Valuation Multiples for a Security Alarm Company

Security alarm companies are responsible for providing security systems and services to consumers. This often includes security alarm system installation, repair, and monitoring. Locksmiths are also included in the security alarm industry. Over the past several years, this industry has benefited from steady demand for security services. According to IBIS World, the security alarm industry generated over $34 billion dollars in revenue. We can expect industry revenue to continue growing in the coming years. However, many security alarm companies struggle to retain profitability. To succeed it is beneficial to understand the value of a security alarm company. This is ideal whether you are looking to buy, grow, or sell a security alarm company. You can start by learning about valuation multiples for a security alarm company.

Valuing a Security Alarm Company

If you are looking to buy or sell a security alarm company, consider learning the principles of valuing a security alarm company. This can help you take steps to increase the value of a security alarm company. The best way to start is by receiving a business valuation. If you are buying, receiving a business valuation can help you determine a fair purchase price for a security alarm company. You may also learn about negotiation strategies for purchasing a security alarm business. If you are selling a security alarm company, business appraisers can help you determine a fair listing price.

There are various valuation approaches that valuation experts may use to determine the value of a security alarm company. The market approach is a common method that utilizes valuation multiples for security alarm companies. In this article, we discuss valuation multiples for a security alarm company. Keep in mind, the information in this article is only a guide. For more specific information, receive a business valuation. Be sure to also see our articles Valuing a Security Alarm Company, Value Drivers for a Security Alarm Company, and How to Value a Security Alarm Company.

As a business appraiser, Peak Business Valuation is here to help! We work with security alarm companies on a regular basis. Peak can provide you with a business valuation and answer any questions you may have on valuing a security alarm company. Start today by scheduling a free consultation with Peak Business Valuation!

Valuation Multiples for a Security Alarm Company

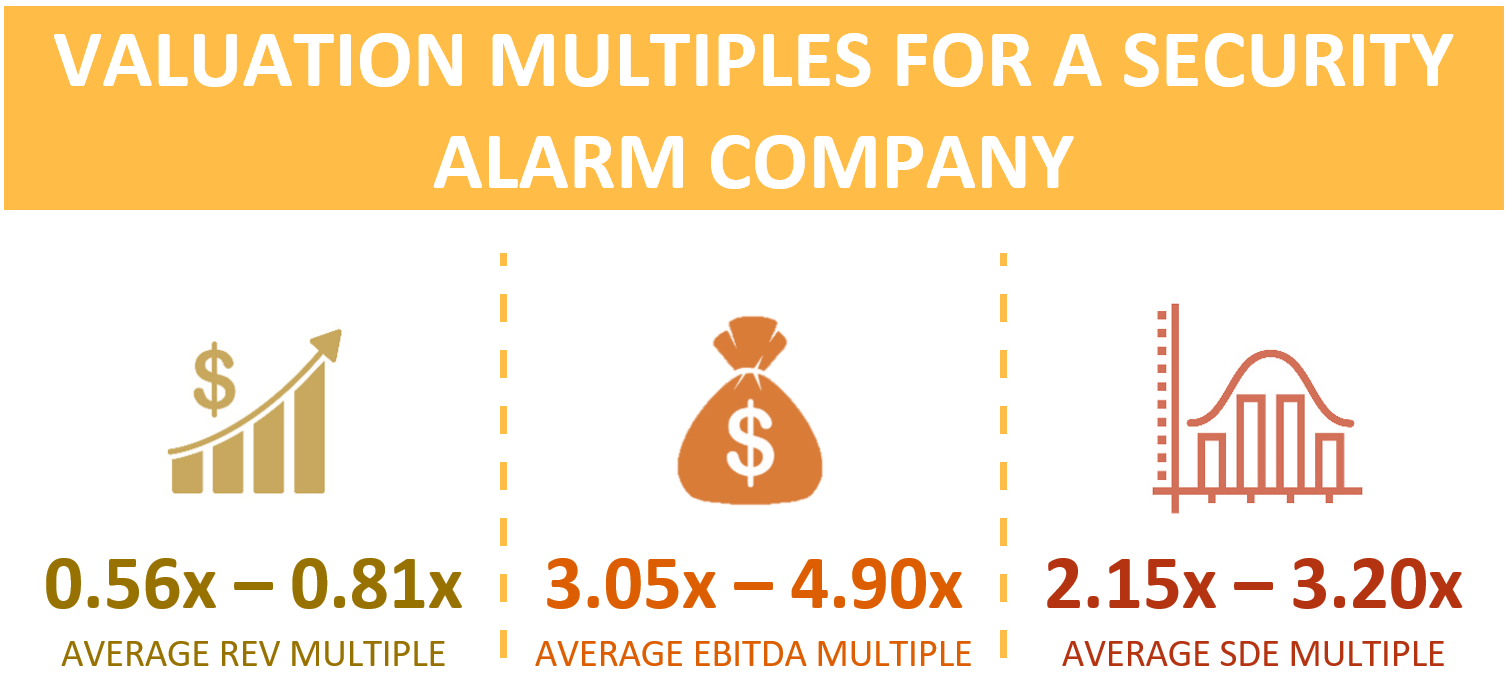

The following visual shows average market multiples for security alarm companies. It includes REV, EBITDA, and SDE multiples for a security alarm company. Understand that these numbers are averages and do not apply to the security alarm company you are buying and selling. For applicable information, schedule a free consultation with Peak Business Valuation. And obtain a business appraisal for a security alarm company.

Disclaimer: These multiples are for educational purposes only. As such, the information provided does not constitute valuation advice. These multiples do not represent the valuation opinion of Peak Business Valuation or its valuation professionals. Instead, seek the guidance and advice of a qualified business valuation professional about any matter in this article.

What is a Valuation Multiple?

Valuation multiples are like ratios that compare two values. When using valuation multiples, business appraisers compare the implied value of a business to a financial metric. These metrics may include cash flow, earnings, or sales. For example, the SDE multiple is common in business valuation for valuing a security alarm company. This multiple compares the implied value of a security alarm company to its seller’s discretionary earnings. Business appraisers assess the multiples of similar companies that recently sold. Then, they apply an applicable multiple to your security alarm company to get a range of value.

For instance, a security alarm company has $256,000 in seller’s discretionary earnings and receives a 2.18x SDE multiple. With these metrics, the security alarm company would have an implied value of $558,080. ($256,000 times 2.18x) On the other hand, if the company receives a 3.02x multiple, the value of the security alarm company would be approximately $773,120. ($256,000 times 3.02x).

Peak Business Valuation, business appraiser, frequently works with individuals who are buying, growing, or selling a security alarm company. We provide business appraisals for security alarm companies. In many cases, this involves using valuation multiples for security alarm companies. In the following sections, we give a range of valuation multiples that security alarm systems typically transact at. Please note that the range of value may vary since each company is different. Below, we highlight SDE, EBITDA, and REV multiples for a security alarm company.

SDE Multiples for Security Alarm Companies

Average SDE Multiple range: 2.15x – 3.20x

On average, security alarm companies transact between a 2.15x – 3.20x average SDE multiple. To calculate an implied value of a security alarm company, apply the multiple to the seller’s discretionary earnings of the company. The calculation is as follows.

SDE X Multiple = Value of the Business

For example, a security alarm company has $390,000 in the seller’s discretionary earnings. If it transacts at a 2.73x multiple, the security alarm company is worth approximately $1,064,700.

$390,000 X 2.73x = $1,064,700

Valuation experts commonly use SDE multiples when valuing a security alarm company. When using this market multiple, valuation analysts add back any expenses the new owner may not incur to the operating profit of the security alarm company. Often, these expenses include a fair owner’s compensation, personal expenditures, and non-recurring or non-related business expenses. With these add-backs, valuation experts can determine the cash flow potential of a security alarm company. Then, they can calculate the fair market value of a security alarm company you want to buy or sell.

EBITDA Multiples for a Security Alarm Company

Average EBITDA Multiple range: 3.05x – 4.90x

Security alarm companies transact at an average EBITDA multiple range of 3.05x – 4.90x. Apply this multiple to a security alarm company’s EBITDA to derive the company’s implied value. Refer to the following calculation.

EBITDA X Multiple = Value of the Business

For instance, suppose a security alarm company has an EBITDA of $302,000 and transacts at an EBITDA multiple of 3.91x. Here, the security alarm company is worth approximately $1,180,820.

$302,000 X 3.91x = $1,180,820

The EBITDA multiple measures a security alarm company’s return on investment (ROI). Valuation experts may use this multiple because it helps normalize differences. This allows for comparisons to be made between similar security alarm companies. Normalized ratios also provide an accurate estimate of the future earnings a buyer can expect from a security alarm company.

REV Multiples for Security Alarm Companies

Average REV Multiple range: 0.56x – 0.81x

According to Peak’s data, security alarm companies sell an average of 0.56x – 0.81x of revenue. Valuation experts can calculate the implied value of the business by multiplying the revenue or sales of a security alarm company by the REV multiple. The equation for valuing a security alarm company using revenue is as follows.

Revenue X Multiple = Value of the Business

For example, a security alarm company generates $1,500,000 in revenue. It then transacts at a 0.68x multiple. In this case, the security alarm company is worth about $1,020,000.

$1,500,000 X 0.68x = $1,020,000

REV multiples measure the total amount of revenue the security alarm company generates. At Peak, valuation experts analyze REV multiples of similar security alarm companies that have recently sold. This helps them determine suitable multiples for your security alarm company. Keep in mind, valuation analysts tend to value security alarm companies using cash flow multiples – SDE and EBITDA.

Summary

Various valuation methods are often used to determine the value of a security alarm company. This includes using valuation multiples for security alarm companies. The above market multiples above are only averages and may not apply to your business. As such, it is best to receive a business valuation. This is beneficial whether you are buying, growing, or selling a security alarm company.

During a business valuation, an expert will identify valuation multiples that are suitable for your security alarm company. In addition, they will discuss the strengths and weaknesses of your security alarm company. With this information, you can take the next steps in maximizing the value of a security alarm company.

Peak Business Valuation is a professional business appraiser. At Peak, we help security alarm companies throughout the country. We are happy to help you determine applicable multiples for a security alarm company! Peak can provide you with a business valuation for a security alarm company. Any questions about valuing a security alarm company are also welcome! Start now with a consultation from Peak Business Valuation!

Schedule Your Free Consultation Today!