Lane Ringlee is Managing Partner, Marizu Madu is a Principal, and Joadi Oglesby is a Consultant at Pay Governance LLC. This post is based on their Pay Governance memorandum. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows (discussed on the Forum here) by Jesse M. Fried, and Charles C.Y. Wang; and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay (discussed on the Forum here) by Jesse M. Fried.

Key Takeaways

- While most S&P 500 companies conducting buybacks in 2018–2021 did not adjust performance goals or incentive awards to account for the lower share count post buyback, those conducting the largest buybacks tend to adjust goals or incentive awards to offset for the impact.

- Although the use of per share metrics is common in incentive plans, most of these companies balance per share metrics with other performance categories, reducing the impact buybacks have on incentive payouts.

- Shareholder returns for companies in our sample conducting buybacks are similar to returns for non-buyback companies, thus dispelling the notion that companies conduct buybacks to inflate stock prices to the benefit of management.

- The majority of activist share repurchase demands are successful.

Introduction

Stock repurchases (or “buybacks”) — where a company uses excess cash flow to repurchase shares of its stock to reduce common shares outstanding — have attracted significant attention from journalists, academic researchers, and government regulators; the concept of repurchases has also accrued significant supporters and detractors. According to Securities and Exchange Commission (SEC) Chair Gary Gensler, “In 2021, buybacks amounted to nearly $950 billion and reportedly reached more than $1.25 trillion in 2022”. [1] In 2023, the SEC revised rules issued in 1982 governing buybacks to require quarterly reporting of daily officer and director stock transactions that occur during a period of a stock repurchase program in addition to narrative disclosure of the details of the company’s buyback program and trading policies applicable during the program. The new regulations are intended to increase transparency of buyback processes and executive stock transactions during such programs. This Viewpoint summarizes Pay Governance research on buybacks within the S&P 500, the impact of buybacks on incentive compensation, and recent regulations governing buybacks.

In 2003, the SEC amended rules that provided companies with a safe harbor from liability for market manipulation for stock repurchases or buybacks as long as the buybacks were conducted in accordance with the rules. Prior to the initial rules issued in 1982 that allowed for buybacks, companies largely had to be dependent upon dividends to allocate excess cash. However, granting special dividends was a much less tax-efficient method, given the dividends were paid to all shareholders and may be taxed as ordinary income, while buybacks allowed shareholders the option to participate in a plan to repurchase shares.

More recently, the Inflation Reduction Act of 2023 included an excise tax of 1% of the aggregated market value of net corporate share buybacks beginning January 1, 2023. Additionally, the current Administration budget proposal includes a limitation on corporate executives selling shares within 3 years of a buyback program at their company.

Buyback Pros and Cons

Why should companies conduct buybacks and what are the key benefits? Proponents argue that buybacks:

- Efficiently reallocate excess cash held by corporations using a method of liquidating stock positions that is more tax effective for shareholders.

- Possibly signal positive underlying fundamentals not directly reflected in the current stock price.

- Reduce stock volatility and increase market liquidity, resulting in a corresponding stabilization of the stock market. [2]

- Provide “optionality” to shareholders to participate in a “sell-back” of shares. [3]

- Help complete the capital raising / investment / cash return to investors cycle that supports and encourages infusions of capital to companies as they execute on growth strategies. [4]

- Provide a greater share in the company’s profits per share to shareholders given the reduction in outstanding shares, which in turn could make the share price more appealing to investors.

Detractors of buybacks argue that the approach underscores short-term management thinking. In particular, detractors say that buybacks:

- Contribute to disparate benefits that reward wealthy shareholders and executives while potentially inflating financial results measured by per share metrics.

- Artificially drive stock prices higher.

- Result in a transfer of wealth, not creation of wealth.

- Use cashflow for repurchases that could be better used for other investments (e.g., R&D or employee wages). • Inflate per share performance metrics used in incentive compensation plans through a reduction in shares that drives incentive compensation higher.

Buy-Backs and Incentive Compensation

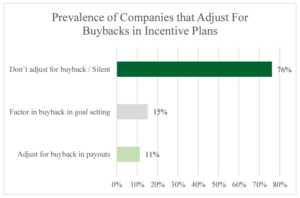

Pay Governance reviewed publicly available incentive plan disclosures via proxy filings of S&P 500 companies that engaged in share buybacks from 2018 to 2021 (total number of buyback events is 561). We found that 46% used per share metrics such as earnings per share (EPS) or cash flow per share in their executive short-term and/or long-term incentive plans. Our research shows that of these companies that use per share metrics, 76% either don’t adjust for buybacks when determining incentive payouts or are silent in the disclosures about the use of adjustments. The findings could suggest that some companies that conduct buybacks have made the determination that buybacks are the most efficient use of capital at that point in time and deem it reasonable to reward management for the buybacks via the positive impact on per share metrics in incentive plans resulting in a boost to the incentive payouts. However, it is more likely that some or most of the compensation committees at these companies take the buybacks into account when setting incentive performance targets and/or determining payouts but do not explicitly disclose that they do so. We found the remaining companies either disclose that they factor in the impact of share repurchases on shares outstanding when setting goals (15% of companies) or adjust for the impact when determining incentive awards (11% of companies). In other words, about one quarter of the companies consider the impact of share repurchases and prospectively adjust goals / set guardrails or retrospectively adjust incentive payouts to offset for the impact of buybacks.

The prevalence in the chart above totals to more than 100% since some companies disclose that they factor in buybacks when setting incentive plan goals as well as adjust for buybacks by excluding unplanned buybacks from performance results.

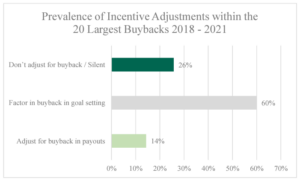

Focusing on the companies that conducted the 20 largest buybacks based on value of shares repurchased in each of the 4 study years, we found that the majority (74%) disclose that they factor in the impact of share repurchases on shares outstanding either when setting goals (60% of companies) or adjust for the impact when determining incentive awards (14% of companies). The companies with the largest buybacks are more likely to factor buybacks into the goal setting process and/or adjust incentive payouts accordingly given the magnitude of the buybacks which have a significant impact on per share metrics and corresponding incentive outcomes.

The establishment and disclosure of such “guardrails” (prospective or retrospective adjustments to incentive payouts) are an effective way to mitigate potential criticisms that buybacks are inappropriately impacting executive incentive payouts.

While prevalence of per share metrics is important to understand the impact or lack of impact of buybacks on incentives, it is also important to consider the relative weighting of per share metrics in the incentive plan, as many organizations use multiple metrics. Pay Governance research on the 20 largest buybacks from a value of shares purchased standpoint from 2018–2021 (total number of companies = 80) found that the use of per share metrics, such as EPS or cash flow per share, in either the short- or long-term incentive plan is not significantly different from the total S&P 500. Over the 4 years, the prevalence of per share metrics averaged 45%, similar to the total sample (46%). In addition, we found the weighting of the per share metrics in the incentive scorecard averaged 52% over the same period, with the other 48% represented by other financial, operational, and individual metrics/goals that are not influenced by share buybacks.

With a significant number of companies not using per share metrics, and those that do weighting the per share metric at about one half of the incentive scorecard, the data suggest that companies engaging in buybacks are not overwhelmingly incorporating per share metrics in incentive plans to boost executive incentive payouts; otherwise, we would have expected to see a greater use of per share metrics and higher weighting of these metrics. The balanced weighting of per share metrics and other financial, operational, and individual metrics suggest that share buybacks do not have an outsized influence on incentive outcomes, thus countering a major area of criticism of the practice.

Total Shareholder Returns: Buyback vs Non-Buyback

Recent research [5] evaluated portfolios of companies that executed repurchases with those that did not conduct repurchases and concluded that stock price returns for the two sets are largely the same. The research rejected the notion that stock prices and compensation for CEOs of companies that conducted buybacks were inflated by the practice. The research underscored its conclusions by identifying three key factors present in these companies: 1. The repurchases generally reduce shares outstanding by a relatively small amount; 2. Buybacks are an ongoing strategy that is anticipated in establishing per share performance expectations; and 3. Compensation committees are knowledgeable about the impact of repurchases and take this into account in setting incentive performance targets and CEO compensation.

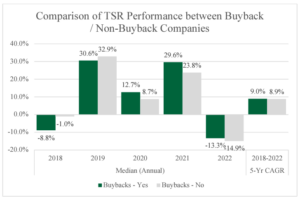

Considering that there is criticism of buybacks based on the premise that the open market purchases of shares results in artificially boosting stock prices, and thus executive gains on stock holdings, we researched S&P 500 companies’ total shareholder returns (TSRs) between 2018–2022 and segmented the analysis into companies that had conducted buybacks during the period and those that had not repurchased shares. While there is some annual variation in results, the 5-year TSRs for those conducting buybacks and those that did not are similar (see chart below).

Share Repurchase Activism

Investors and activists may use their influence to encourage or mandate target companies to address ESG, remuneration, personnel, and capital allocation issues. In some cases, these actions related to capital or cash allocation take the course of demands to conduct stock repurchases. In terms of prominence, the demands to return cash to shareholders (via repurchase or special dividend) are less common than ESG and remuneration actions.

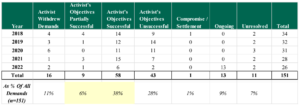

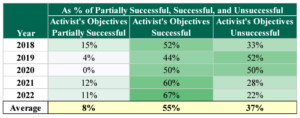

Our research indicates that from 2018 to 2022, there were 151 initiatives launched by activist investors to mandate share repurchase or returns of cash to shareholders. The activist demands were mostly either partially or completely successful at 44% (6% and 38% respectively). Activists are classified based on their “focus” per Insightia Activism(1). Our research includes “Primary Focus” activists such as Carl Icahn and Bulldog Investors, “Partial Focus” activists such as Saba Capital Management, “Occasional” activists such as Kinesic Capital, and a few “Concerned Shareholder” activists as well.

Share Repurchase Demand Outcomes 2018–2022

2021 and 2022 saw an increase in share repurchase demands with the highest rate of being successful at 6067%. In addition, there are 11 ongoing demands initiated in 2023.

Share Repurchase Demands as % of Those Partially Successful, Successful, and Unsuccessful

(1) Data provided by Insightia Activism as of April 2023

Given the majority of activist share repurchase demands are successful, we conclude that activists/shareholders view buybacks positively and can be the best use of capital depending on a company’s specific circumstance. Pay Governance will follow up with another Viewpoint that examines the effect of activist buyback demands on TSR in the year or years following a successful campaign.

Conclusion

Our research of S&P 500 companies indicates that many of the criticisms of share repurchases are overstated or unfounded. While only a minority of companies explicitly disclose accounting for the impact of buybacks in incentive goals or actual awards, the actual impact for those that don’t is less than many perceive due to the use of multiple performance goals in incentive scorecards, goals that define performance on an absolute (not per share) basis, and performance targets that implicitly include board approved repurchase budgets. In addition, the majority of companies with the largest buybacks explicitly disclose adjusting for the impact of buybacks in incentive goals and payouts. Not surprisingly, we also found that TSRs for companies that conduct buybacks are very similar to returns of companies that don’t conduct buybacks, thus deflating the criticism that buybacks inflate stock prices and executive pay. Companies that conduct significant buybacks should consider the most appropriate means to transparently communicate with shareholders on the impact buybacks have on incentive plans (i.e., adjusted goals or performance, or repurchases embedded into performance targets) given their individual situations.

Endnotes

1SEC Adopts Amendments to Modernize Share Repurchase Disclosure. U.S. Securities and Exchange Commission. May 3, 2023. https://www.sec.gov/news/press-release/2023-85.(go back)

2Craig M. Lewis and Joshua T. White. Corporate Liquidity Provision and Share Repurchase Programs. Harvard Law School Forum on Corporate Governance. October 8, 2021. https://corpgov.law.harvard.edu/2021/10/08/corporate-liquidity-provision-and-sharerepurchase-programs/.(go back)

3Six muddles about share buy-backs. The Economist. May 31, 2018. https://www.economist.com/business/2018/05/31/six-muddlesabout-share-buy-backs.(go back)

4Harry DeAngelo. The Attack on Share Buybacks. European Financial Management. December 16, 2022. https://onlinelibrary.wiley.com/doi/full/10.1111/eufm.12407.(go back)

5Nicholas Guest et al. Share Repurchases on Trial: Large-Sample Evidence on Market Outcomes, Executive Compensation, and Corporate Finances. Financial Management. January 23, 2023. https://onlinelibrary.wiley.com/doi/abs/10.1111/fima.12415.(go back)

Print

Print