TotalEnergies SE

Weekly Valuation – Valutico | 14 November 2022

About TotalEnergies

TotalEnergies is a French company covering the total oil and gas supply chain, as well as operating as a chemicals manufacturer and a builder of solar plants and wind farms, which are also operated by the company itself. While TotalEnergies was able to reap massive profits out of the current peak of oil and gas prices, the company is preparing for the energy transformation. The target is to have 100 Gigawatt gross installed renewable power generation capacity by 2030.

Recent Financial Performance

Two weeks ago TotalEnergies announced its net income for the third quarter of 2022 which increased by 43% compared to 2021 and amounted to €6.6 billion. This impressive result could have been as high as €9.9 billion were it not for new impairments from the Russian operations which were responsible for a negative adjustment of €3.3 billion. In the first three quarters of 2022 the company generated a net income of €17.3 billion, an increase of almost 70%.

This strong financial performance is also reflected in the stock market as TotalEnergies is currently trading at €57 per share, which is a year-on-year increase of roughly 30%. This strong share price performance was further bolstered by an average gross annual dividend yield of roughly 6% over the past 10 years. Compared to the most popular indices such as S&P 500 and Dow Jones, which fell by roughly 20% and 9% respectively last year, this overall performance is exceptional.

Net Zero Emissions by 2050

TotalEnergies has set the goal to be carbon neutral by 2050, to reach this aim the company will install 500 Gigawatts of renewable power generation capacity, which will amount to 50% of the overall energy production of the firm. To have net zero emissions by 2050 TotalEnergies introduced a plan to have CO2 storages in the European sea and also natural carbon sinks, which are currently being developed in cooperation with farmers throughout Australia.

Headwind for TotalEnergies

Despite the staggering profits, TotalEnergies has had to deal with a report published by Greenpeace, where the company was accused of having three to four times higher CO2 emissions than they have stated for 2019. This could threaten the progress being made toward their net zero emission goal. Furthermore, it is not certain that the current income situation will remain, as many European countries are currently considering imposing additional taxes on extraordinary earnings of energy companies due to the high oil and gas prices.

Valutico Analysis

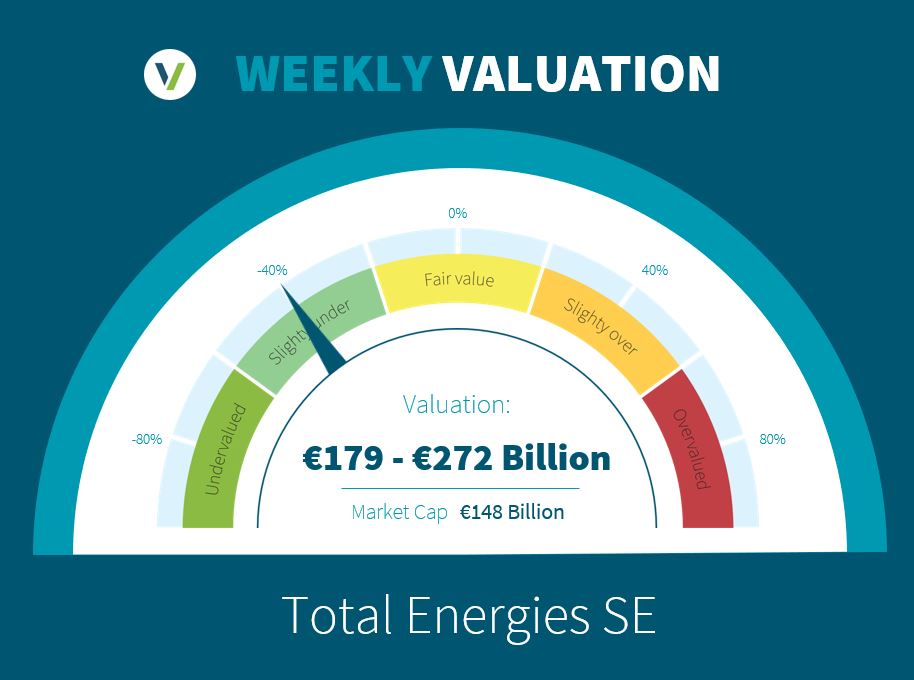

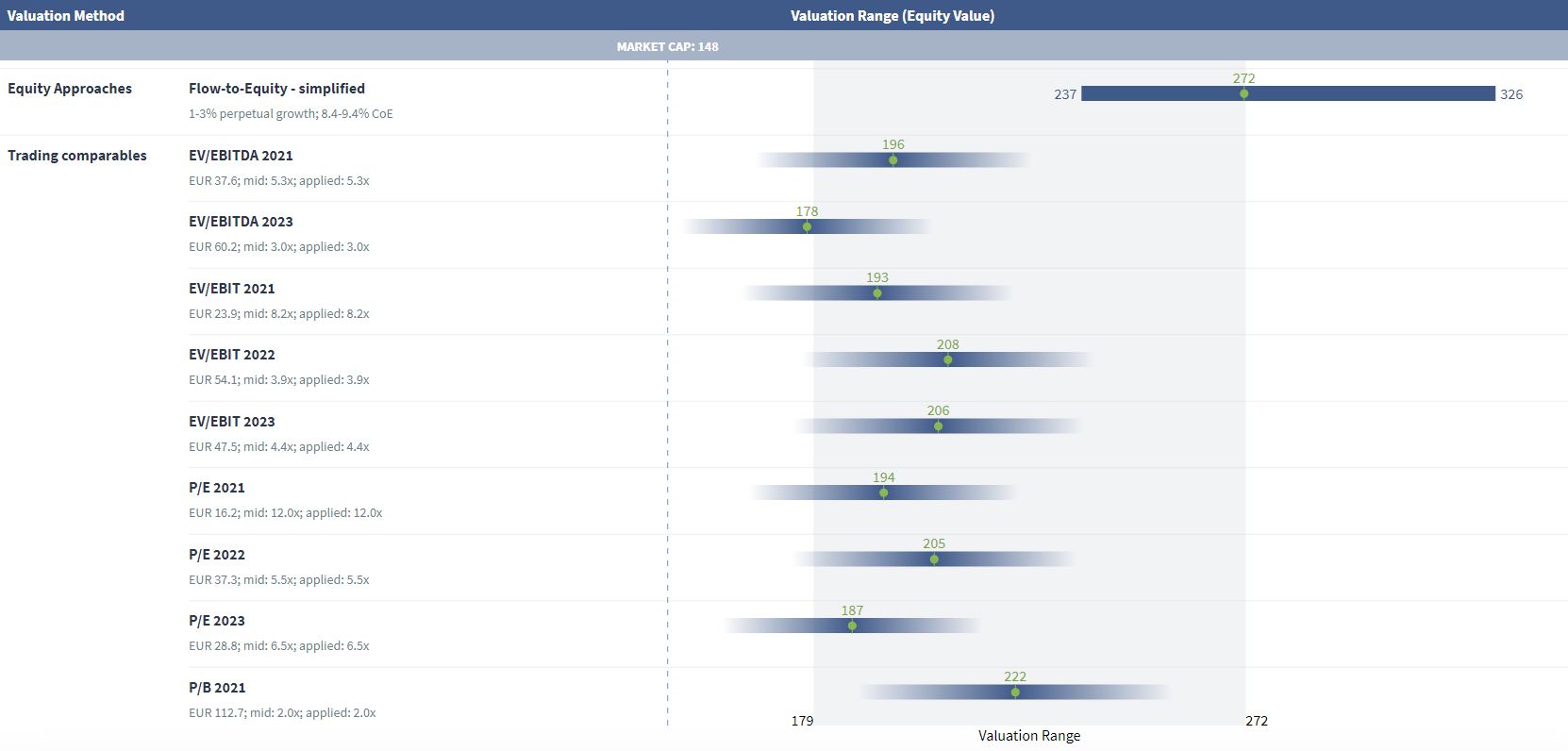

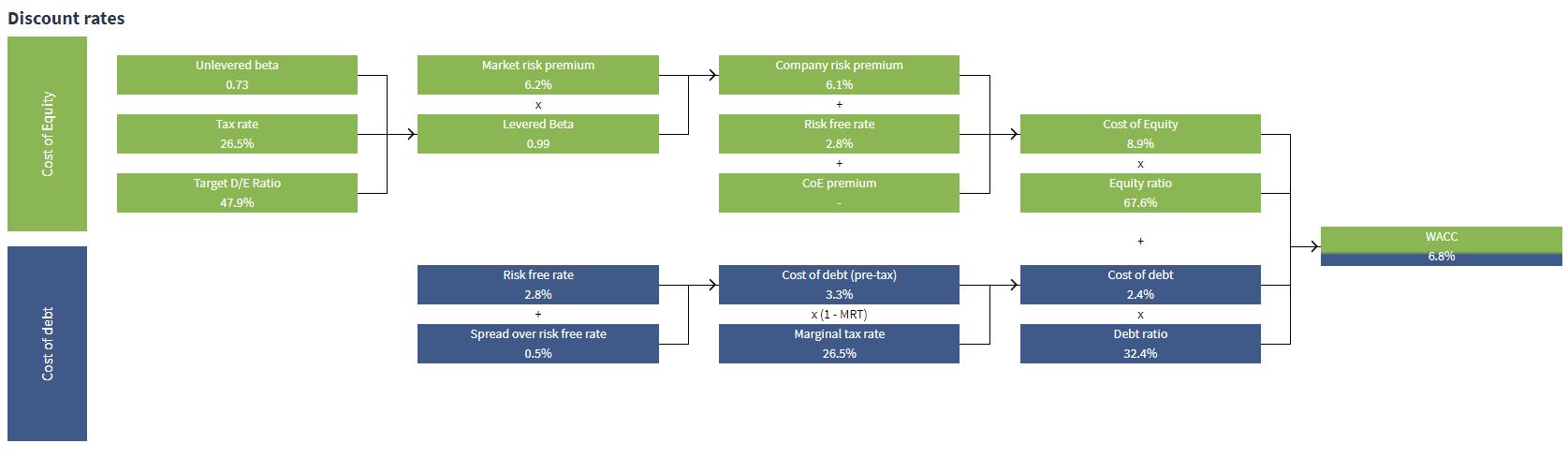

We analyzed TotalEnergies by using the Flow to Equity method and a Trading Comparables analysis. The Flow to Equity analysis produced a value of €272 billion, with a Cost of Equity of 8.9%.

Our Trading Comparables analysis produced a valuation range of €178 billion to €222 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT, P/E and P/B. We used a wide range of peers for this analysis, including the likes of Equinor, Shell and Exxon Mobil.

Combining the above two approaches results in our concluded valuation range of €178 billion to €272 billion. At TotalEnergies’ current market capitalization of €148 billion, our analysis suggests that the company is undervalued. Will TotalEnergies continue to outperform most indices and close the gap to our valuation or are they just experiencing a purple patch due to the misfortune of others?

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.