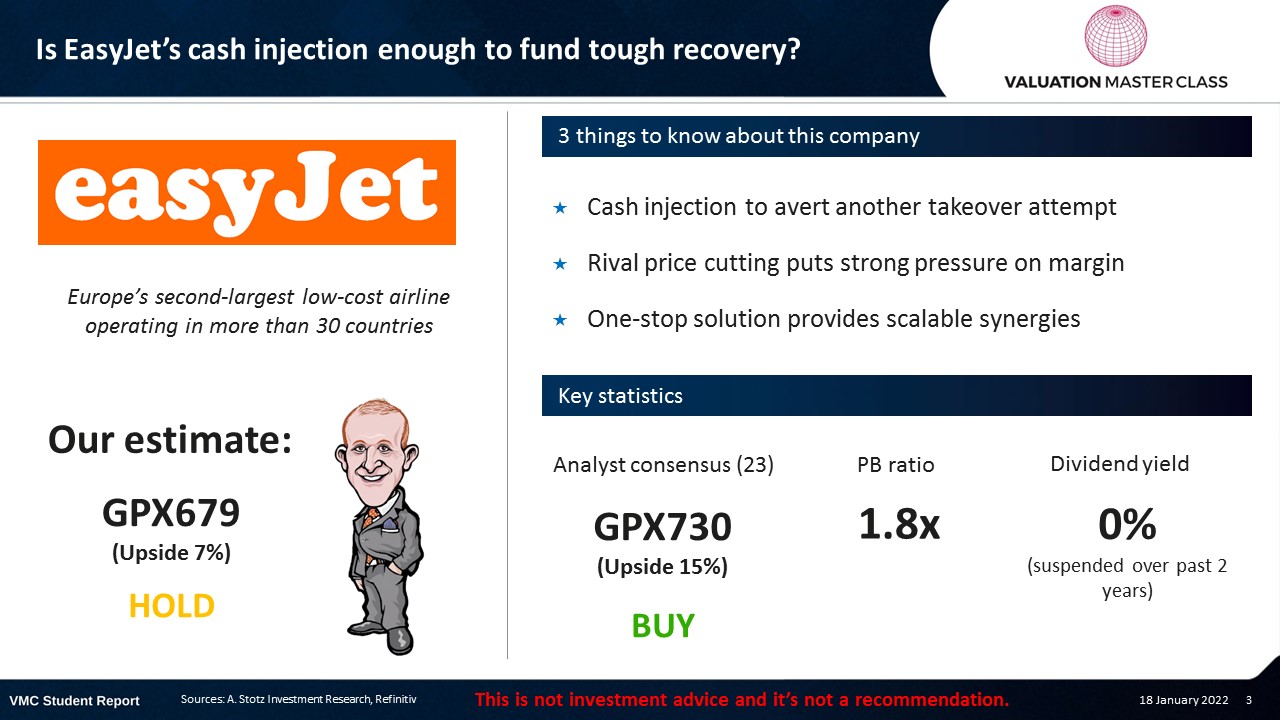

Is EasyJet’s Cash Injection Enough to Fund Tough Recovery?

Highlights:

- Cash injection to avert another takeover attempt

- Rival price cutting puts strong pressure on margin

- One-stop solution provides scalable synergies

Download the full report as a PDF

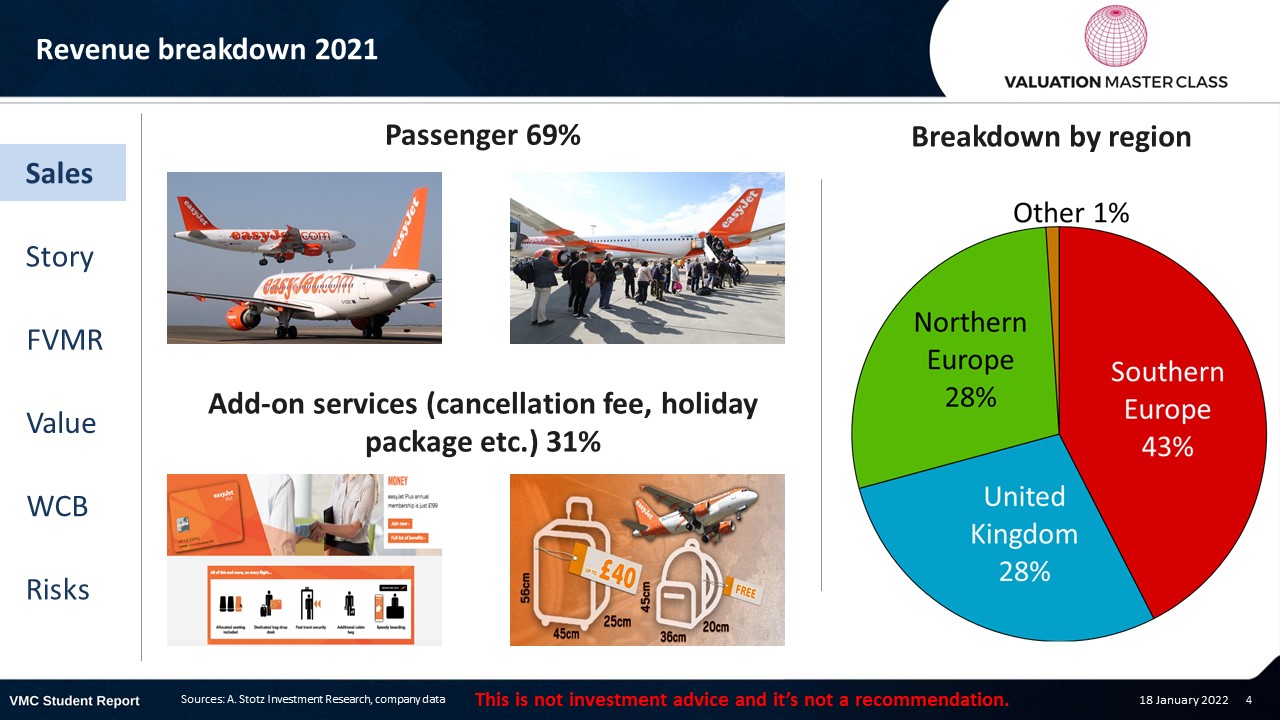

EasyJet’s revenue breakdown 2021

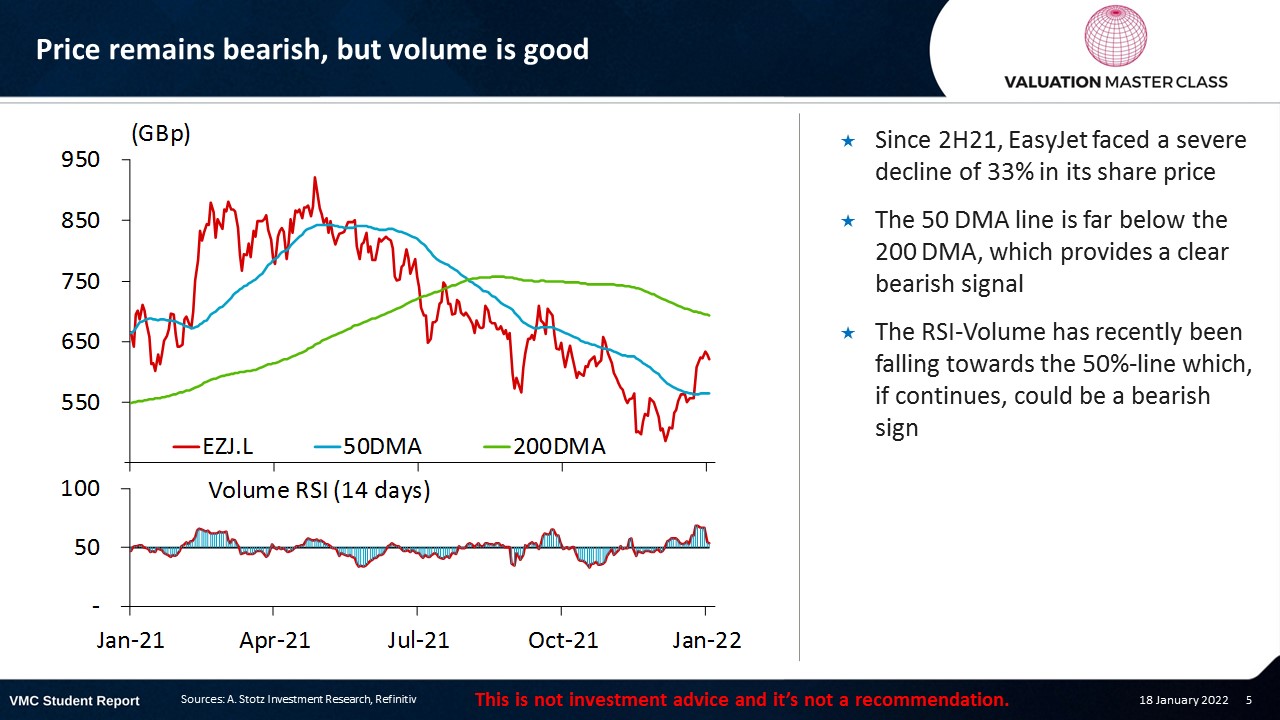

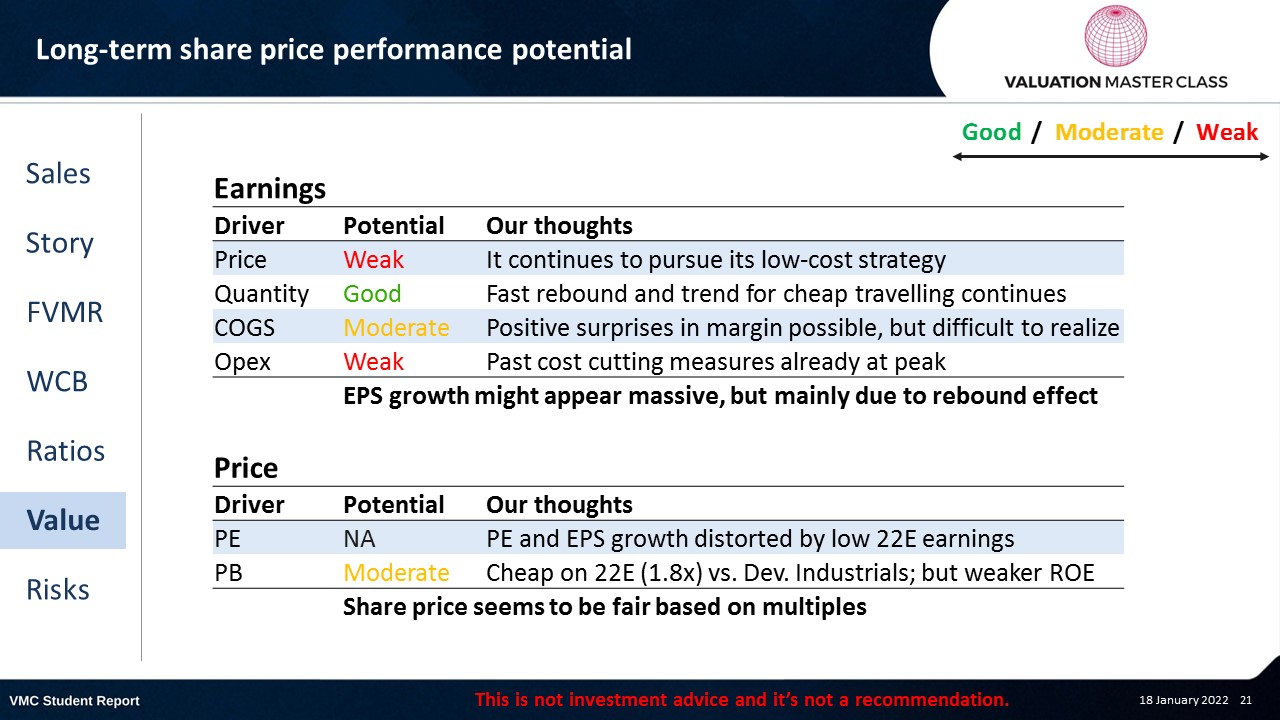

Price remains bearish, but volume is good

- Since 2H21, EasyJet faced a severe decline of 33% in its share price

- The 50 DMA line is far below the 200 DMA, which provides a clear bearish signal

- The RSI-Volume has recently been falling towards the 50%-line which, if continues, could be a bearish sign

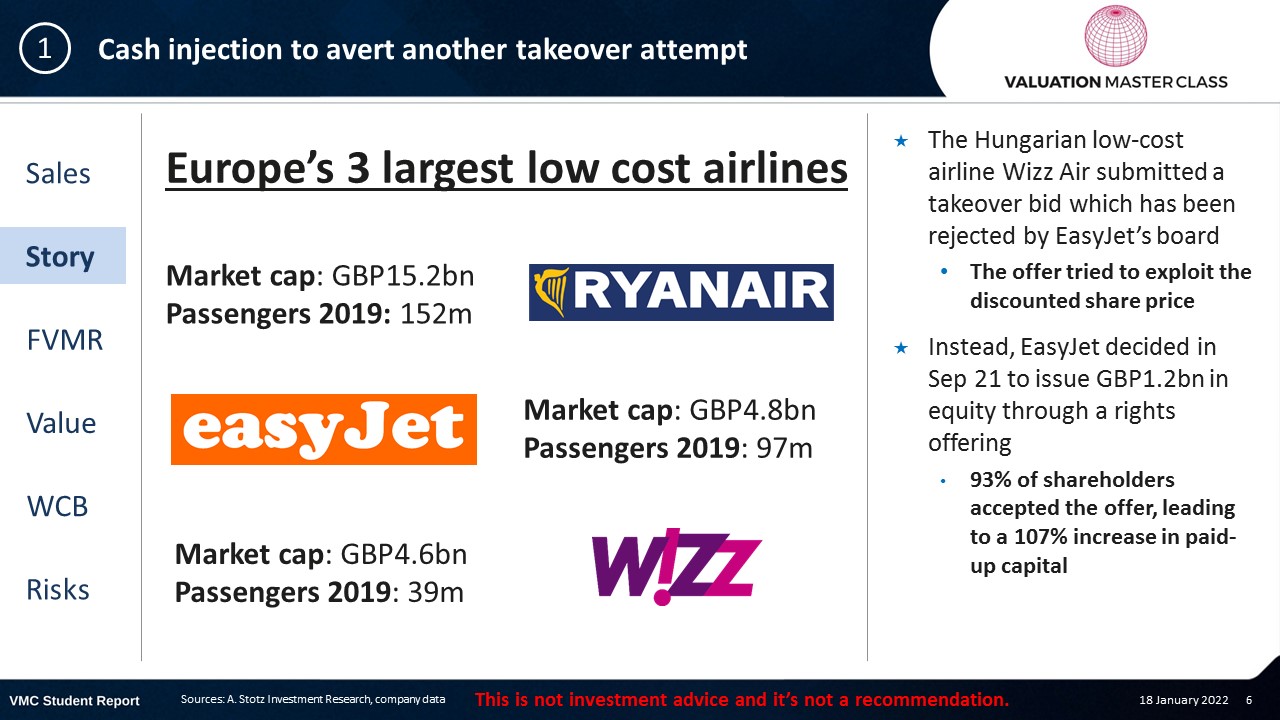

Cash injection to avert another takeover attempt

- The Hungarian low-cost airline Wizz Air submitted a takeover bid which has been rejected by EasyJet’s board

- The offer tried to exploit the discounted share price

- Instead, EasyJet decided in Sep 21 to issue GBP1.2bn in equity through a rights offering

- 93% of shareholders accepted the offer, leading to a 107% increase in paid-up capital

What are the benefits of right offerings vs public issuance of new shares?

- In a rights offering, the company offers existing shareholders to purchase additional shares (generally at a large discount to market price)

- No underwriting fees

- Fast way of raising capital

- Shareholders can avoid dilution by exercising the right

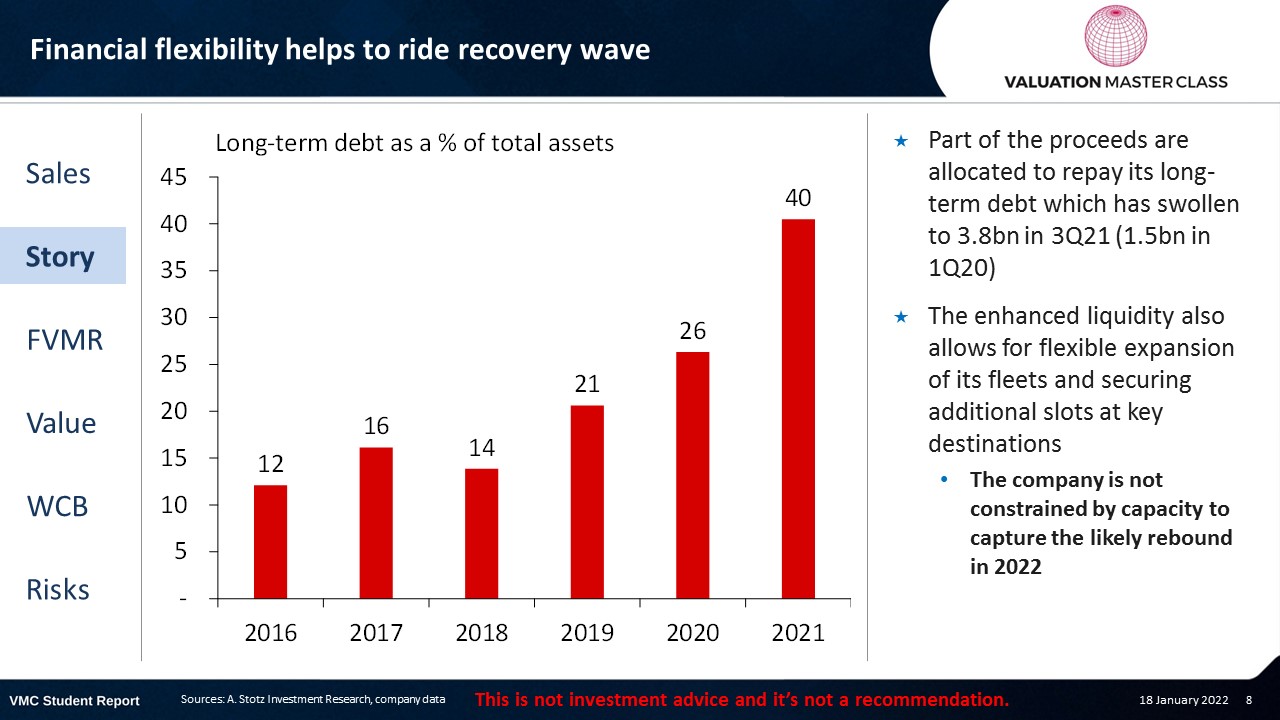

Financial flexibility helps to ride recovery wave

- Part of the proceeds are allocated to repay its long-term debt which has swollen to 3.8bn in 3Q21 (1.5bn in 1Q20)

- The enhanced liquidity also allows for flexible expansion of its fleets and securing additional slots at key destinations

- The company is not constrained by capacity to capture the likely rebound in 2022

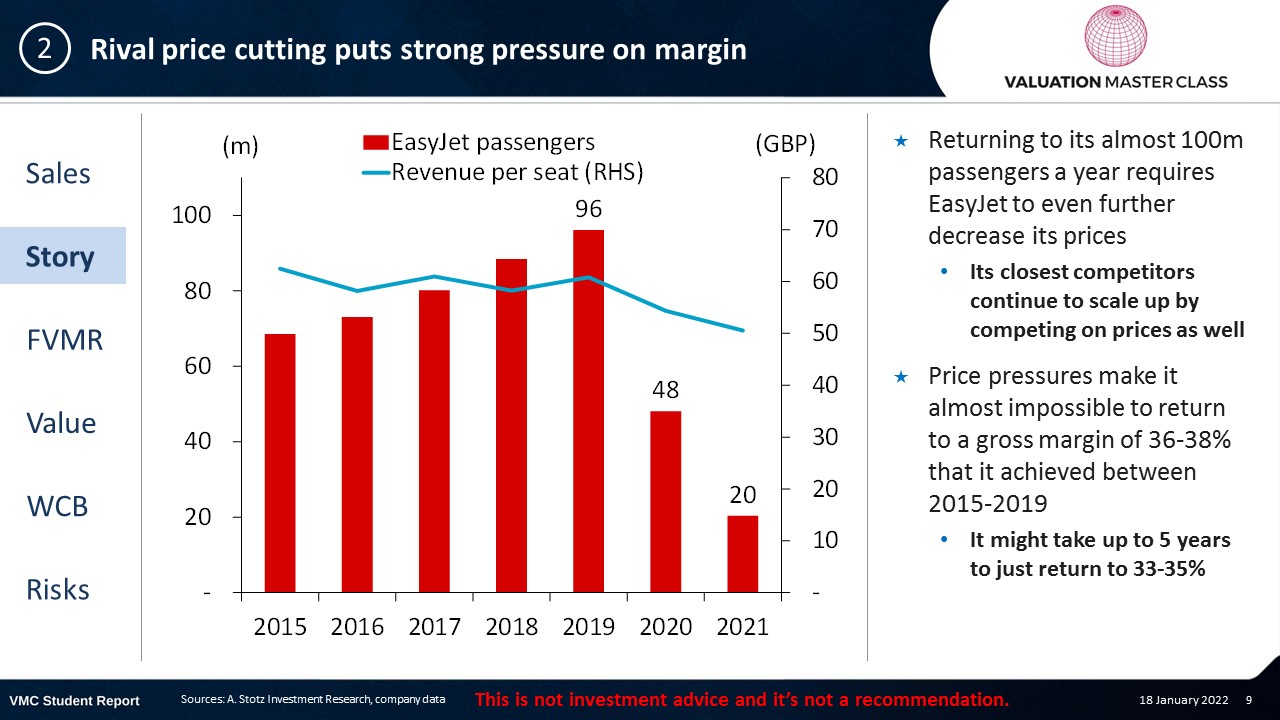

Rival price cutting puts strong pressure on margin

- Returning to its almost 100m passengers a year requires EasyJet to even further decrease its prices

- Its closest competitors continue to scale up by competing on prices as well

- Price pressures make it almost impossible to return to a gross margin of 36-38% that it achieved between 2015-2019

- It might take up to 5 years to just return to 33-35%

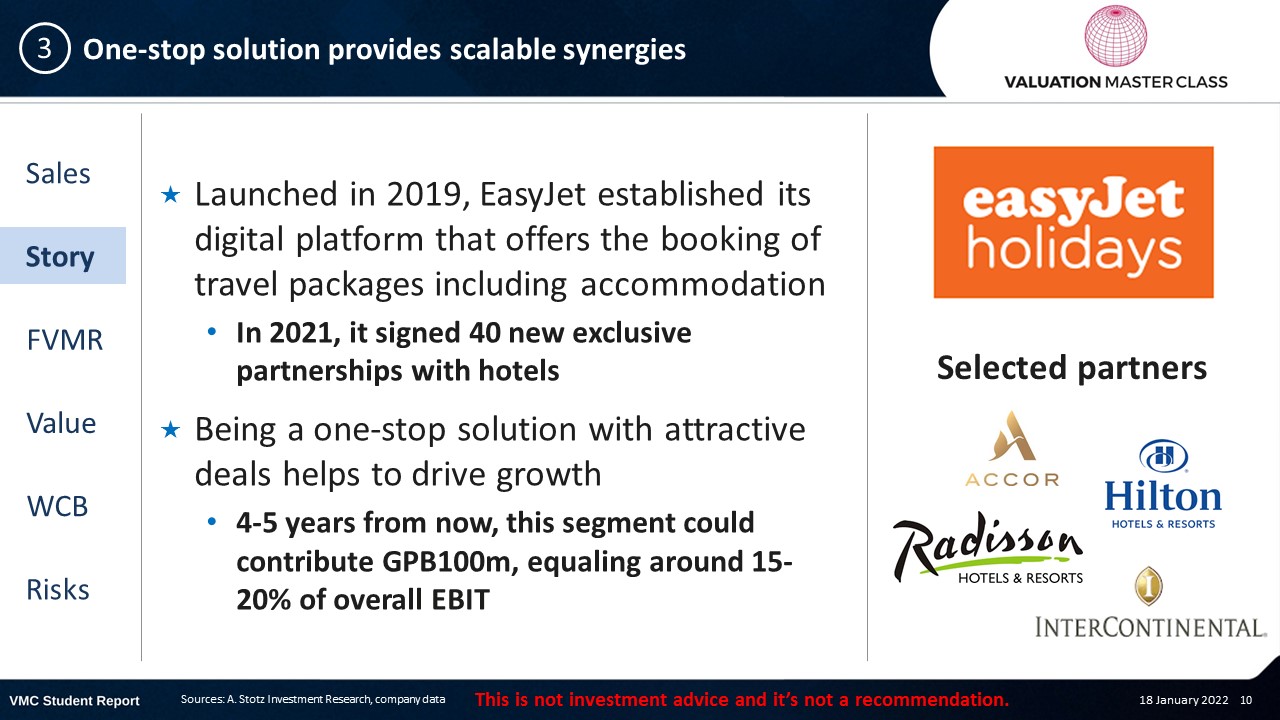

One-stop solution provides scalable synergies

- Launched in 2019, EasyJet established its digital platform that offers the booking of travel packages including accommodation

- In 2021, it signed 40 new exclusive partnerships with hotels

- Being a one-stop solution with attractive deals helps to drive growth

- 4-5 years from now, this segment could contribute GPB100m, equaling around 15-20% of overall EBIT

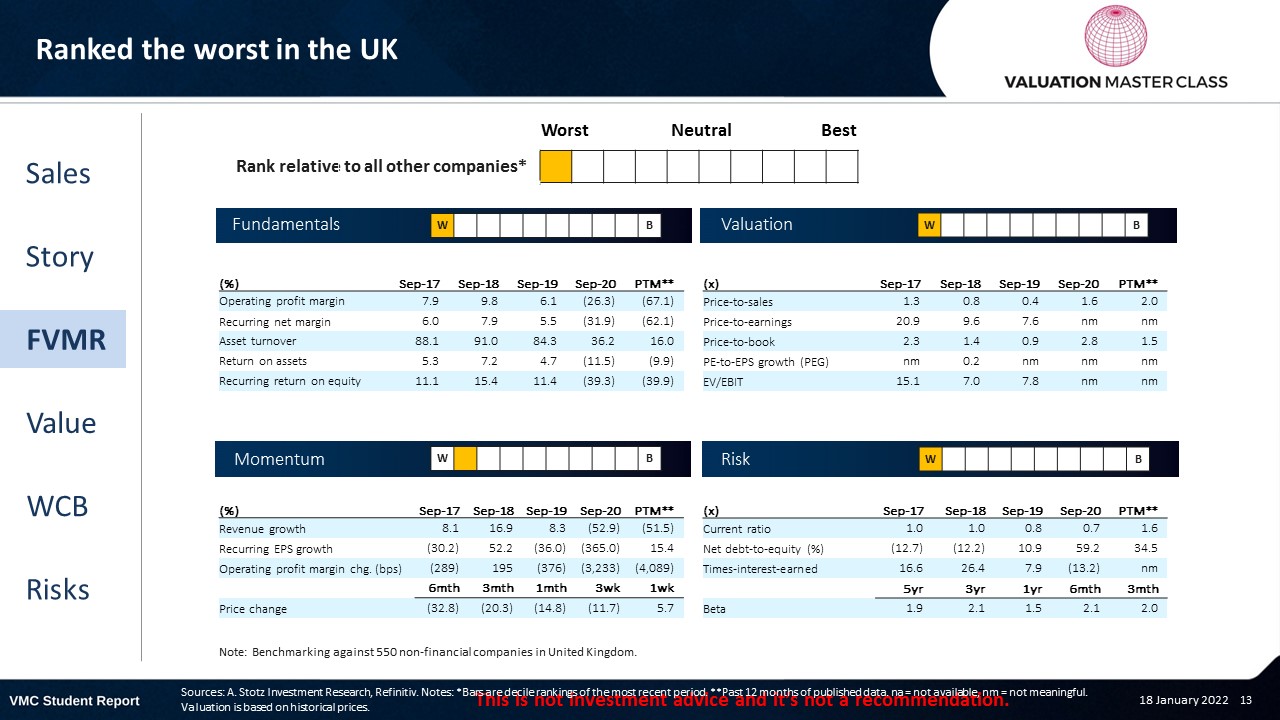

FVMR Scorecard – EasyJet

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus mixed, but majority sees upside

- 15 analysts issued a BUY recommendation as the stock price still trades at a large discount to its pre-pandemic level

- 2 analysts expect the company to struggle in its recovery (STRONG SELL)

- Consensus expects recovery in margin but it will be a long way to return to 35%+

Get financial statements and assumptions in the full report

P&L – EasyJet

- Net profit could return positive in 22E after facing 2 years of losses

- The bottom-line mainly depends on a demand rebound in traveling and no further gov’t restrictions to combat COVID

Balance sheet – EasyJet

- EasyJet has the flexibility to increase its fleet as most orders include a purchase right but no obligation

- With the demand recovery, I expect the company to return to higher capacity

- Leveraged increased significantly but was partly offset by the equity right offering

Ratios – EasyJet

- Asset efficiency starts to recover in 22E and 23E

- Declining leverage as part of the rights offering proceeds are used to repay debt

Long-term share price performance potential

Free cash flow – EasyJet

- Cash flow should return positive from 22E onward

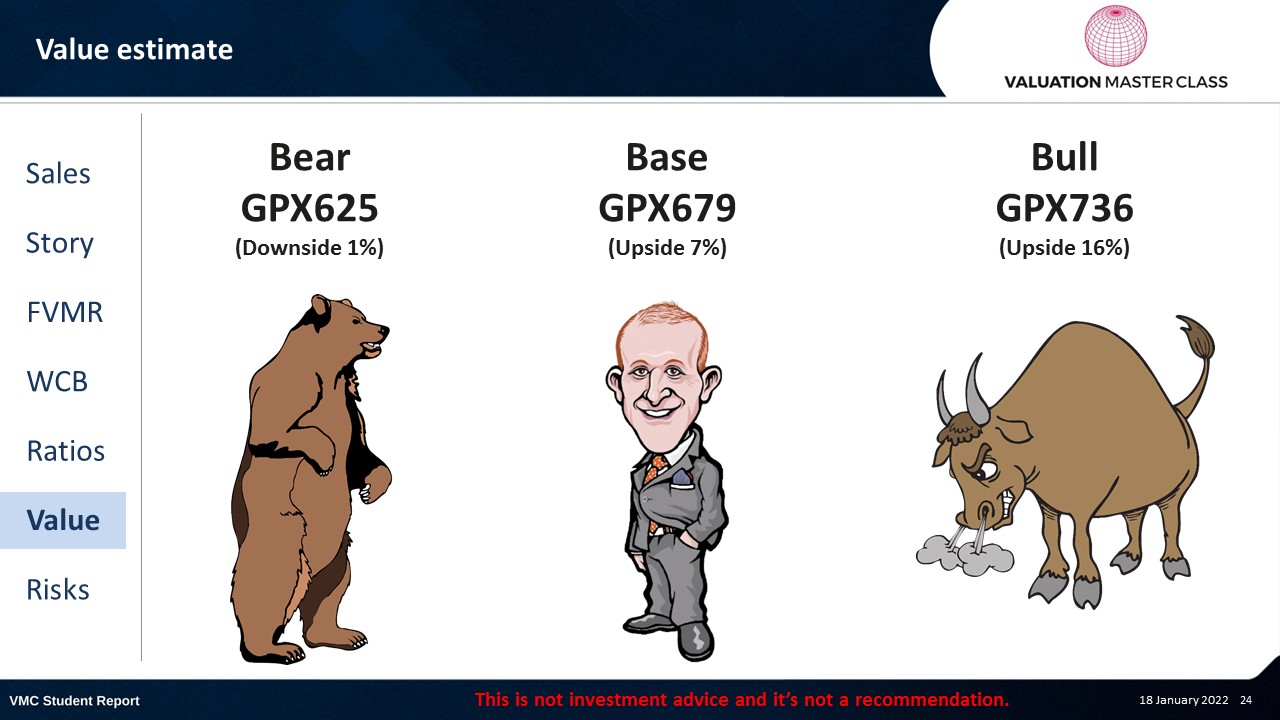

Value estimate – EasyJet

- I am a bit more cautious about the demand rebound in the aviation industry

- Also, price competition might lead to lower-than-expected revenue

- It could take a long time to recover its margin to pre-pandemic level

- I don’t think that it can achieve a margin of 37%+ in the next 5 years like it did before 2019

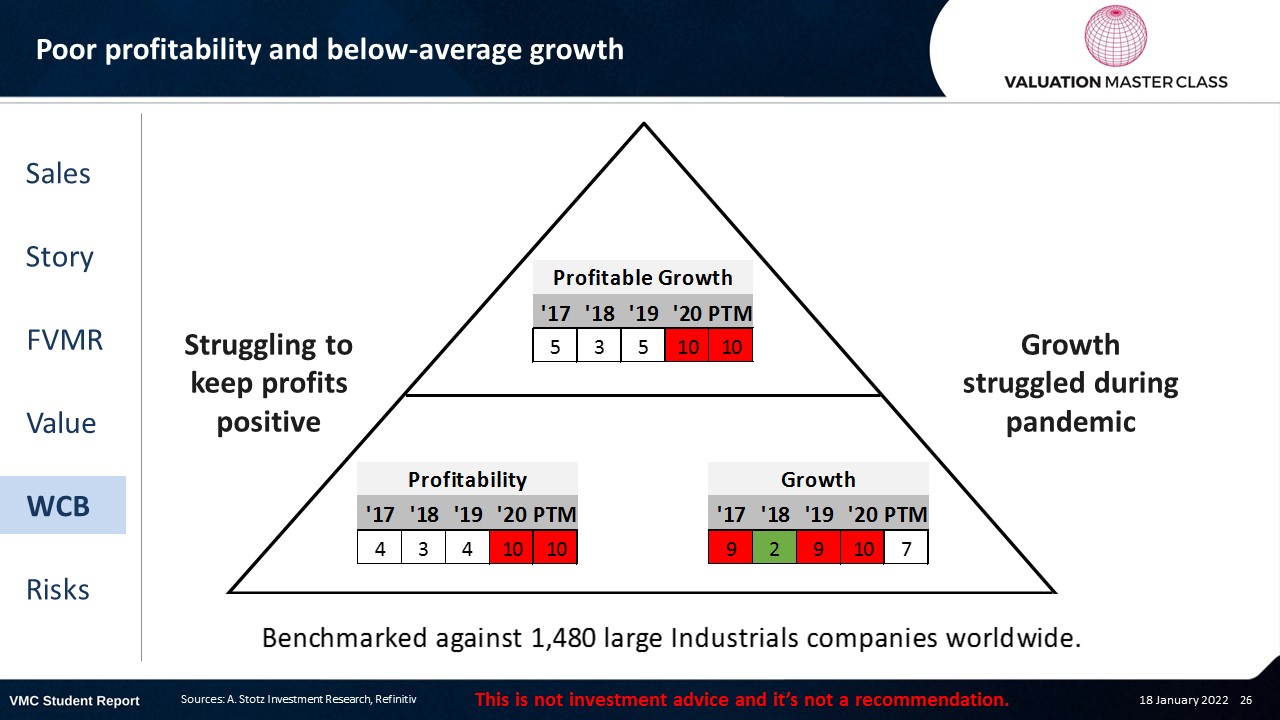

World Class Benchmarking Scorecard – EasyJet

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is falling behind competitors in capturing rebound

- Price reductions by competitors and intensified competition for airport slots

- Lower-than-expected demand rebound in the aviation industry

- Adverse regulatory changes and environmental liabilities

Conclusions

- Price wars determine which low-cost airlines survive

- Excessive liquidity through rights offering might lead to overinvestments

- With high uncertainty and low upside, at best, hold for now

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.