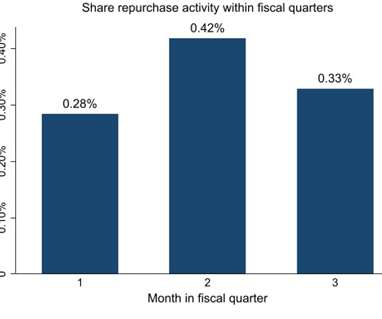

The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation

Harvard Corporate Governance

APRIL 28, 2022

Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on Thursday, April 28, 2022 Editor's Note: Ingolf Dittmann is an Assistant Professors of Economics, and Stefan Obernberger is an Assistant Professors of Finance, and Amy Yazhu Li is a PhD candidate at Erasmus University Rotterdam, and Jiaqi Zheng is a PhD candidate in Finance at the University of Oxford.

Let's personalize your content