Carey Oven is National Managing Partner at the Center for Board Effectiveness and Chief Talent Officer, Ira Kalish is Chief Global Economist, and Daniel Bachman is a Senior Manager at Deloitte & Touche LLP. This post is based on a Deloitte memorandum by Ms. Oven, Mr. Kalish, Mr. Bachman, and Jamie McCall.

Why it matters

From an economic perspective, the past few years have resembled a roller coaster. As the pandemic

spread and global commerce grinded to a halt, there were predictions that mass lockdowns would create a severe global recession (or worse). Such concerns had merit, and for a brief time the nation’s economy plummeted into recession. But as businesses adapted to the pandemic’s “new normal,” and especially as the slow reopening process began, some industries benefited from a recovery that was just as swift as the descent.

The recovery from the pandemic has been uneven at best, and it brought its own challenges—chief among them inflation. Board-level strategy around such issues often requires weighing a proverbial constellation of economic data. While cost cutting is often the “standard playbook” response in this area, there is value in weighing all the options available to promote economic resiliency. Periods of volatility are also an opportunity for boards to reaffirm their stewardship commitments. Such actions can pay dividends in social capital—a return on investment that, while not measured in dollars, can be just as valuable.

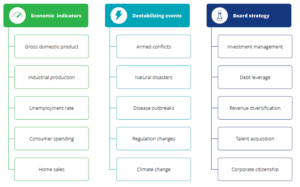

It’s raining economic data

The macroeconomic climate has long been a focus of boardroom attention. But at present, the constellation of economic forces at play paints a very murky picture. [1] For the United States and most of the world, inflation remains stubbornly high. And while the rate of inflationary pressure is beginning to ease, [2] its stickiness is concerning. [3] From a governance and oversight perspective, there is little information available about how boards might best strategize around inflation specifically or economic volatility more generally. [4] To some extent, this paucity of data reflects how difficult it is to disentangle board actions prompted by economic conditions from the myriad array of other business, social, and political variables that could be at play.

In a globalized and interconnected world, many companies operate on a transnational scale. But

since local economic conditions can vary widely by country, there may be a need to have multiple

and perhaps different strategies for different markets. Additionally, for companies that sell a large array of differentiated goods, the strategy for managing adverse economic pressures may vary

between products. Finally, while inflation and other economic indicators may be industry-agnostic, their impact can vary greatly by sector. Consider something like computer chips, which in the past few years surged in price due to inflation and other types of economic headwinds. [5] Where companies stood in terms of strategizing around these price increases varied dramatically based on where they sat— was the firm a supplier of the chips or a buyer?

The line between high-level strategy and management in economic resiliency depends on the board’s level of engagement. [6] For some companies, the specific details of how a company responds to economic conditions might be viewed as something better left to management. For others, the nature of the business or the governance culture may mean the board is involved at a more granular level. But regardless of the board’s engagement level, directors can play an important role in assessing whether management’s approach is congruent with stakeholder needs. Especially during times of economic turmoil, oversight is vital to achieving an appropriate balance between short-term actions and long-term growth. [7]

Just like the public at large, board members are confronted with a torrent of economic data. Formerly esoteric topics, like the meetings of the Federal Open Market’s Committee (FOMC), are now nightly news items. To make sense of the noise and guide business decisions, directors should consider periodic briefings from economists. Regular updates on the economic climate, especially as it pertains to the company’s specific lines of business, can help directors provide more effective oversight.

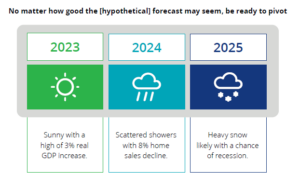

Today’s forecast: Partly sunny with a chance of inflation

Trying to anticipate and govern around future economic conditions is like planning around any

forecast. The interconnected nature of global markets means uncertainty is always high. No matter how skilled an economic forecaster may be, it just is not possible to anticipate large-scale events involving geopolitics and natural disasters. In December 2019, when economists released their annual forecasts for 2020, who could have known a novel virus called SARS-CoV-2 would soon upend the global economic order? For that reason, there could be value in creating strategies for a range of likely scenarios. [8]

Deloitte’s research has long highlighted that there are many paths to organizational resilience, even when dealing with a constantly shifting macroeconomic landscape. The “standard enterprise

playbook” response often is to reduce costs. And while cost- reduction approaches are industry-dependent, actions in this area often involve staffing cuts, wage freezes, changing investment strategies, and altering the firm’s plans on debt financing. [9] However, there can be trade-offs to cost containment. For example, companies focused on controlling expenditures can miss the opportunity to forge a new market niche or make a bargain price acquisition. [10] Thus, especially during times of economic uncertainty, board oversight is vital to achieving short-term goals without sacrificing long-term growth. [11]

Over the past few years, the role of the enterprise as a purpose- driven entity has become a priority for many boards. [12] This has meant an increasing number of companies seeking to foster positive social impacts through community relationship building, philanthropy, and similar initiatives. [13] Since these activities do not normally generate revenue, it can be tempting to curtail them during periods of economic turmoil. However, while it is not easy to measure the value of community stewardship in dollars and cents, it can pay large dividends in the form of social capital. [14] Avoiding the perception of the corporation as a “fair weather” community steward can be a distinct competitive advantage.

Boardroom discussion questions

While creating a proactive strategy to manage inflationary pressures (or any other economic force)

is a complex process, being briefed by economists that specialize in a company’s line of business can help boards make better decisions. What follows are some questions around this area that could guide boardroom discussion:

- Should the board institutionalize periodic briefings from economists (internal or external), and if so, how frequently?

- What are the most likely macroeconomic scenarios for the company’s line or lines of business in the short and long term? What is the confidence level for each scenarios?

- How are economic conditions like inflation having an impact on the board’s stakeholders, and do those impacts suggest a need to change strategy?

- Is there an opportunity to build a competitive advantage and social capital by expanding board stewardship during periods of economic volatility?

Endnotes

1Daniel Bachman, United States Economic Forecast, Deloitte Global Economist Network (Deloitte Insights), accessed February 7, 2023.(go back)

2Since spiking in April 2022 and through the time of publication, the 10-year Treasury breakeven rate has generally declined. The rate represents one way of measuring future inflation expectations from investors. The metric is the difference between the nominal yield of a bond and the yield of an inflation-linked bond of the same duration. See Stefania D’Amico, Don Kim, and Min Wei, Tips from TIPS: The informational content of Treasury Inflation-Protected Security Prices, Finance and Economics Discussion Series (FEDS) 2014-024 (Washington, DC: Federal Reserve Board, 2016).(go back)

3John H. Cochrane, Inflation past, present and future: Fiscal shocks, Fed response, and fiscal limits, Working Paper 30096 (Cambridge, MA: National Bureau of Economic Research, May 2022).(go back)

4Roberto Moro Visconti, “Inflation risk, wealth expropriation and governance implications,”

Corporate Ownership and Control 10, no. 4 (2013): pp. 329–40.(go back)

5John Mullin, “Supply chain disruptions, inflation, and the Fed,” Federal Reserve Bank of Richmond Econ Focus, September 6, 2022.(go back)

6David A. Nadler, “Building better boards,” Harvard Business Review, May 2004.(go back)

7Idoya Ferrero-Ferrero, María Ángeles Fernández-Izquierdo, and María Jesús Muñoz-Torres, “The impact of the board of directors characteristics on corporate perform nce and risk-taking before and during the global financial crisis,” Review of Managerial Science 6, no. 3 (2012): pp. 207–26.(go back)

8Ira Kalish et al., “Amid geopolitical complexity uncertainty persists,” On the board’s agenda

(Deloitte Center for Board Effectiveness, May 2022).(go back)

9Yee Peng Chow et al., “Macroeconomic uncertainty, corporate governance and corporate capital structure,” International Journal of Managerial Finance 14, no. 3 (2018): pp. 301–21.(go back)

10Bill Marquard, Andrew Grimstone, and Ira Kalish, “Navigating your business through a recession,” (Deloitte Development, September 2022).(go back)

11Ferrero-Ferrero et al., “The impact of the board of directors characteristics on corporate performance and risk-taking before and during the global financial crisis.”(go back)

12Diana O’Brien et al., “Purpose is everything: How brands that authentically lead with purpose are changing the nature of business today,” Deloitte Insights, October 15, 2019.(go back)

13Jennifer Lee, Jeffery Weirens, and Don Fancher, “Future of trust: Recovery for continued prosperity,” Deloitte, April 2020.(go back)

14Teshanee Williams et al., “Beyond bridging and bonding: The role of social capital in organizations,” Community Development Journal 57, no. 4 (October 2022): pp. 769–92; Punit Renjen, “The value of resilient leadership: Renewing our investment in trust,” Deloitte Insights, October 2020.(go back)

Print

Print