Is Hyundai’s Parallel Strategy a Potent Value Play?

Hyundai sees the future in hydrogen, unlike other carmakers

Highlights:

- Contrarian bet on hydrogen could be a winning strategy

- Long-awaited margin rebound could justify re-rating

- Reducing reliance on global supply chains

Download the full report as a PDF

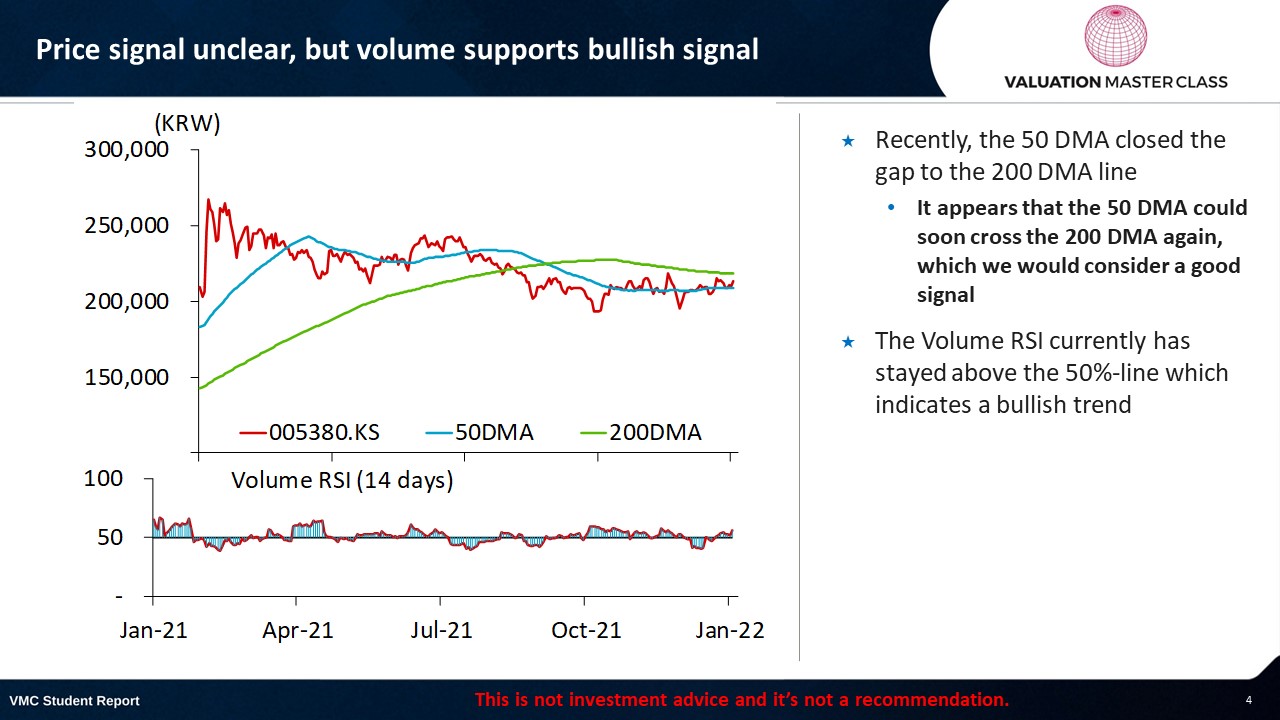

Price signal unclear, but volume supports bullish signal

- Recently, the 50 DMA closed the gap to the 200 DMA line

- It appears that the 50 DMA could soon cross the 200 DMA again, which we would consider a good signal

- The Volume RSI currently has stayed above the 50%-line which indicates a bullish trend

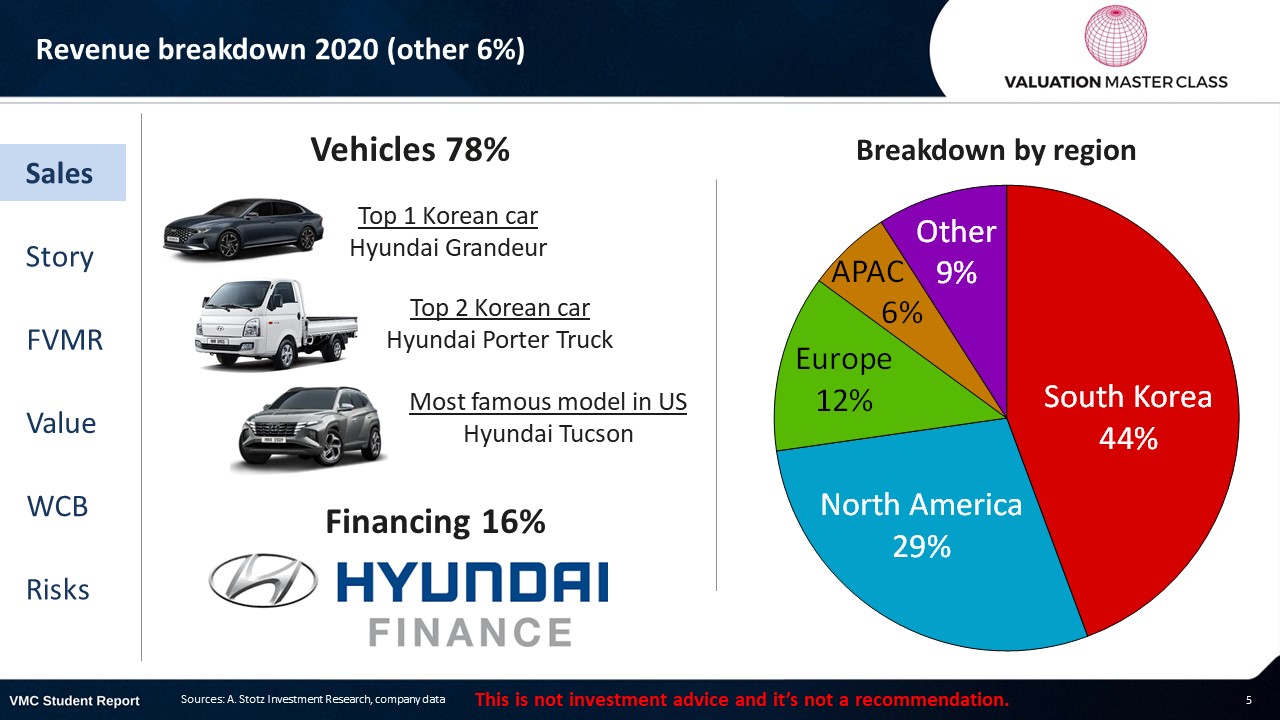

Hyundai’s revenue breakdown by segment

Contrarian bet on hydrogen could be a winning strategy

- Hyundai and Toyota are the only large car producers that are sticking with fuel cell electric vehicles (FCEV)

- They have 90% market share of in FCEV

- Hyundai has allocated 2022 CAPEX of US$1.1bn, roughly 15% of its total CAPEX budget, to develop two further fuel cell plants

- This brings annual production to 100,000

- A bold move considering that almost all car makers exited from hydrogen to focus on EV

What are the differences among electric vehicles?

Battery electric vehicles (BEV)

- Pure electric vehicles that use rechargeable batteries

- Tesla’s main approach, followed by most other carmakers

Plug-in hybrid vehicles (PHEV)

- Hybrid models that use both an electric motor and a gas engine, Toyota has been a leader in hybrids

Fuel cell electric vehicles (FCEV)

- Instead of a battery, it uses fuel cells that generate electricity through hydrogen

Still, Hyundai is also well-prepared for EV roll-out

- A top 5 largest EV producer

- In 2021, it sold more than 100,000 battery electric vehicles (BEV)

- This gives it a market share of 5%, compared to Tesla’s 14.6%

- The company continues to give equal priority to EV and hydrogen

- If hydrogen turns out to be a more feasible solution, then Hyundai could be a big winner

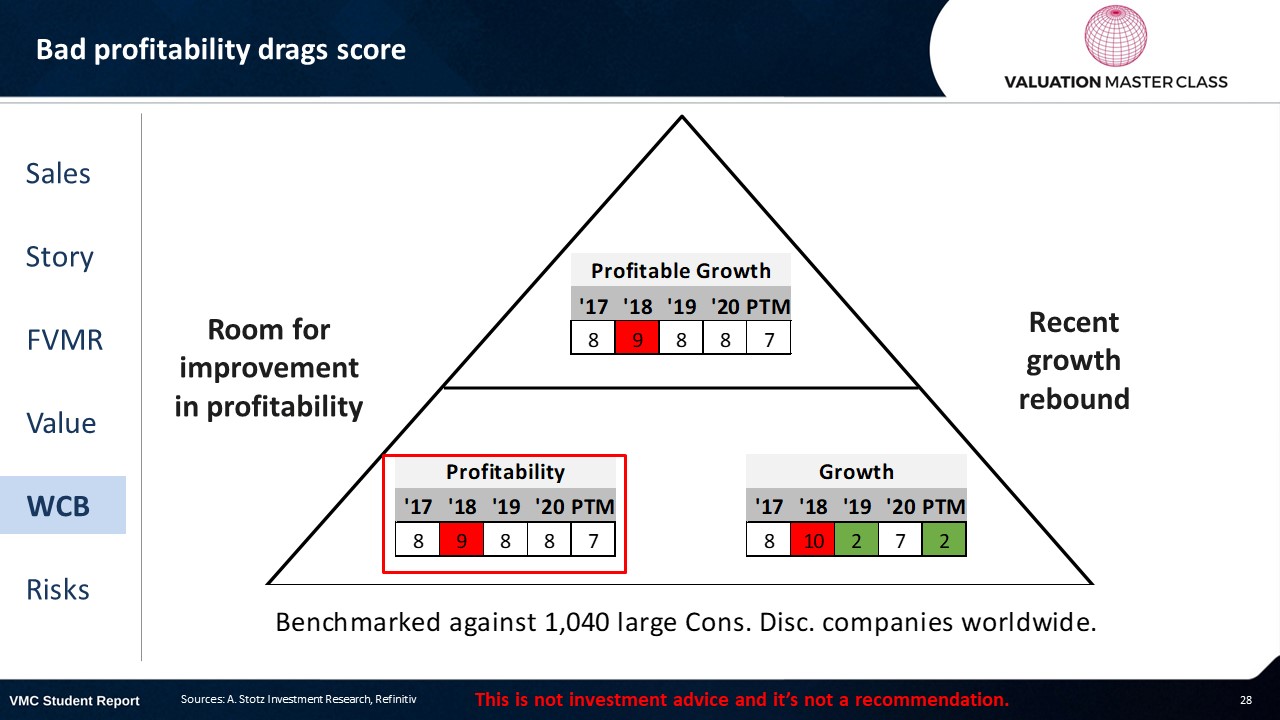

Long-awaited margin rebound could justify re-rating

- Hyundai has fallen from one of the most profitable carmakers to below-average profitability in 2020

- Mainly from fierce price competition, higher labor costs and the recent chip shortage

- However, the company’s efforts to focus on higher-margin car models and reducing SG&A is starting to pay off

- If it can maintain a 6-7% EBIT margin it changes the market’s assessment of the company

Reducing reliance on global supply chains

- The company missed its 2021 sales target by 4% amid the chip crisis

- Still, it was among only 3 carmakers that were able to increase sales volume YoY

- Through its affiliate Hyundai Mobis, the Korean carmaker plans to produce its own chips in the future to reduce its reliance on third-party suppliers

- The further integration along the supply chain could lead to long-term cost reductions

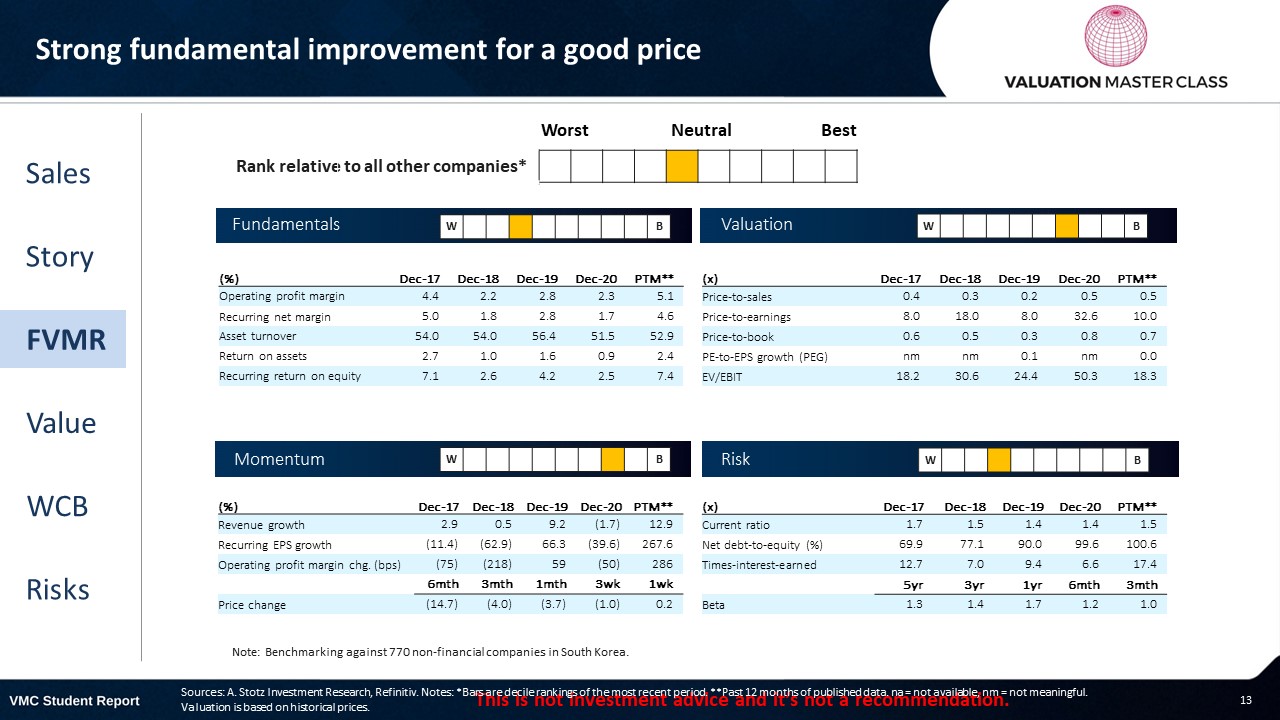

FVMR Scorecard – Hyundai

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

What does a PB-ratio of less than 1x indicate?

- Book value is the value attributable to shareholders in case the company sells all its assets and repays its liabilities (also called liquidation value)

- A price-to-book ratio of less than 1x indicates that the market values the net assets less than the balance sheet suggests

- If a company trades at a very low PB, it could be either a cheap opportunity to BUY or a sign that something seriously wrong with the company

Consensus remains optimistic regarding profitability turnaround

- Analysts are more positive about Hyundai than the market

- They are optimistic that Hyundai can achieve a higher level of profitability which would close the gap with its peers

- If it can maintain a 6-7% EBIT margin, then this could be a catalyst for share price performance

Get financial statements and assumptions in the full report

P&L – Hyundai

- Hyundai is likely to recognize a record profit in 2021E

- Due to strong car sales and increased cost-cutting

- 9M21 net profit already stood at 4,159

- If achieved, it could be the starting point of turning around the profitability to industry-average

Balance sheet – Hyundai

- The company has a solid cash position, holding around 14% of its assets in cash as of 2020

- Strategic partnerships and fixed assets investments are necessary to maintain a leading role in climate-neutral car development

- Hyundai has moderately high leverage

- The liabilities-to-assets ratio stood at 64% in 2020

- Higher jumps in retained earnings would come from increased profitability

Ratios – Hyundai

- Revenue is expected to rebound over the next two years in line with heightened global demand for sales

- Shareholders should expect a higher return on equity

- Hyundai has been among the least profitable car companies in the past years

- However, 2021 proved its capability to bring profits to the industry average

- This was evidenced by its 2Q21 and 3Q21 gross margin of 6.4% and 6.2%, respectively

Free cash flow – Hyundai

- FCFF is expected to be strong in the near term future

- CAPEX is likely to increase as heavy R&D investments are necessary related to hydrogen technology, development of chips, and batteries

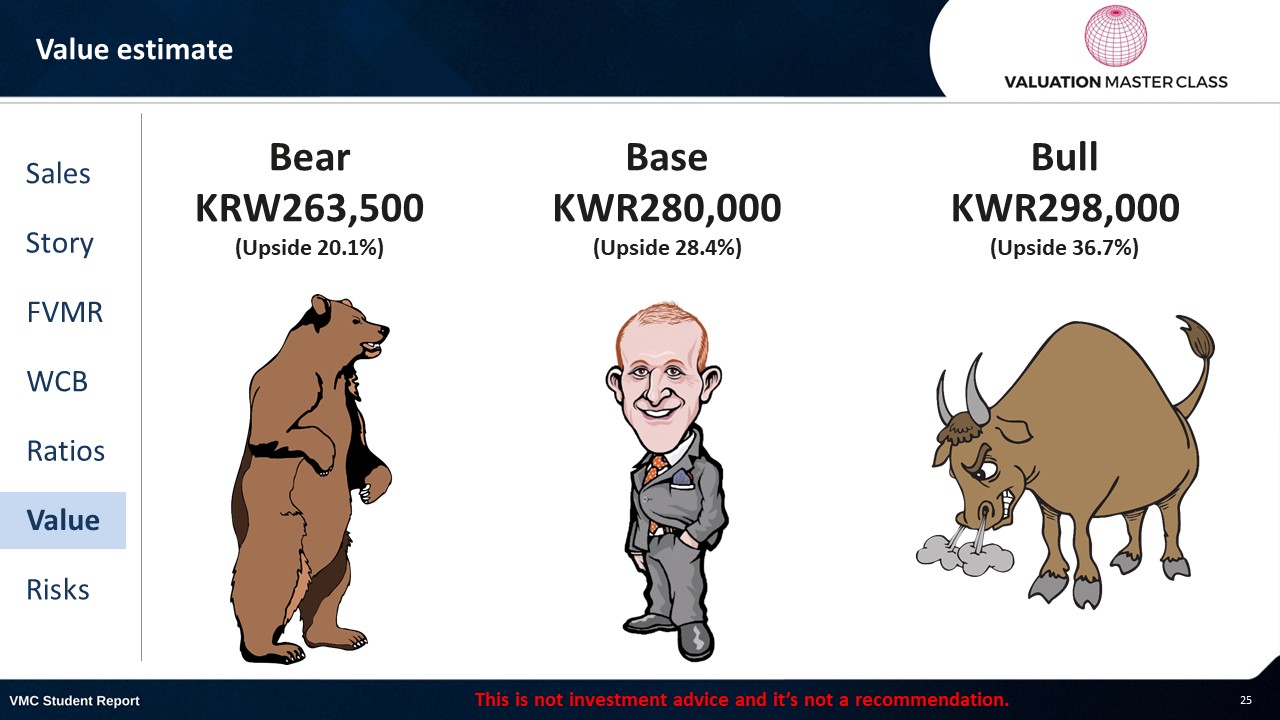

Value estimate – Hyundai

- Global car sales are likely to see a strong rebound as chip shortage eases and demand remains robust

- Hyundai started to turn around the declining margin trend

- The key challenge is to maintain such a margin over the long run

- We think that the market has not fully acknowledged the strong efforts yet

World Class Benchmarking Scorecard – Hyundai

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

The key risks for Hyundai

- Ongoing supply chain disruptions create shortages that could lead to lower sales

- Failure to maintain a higher level of profitability

- Hydrogen strategy might not pay off leading to wasted R&D investments

Conclusions

- Parallel strategy of hydrogen and EV gives it a unique edge

- Maintaining a higher margin could be sufficient for a re-rating by the market

- Low PB multiple of 0.8x makes it an interesting value play

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.