Themes from Q1 2023 Earnings Calls

Part 1: Upstream

The oil and gas industry is dynamic and ever-evolving, and recent earnings calls have shed light on some key topics and debates among operators. As in prior quarters, shareholder returns took center stage during these discussions, with varying opinions emerging on the most effective method of returning capital. While some operators advocated for stock buybacks, others leaned towards dividends.

Simultaneously, the industry witnessed ongoing improvements in completion operations and infrastructure utilization, leading to cost reductions in the Eagle Ford play. Operators highlighted the region’s high rate of return and abundant drilling inventory, enabling them to maintain production levels and generate attractive returns.

Despite the strength of the Eagle Ford, attention and resources were increasingly directed towards the Permian Basin, where operators aimed to capitalize on improving well economics, flexibility in project scheduling, and cost savings to drive enhanced free cash flow.

Dividends or Buybacks?

During the earnings calls, the emphasis on shareholder returns was evident. While virtually all operators discussed shareholder returns at length, there appeared to be differing opinions on the most effective method of returning capital to shareholders. Some advocated for stock buybacks, while others seemed to prefer dividends.

- “Due to what we see as a significant disconnect between the current share price and its intrinsic value, repurchasing our shares continues to be a remarkable low-risk capital allocation opportunity which will dramatically reduce our denominator and thereby meaningfully grow our long-term free cash flow per share.”

– Alan Shepard, CFO, CNX Resources Corporation - “In terms of our preferred vehicle for shareholder returns, there’s no change to our approach. We’ll pay a competitive sustainable base dividend with the lion’s share of shareholder returns coming through share repurchases. We currently have $2 billion of buyback authorization outstanding, which gives us plenty of room to keep executing.”

– Dane Whitehead, Executive Vice President and CFO, Marathon Oil Corporation - “As a team, we’ve been prioritizing that dividend, we’ve committed to paying out 65% of discretionary cash flow in the form of a dividend and we don’t want to cannibalize any of that, for buybacks right now.”

– Chris Conoscenti, CEO, Sitio Royalties - “We strengthened our balance sheet by retiring debt, paid out nearly 100% of free cash flow in regular and special dividends, and we utilized our repurchase authorization to buy back $310 million worth of stock late in the quarter during a significant market dislocation. I am confident EOG has the assets, the technology and the people to deliver both return on capital and return of capital for years to come.”

– Ezra Yacob, CEO, EOG Resources

Reaction to the Decline in NYMEX and WAHA

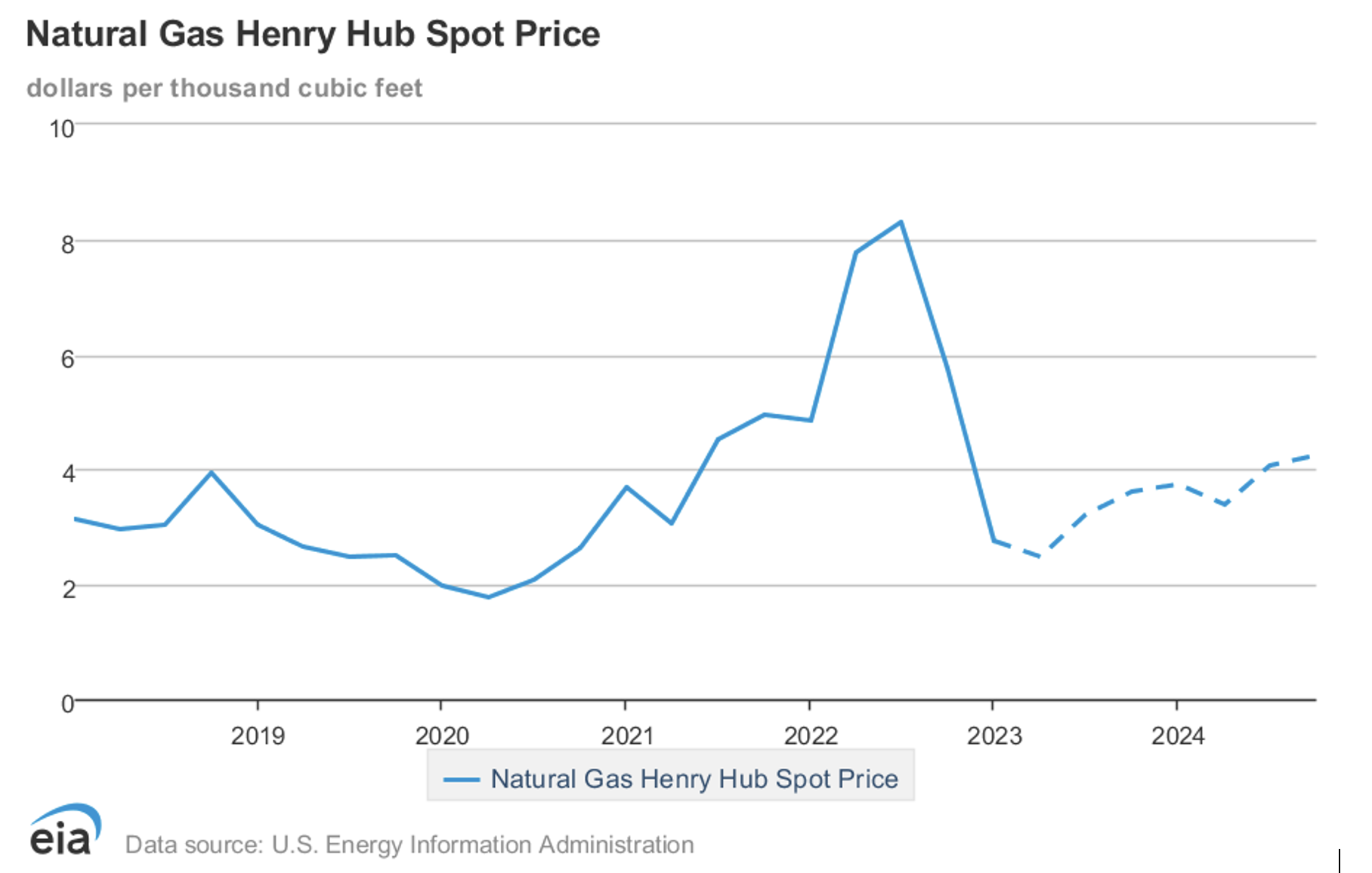

Oil and gas prices are no stranger to volatility, as evidenced by the first quarter of 2023. WAHA Hub and Henry Hub natural gas prices fell sharply. As shown below, Henry Hub hit the lowest price since the fourth quarter of 2020:

Upstream operators noted this shift and its adverse impact in the short term but overall seemed relatively unphased. As the U.S. continues to take a more significant role in exporting natural gas to the rest of the world, natural gas production will likely continue increasing to meet massive demand. They may also be comforted by the knowledge that natural gas prices tend to be seasonal, with prices peaking in the winter.

- “Our industry has been smacked with a collapsed NYMEX… this rapid deterioration of pricing over the past two quarters, when you couple it with the much-discussed inflationary pressures on every imaginable input to the sector… will pose near-term challenges throughout the industry. CNX might be the only player in basin that will be free cash flow positive for the remainder of 2023 at the current strip. We believe the industry is going to struggle to continue to execute the Shale 3.0 business model of returning capital to shareholders in this phase of the commodity cycle where you’ve got prices that are low and costs that remain high.”

– Nicholas Deiuliis, CEO, CNX Resources - “For North American gas, near-term prices reflect high inventory levels due to this year’s warm winter and reduced LNG demand during repairs at Freeport. As such, we are currently evaluating options to delay some activity at Dorado. The medium- and long-term outlook for natural gas, however, continues to strengthen. Currently, U.S. LNG demand is at record levels, with an additional 7 Bcf a day capacity under construction or through FID with expected startup between 2024 to 2027 that should position the U.S. as a leader in the global LNG market.”

– Ezra Yacob, CEO, EOG Resources - “Liquids prices have rebounded from recent lows in early Q1 and fundamental data is pointing to continued recovery throughout this year, especially for the propane barrel. While lack of cold weather and several PDH outages resulted in high propane inventories this winter, a resurgence in international demand has pushed more barrels into the global market in recent weeks… U.S. propane exports have already increased 20% year-to-date at 1.6 million barrels per day compared to 2022’s average of 1.35 million barrels per day. Additionally, the propane exports hit an all-time weekly high at 1.85 million barrels per day in April, according to EIA data. The increase this year is the result of the post-COVID recoveries in demand and the Chinese economy reopening. Looking at the macro infrastructure picture, this year is expected to be a pivotal one for the (liquefied petroleum gas) market.”

– Dave Cannelongo, Senior Vice President of Liquids Marketing & Transportation, Antero Resources

The Permian and Eagle Ford Take the Spotlight

The energy industry is experiencing ongoing improvements in completion operations and leveraging existing infrastructure to reduce finding and development costs in the Eagle Ford play. Managers highlighted Eagle Ford’s high rate of return and a substantial drilling inventory, which allows for maintaining current production levels, generating high returns, and lowering breakevens. Operators also are paying attention to the tremendous results in the Permian Basin comparable with other top-performing plays. Despite strength in the Eagle Ford, companies are focusing their capital and operational teams on the Permian, hoping to harness improving well economics, project scheduling flexibility, and cost savings to generate more free cash flow.

- “Ongoing improvements to completion operations and leveraging the benefit of existing infrastructure, enable our Eagle Ford finding and development costs to continue to decline. Last year, the Eagle Ford’s rate of return was the highest in the play’s history. Longer term, we have over a decade of drilling inventory in the Eagle Ford, allowing us to maintain the current production base, while generating high returns and lowering breakevens.”

– Billy Helms, President and COO, EOG Resources Inc. - “We’re delivering tremendous results in the Permian Basin since our return to activity last year. Today, the Permian is effectively competing for capital on a heads-up basis with the best of the Eagle Ford and Bakken in our portfolio, a very high bar to clear.”

– Lee Tillman, CEO, Marathon Oil Corporation - “We make the same observation you do about the relative maturity of different basins. It feels like places like the Eagle Ford and the Williston have a lot less remaining organic growth and maybe more of a maintenance mode or a slight decline. And that leads to a different opportunity set for operators in terms of who’s going to be the ultimate holder of those assets longer term. Now for the mineral owners, for us, as we look at these opportunities, we like a balance of current production plus remaining development potential. And so when we look at opportunities that were, let’s say, just Eagle Ford or just Williston Basin compared to something that’s just in the Permian or just in the DJ Basin, it’s a harder comparison for us to make the same sort of underwriting assumptions about future growth just because we know that there’s less remaining running room in those places. So that’s why you see us continue to come back to places like the Permian and the DJ.”

– Chris Conoscenti, CEO, Sitio Royalties - “We’ll focus a hundred percent of our capital and operational teams on the Permian. This will yield stronger well economics, enhanced flexibility in project scheduling and improve cycle times. Together, this will reduce our reinvestment rates and increase the conversion of EBITDAX and the free cash flow. The bottom line, we will generate more free cash flow with our investment dollars through significant capital efficiency gains and cost savings as a focused Permian company.”

– Joe Gatto, CEO, President, Director, Callon Petroleum Company

Conclusion

The oil and gas industry experienced an eventful first quarter of 2023, marked by discussions around shareholder returns and fluctuations in natural gas prices. Meanwhile, the industry witnessed ongoing improvements in the Eagle Ford play, with its remarkable rate of return and ample drilling inventory. Companies strategically shifted their focus to the Permian Basin, recognizing the potential for further growth, improved economics, and cost efficiencies.

As the United States solidifies its position as a major natural gas exporter, production is expected to increase in response to global demand. The energy industry continues to navigate these trends and adapt to the ever-changing landscape, poised for future opportunities and challenges.

Mercer Capital has its finger on the pulse of the minerals market. As the oil and gas industry evolves through these pivotal times, we take a holistic perspective to bring you thoughtful analysis and commentary regarding the full hydrocarbon stream, including the E&P operators and mineral aggregators comprising the upstream space. For more targeted energy sector analysis to meet your valuation needs, please contact the Mercer Capital Oil & Gas Team for further assistance.

Energy Valuation Insights

Energy Valuation Insights