Aneuser-Busch InBev SA/NV

Weekly Valuation – Valutico | 12 December 2022

Link to the detailed valuation

About Aneuser-Busch InBev

Anheuser-Busch InBev, a Belgium-based beer brewing and distribution giant operating in the global market, has an impressive portfolio of over 500 beer brands including Budweiser, Becks, Stella Artois and Corona. Recently, Budweiser hit the headlines when its €71 billion sponsoring deal as the official beer supplier to the stadiums of the 2022 FIFA World Cup was not honored because Qatar refused to sell beer in their football stadiums.

Recent Financial Performance

In October Anheuser-Busch InBev published its earning call for the third quarter, where they announced a revenue of $15.1 billion which is an increase of 5.7% compared to last year’s Q3. The company also was able to increase its EBITDA by 6.5% with an overall EBITDA margin of 35.2%. Furthermore, volumes of goods sold grew by 3.7% which was mainly driven by an increase of 5.2% in non-beer products.

2022 World Cup Supplier Deal

Budweiser, one of the company’s brands, signed a €71 million contract with FIFA to be the official beer supplier of the 2022 World Cup and one of the official main sponsors. However, this contract could not be completely fulfilled because two days before the start of the World Cup, at the insistence of the Al Thani royal family, it was announced that no alcoholic beer could be served in or around the stadiums. Therefore, the company could only serve non-alcoholic beer in the football stadiums in Qatar. Budweiser took this with humor and announced that it would give away the leftover beer to the fans of the nation that wins the World Cup.

To pay for the damage, Anheuser-Busch InBev wants to cut €39 billion from its 2026 World Cup deal in North America, which is currently worth €107 billion.

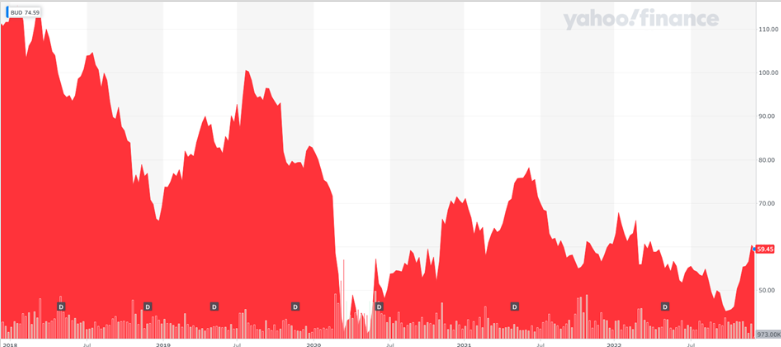

Share Price Performance

The last five years have been tough for the Anheuser-Busch InBev share. The sharp drop to €37 per share after the Covid-19 outbreak is particularly noteworthy. This was due to several closures and falling demand for beer and other alcoholic beverages as social gatherings were banned and bars and nightclubs closed. After this shock to the price of the company’s shares, they recovered to €80 per share in November 2021, after which they went steadily downhill until they reached €46 per share in early October this year. However, since the last earnings call at the end of October, the brewery giant’s share price has risen by 21% to reach a price of €56 per share.

Anheuser-Busch’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3iAK7C9.

Valutico Analysis

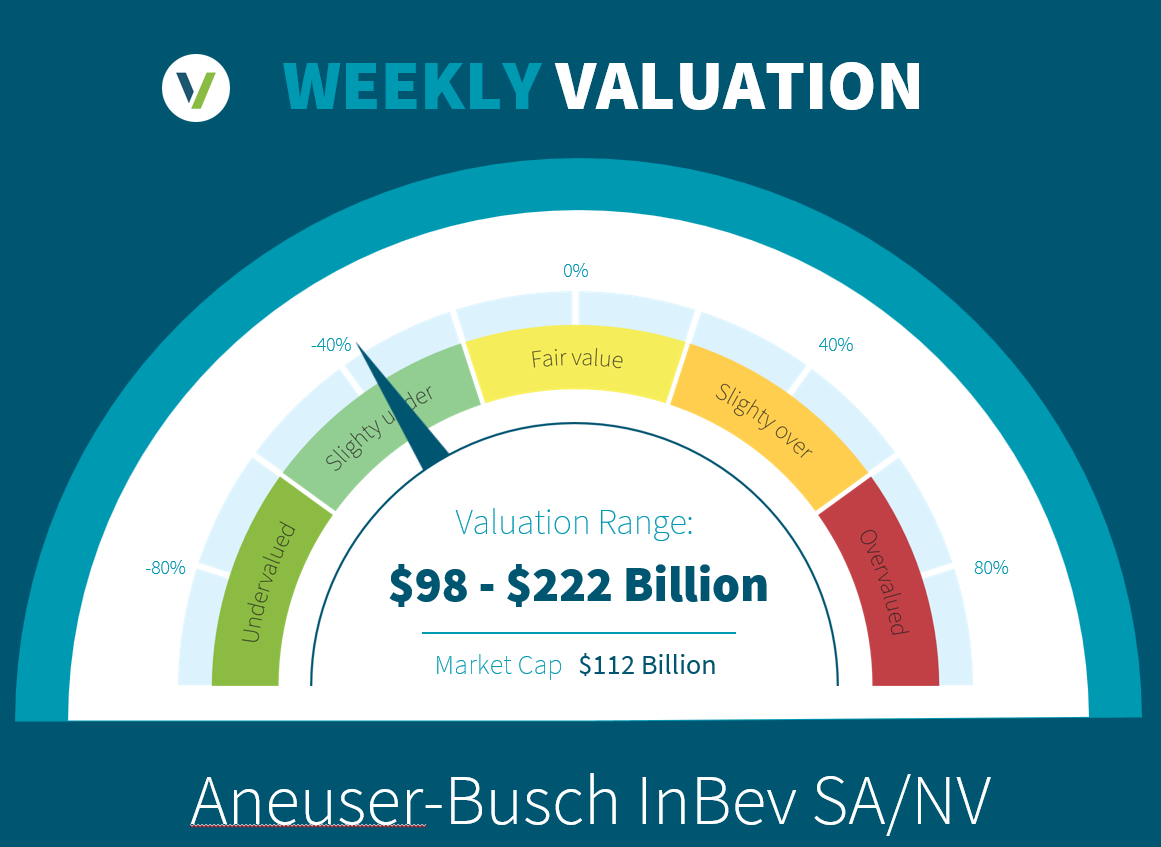

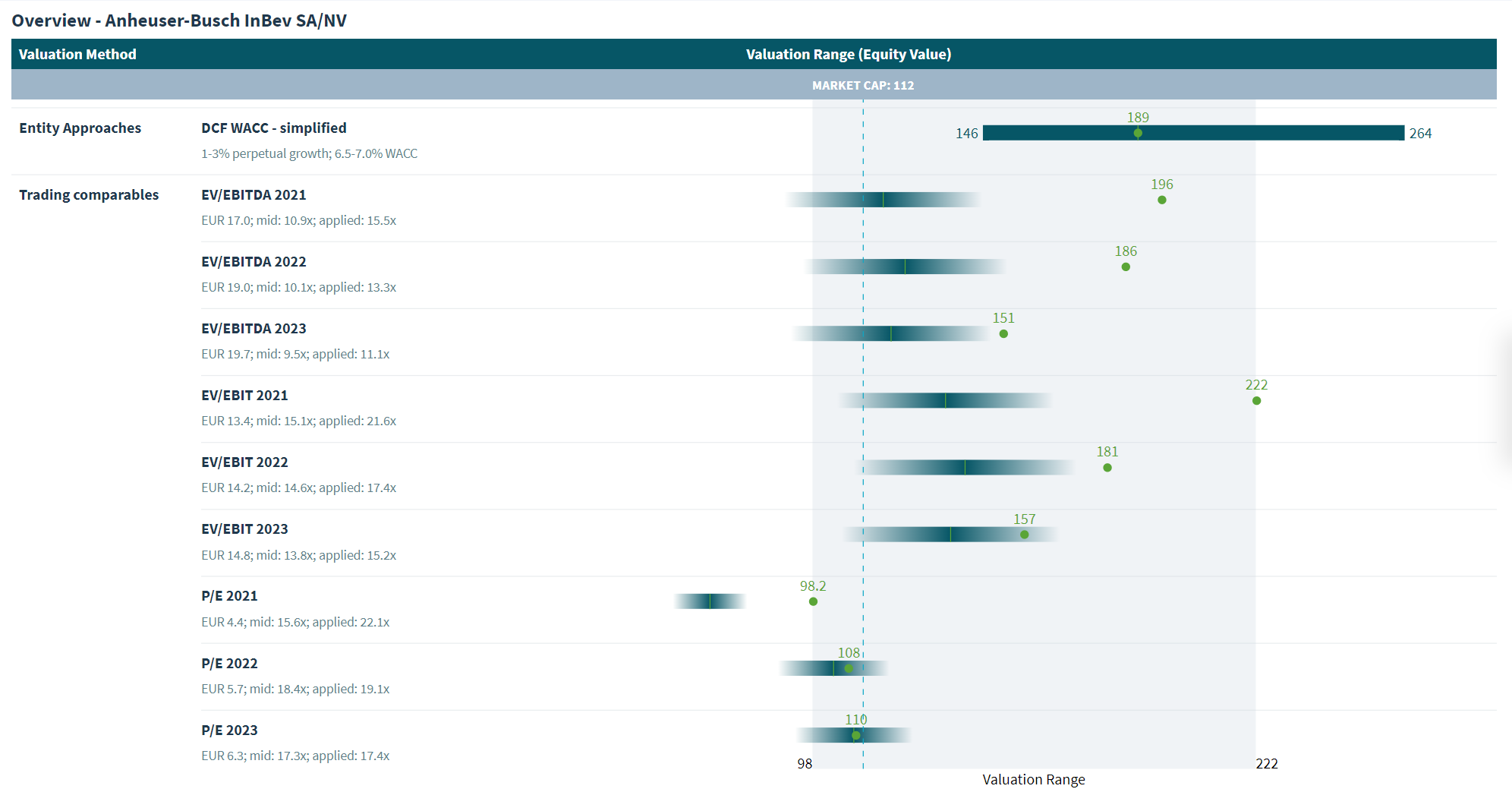

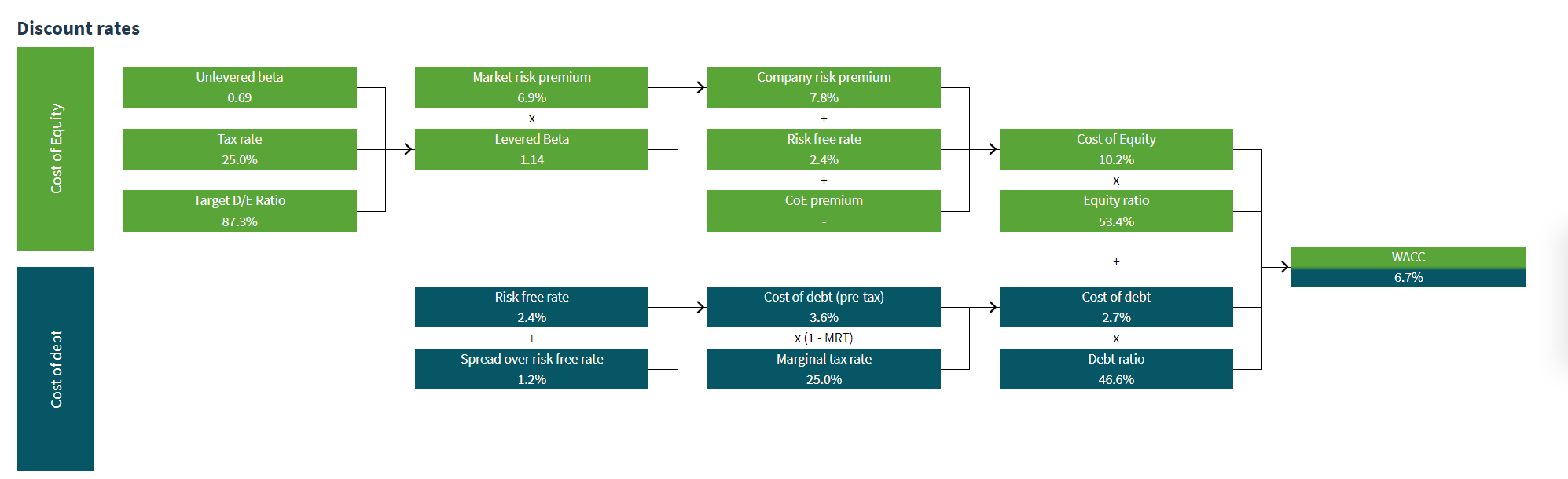

We analyzed Anheuser-Busch InBev by using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of €189 billion using a Cost of Equity of 6.7%.

The Trading Comparables analysis resulted in a valuation range of €98 to €222 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Heineken and Carlsberg.

Combining the value of our DCF WACC and Trading Comparables analysis resulted in a value range of €98 billion to €222 billion. In comparison to Anheuser-Busch InBev’s market capitalization of €112 billion we suggest that the company is undervalued.

Link to the detailed valuation

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.