ESG Global Study 2022

Harvard Corporate Governance

JUNE 17, 2022

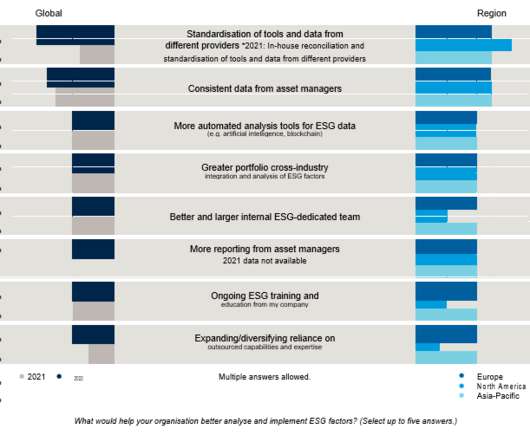

Posted by Jessica Ground, Capital Group, on Friday, June 17, 2022 Editor's Note: Jessica Ground is Global Head of ESG at the Capital Group. This post is based on her Capital Group memorandum. Executive summary. ESG adoption is on the rise, fuelled by client demand and a desire to make an impact. As ESG momentum continues to gain steam, investors are refining and evolving their strategies.

Let's personalize your content