize in trying to sway clients, who I point out are not retail investors but the most sophisticated financial professionals in the world, the people at gigantic money management firms and public pension funds. ISS and Glass Lewis provide consulting services for the companies they cover; Egan-Jones does not, and they are happy to explain to you why they are free from this particular conflicts of interest. ISS is registered as an investment adviser and Egan-Jones is registered as a National Recognized Statistical Rating Organization (NRSRO), both with extensive requirements and regulatory restrictions.

There is zero evidence of any collusion between these three companies. And, very significantly, there is plenty of evidence that there are no barriers to entry. Indeed, there are two other proxy advisory firms, both created within the past few years that I, a retail investor, use to vote my proxies. They are Iconik, which is very impressive, and the non-profit Shareholder Commons, which is free and very useful. A former SEC commissioner started a proxy advisory service called Proxy Governance that had an excellent product. But the sophisticated financial professionals I mentioned, who are all fiduciaries and thus subject to the strictest standard of care and loyalty in our legal system, declined to buy the product because the company was funded by the business community, and they believed its recommendations were biased.

Some new proxy advisory services compete with the big three by promoting their businesses as being “anti-woke.” I urge the committee staff to check out Proxy Navigator and Bowyer Research, though in my opinion their credibility is in question as they both submit shareholder proposals as well as advising on how to vote on them. I could easily start my own proxy advisory service tomorrow, much easier today than it was in 1985 when ISS had to get all the company proxy statements and send all the proxy recommendations on paper. This is exactly how robust free markets work. Any new restrictions or requirements will only prevent new entrants from competing with the established firms.

My fellow panelists will tell you how influential the big proxy advisory services are. What they might not mention is that if indeed they are influential, CEOs should be delighted. In 2024, ISS recommended a vote with management on 96 percent of the management proposals, which represent anywhere from 93% to 98% of the voted items. And those proposals received 96 percent of the vote. Almost all were recommendations to vote in favor of unopposed candidates for the board, approval of the auditors, and other routine matters.

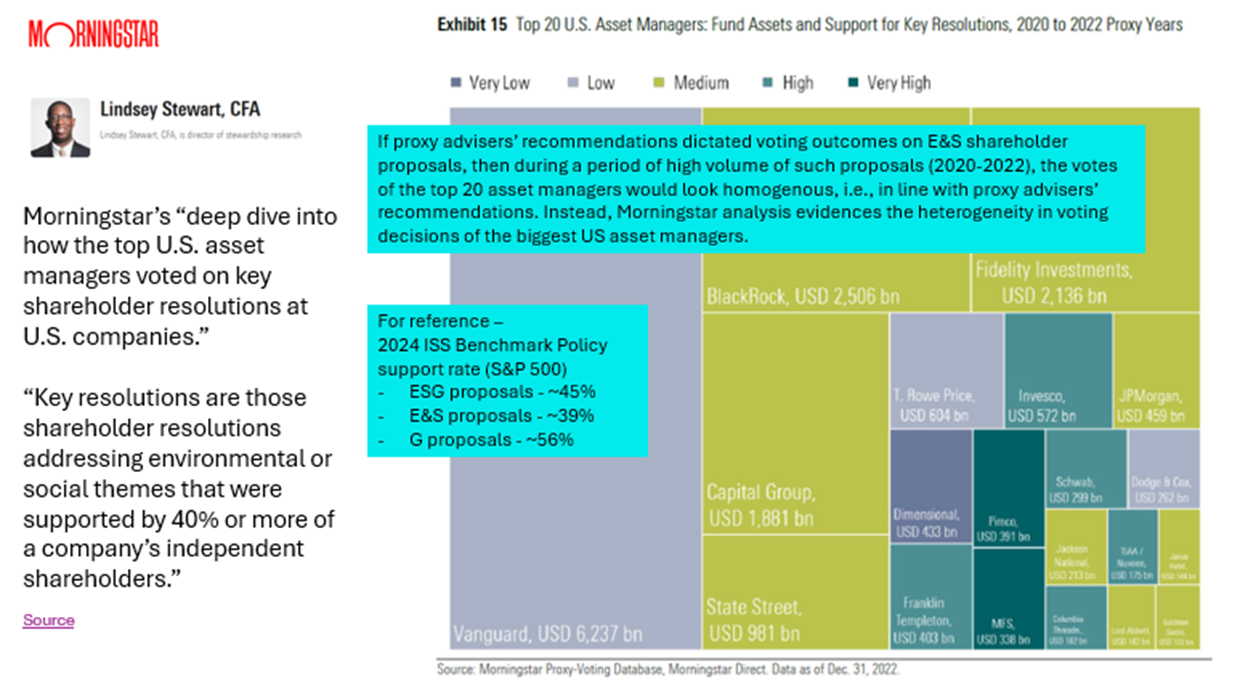

ISS is not as influential in the other four percent, however, proving that fiduciary financial professionals appreciate the analysis but make their own decisions. In 2024, for Russell 3000 companies, ISS recommended voting against 12 percent of the proposals on executive pay. Fewer than one percent failed to receive a majority vote, and that number is lower than it was in 2023. The most outrageous pay plan in American history was the $55.8 billion for Elon Musk at Telsa, approved twice by his board and thrown out twice by the Delaware Chancery court. Despite proxy advisory firm recommendations against this plan, however, it was overwhelmingly approved by more than 70 percent of the outside shareholders. ISS recommended a vote in favor of Tesla’s move from Delaware to Texas, and it received 84 percent of the votes cast.

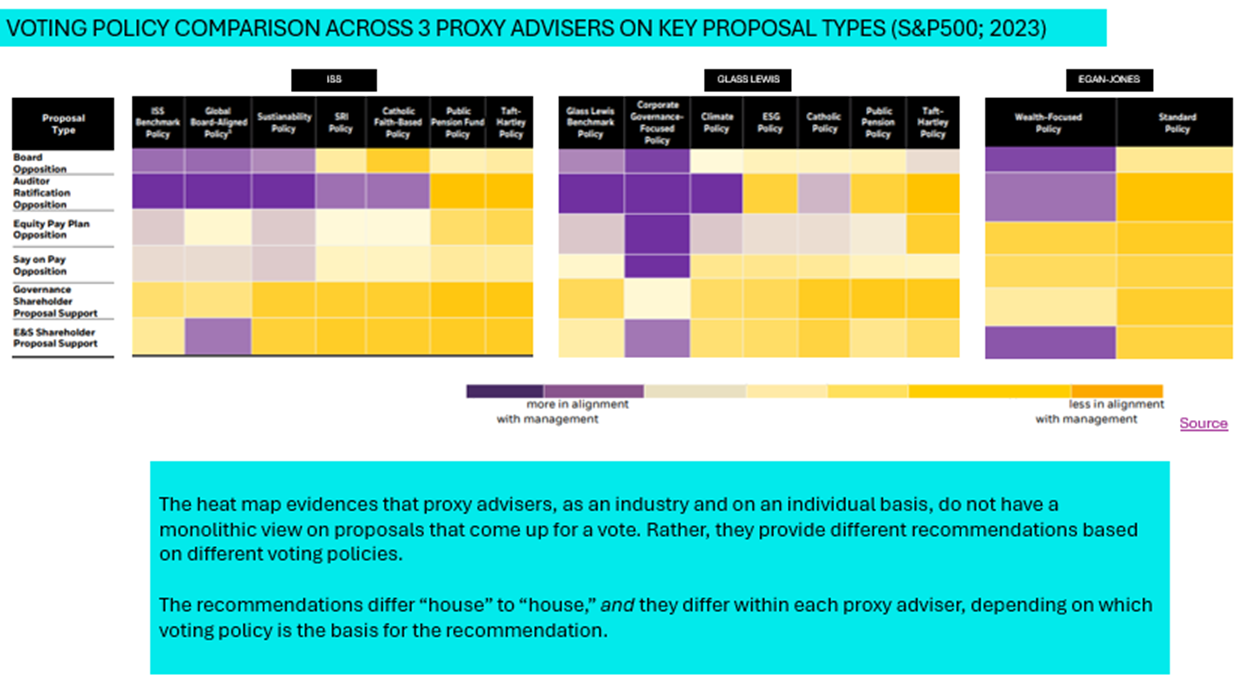

What’s more, the proxy advisory firms also compete with different ways to analyze proxy proposals. These firms – whether ISS, Glass Lewis, or Egan-Jones – do not provide just one recommendation. They serve investors with differing investment theses, providing recommendations based on the investors’ proxy voting criteria. The data bears out the facts.

Studies have shown that fund managers are more likely to vote contrary to shareholder interests if the portfolio company is also a client of their firm.[ii] That is a conflict of interests. In the early days of ISS, we had a different business model in mind. But our conversations with pension plan fiduciaries and investment firms included many requests for proxy recommendations, unlike the-then most successful proxy advisory firm, the non-profit IRRC, which provided both-sides-style analyses but no recommendations. Independent, third-party analyses of proxy issues were a market response to customer demand for a way to reduce fund manager conflicts of interest. And the clients of the proxy advisory firms are much more influential on the proxy advisors’ policies than the proxy advisors’ policies are on the clients. That is how markets work.

This is a good time to mention that even a 100 percent vote on a proxy proposal is not binding on management; they are advisory only and corporate insiders can and do ignore majority votes. So, proxy advisors recommend a vote with management more than 90 percent of the time, no one is required to purchase their services, sophisticated financial professionals who wish to get independent analysis of proxy issues have a range of choices or proxy advisory firms but make their own decisions, and corporate insiders decide whether to abide by the shareholders’ vote.

I note that the last time I testified on this subject, my fellow panelists were unable to come up with a single proxy issue that the proxy advisory services analysis was objectively wrong about the four percent where they did not agree with management. They complained about the expense of responding to proxy proposals and proxy advisory analyses. Their numbers were self-reported and failed to include the very significant benefits from the feedback they get from shareholders. If they do not understand that responding to market forces is a core element of competitive capitalism, they should be in another line of work. They’re trying to kill the messenger here, restricting the sole source of thorough, quantitative analysis of the few matters that under law must be voted on (though not approved) by shareholders.

Proxy advisory firms publish reports that financial services firms and other institutional investors can purchase if they wish. There is no requirement to subscribe. No fund manager is required to follow their advice. The proxy advisory services constantly adapt and improve their recommendations according to client preferences, like any other business.

Proxy advisors publish reports for subscribers. Unlike proxy solicitors, they are not paid advocates for any party. Unlike the ratings agencies, they are not mandatory and they are not paid by the companies they report on. The 1st Amendment requires us to be very careful about government restrictions on independently produced publications. In this case there is simply no evidence of any kind that there is anything improper in the way they do business.

I would like to note that the last time I testified, Chairman Hill asked me what I thought about pass-through voting, giving the voting power to the beneficial holders. Shortly after that hearing, Blackrock and other firms offered that as an option to customers. Blackrock has found, very few have the time, interest, or expertise to vote their proxies and prefer to let the same professionals who make the buy-sell-hold decisions vote their proxies as well. This is an economically sound conclusion from the retail shareholder perspective, and it also prevents problems from companies’ inability to obtain a quorum.

I would also like to recommend that the Subcommittee invite the proxy advisory services and, even more important, the institutional investors who subscribe to their services to testify at the next hearing. I am sure you will be reassured at the quality and variety of options offered by the proxy advisors and by the policies and procedures their clients apply in evaluating the small, advisory-only proposals, including those management does not support.

[i] Graphics courtesy of ISS. I also reached out to Glass-Lewis with the same questions but they did not respond, further demonstration a lack of coordination.

[ii] See for example https://corpgov.law.harvard.edu/2017/05/02/proxy-voting-conflicts-asset-manager-conflicts-of-interest-in-the-energy-and-utility-industries/

Print

Print