Rex Wang Renjie is an Assistant Professor of Finance at the Vrije Universiteit Amsterdam and Tinbergen Institute; Patrick Verwijmeren is a Professor of Corporate Finance at the Erasmus School of Economics; and Shuo Xia is an Assistant Professor of Finance at Halle Institute for Economic Research and Leipzig University. This post is based on their working paper. Related research from the Program on Corporate Governance includes Index Funds and the Future of Corporate Governance: Theory, Evidence and Policy (discussed on the Forum here), and The Specter of the Giant Three (discussed on the Forum here) both by Lucian A. Bebchuk and Scott Hirst; and The Limits of Portfolio Primacy (discussed on the Forum here) by Roberto Tallarita.

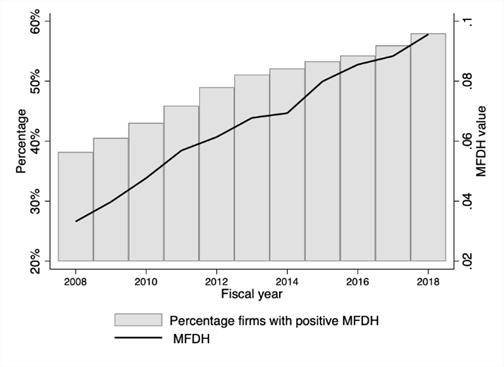

In the last decade, investment in corporate bonds has seen a surge through bond mutual funds. By 2019, these funds represented over 25% of the U.S. corporate bond market, holding approximately $1.5 trillion, a threefold increase from $423 billion in 2009. Consequently, fund families managing both equity and bond funds are more likely to hold stocks and bonds from the same company simultaneously (“dual holdings”). Using detailed holding data of mutual funds, our paper first documents a rising trend in mutual fund dual holdings of U.S. publicly traded firms. As illustrated in Figure 1, among firms with mutual fund equity ownership and outstanding bonds, the percentage of firms with dual holdings increased from 38% in 2008 to 58% in 2018, and firm-level mutual fund dual holding intensity (MFDH) increased threefold.

Figure 1: Time-series variation of our firm-level mutual fund dual holding measure (MFDH)

This trend naturally leads to questions about whether fund managers within these mutual fund families coordinate decisions, and then how dual holdings might affect corporate actions. The answer is not obvious due to mixed incentives for mutual fund managers. On the one hand, because investors chase performance and management fees are proportional to fund size, fund managers face intense competition, even within the same family. In addition, each fund has a fiduciary duty to its own investors, with equity and bond investors having significantly different risk preferences and investment goals. If managers only prioritize their own funds, and not the other funds in the family, dual-holding families may not impact or even exacerbate agency conflicts of their portfolio companies.

On the other hand, a growing body of literature suggests coordination and cross-subsidization within fund families. Dual holdings could also enhance monitoring effectiveness, as firm managers are more likely to listen to the “voice” of dual holders or be threatened by their potential “exit” because of their double stakes in the company. As such, if equity and bond funds collaborate to maximize the family’s overall value, dual ownership could potentially benefit their portfolio companies.

We empirically study how mutual fund dual holdings affect agency problems and corporate actions by focusing on investment decisions. Firm investment is at the core of shareholder-creditor conflicts. Shareholders, with subordinate cash flow claims, may lack motivation to finance valuable projects during financial distress, resulting in the debt overhang problem. Firm investment is also at the heart of the shareholder-management agency problem: because of the separation of ownership and control, entrenched managers may engage in “empire-building” by making excessive investments.

To estimate the causal effects of mutual fund dual holdings on corporate investment, we use cross-family mutual fund mergers as a source of exogenous variation in dual holdings. Using fund mergers as instrumental variables for firm-level mutual fund dual holdings in a difference-in-differences framework, we find that dual ownership helps prevent debt overhang problem. While distressed firms cut investments by about 3.5 percentage points on average, a unit increase in dual holdings is sufficient to offset this investment decline, potentially resolving the underinvestment problem. In contrast, for firms with entrenched managers, we find that dual holdings reduce investments, in line with a reduction in “empire-building”.

We also study the financing aspect and provide evidence that dual holding families are willing to supply capital to firms that need financing for investments. Our analysis shows that a distressed firm with a one-unit increase in dual holdings becomes about 10% more likely to issue new bonds. We confirm that a significant share of the newly issued bonds are bought by mutual fund dual holders, impacting pricing and contracting terms. More specifically, dual holdings lead to a 41 basis points reduction in offering yield for issuers with high-yield credit ratings, effectively lowering these firms’ cost of debt financing. Covenants are less restrictive with dual holdings, allowing financially distressed firms to be more flexible in selecting investment projects and refinancing in the future.

Furthermore, we find that equity funds are less likely to miss votes at shareholder meetings of firms from which their families also hold bonds. This suggests that equity funds from dual holding families exert more effort to influence corporate decision-making. This increasing involvement in corporate governance also helps explain why dual holders are willing to supply additional capital with lower yields and fewer restrictions.

Overall, our findings suggest that mutual fund dual holders enable firms to increase value-enhancing investments by allowing them to refinance at lower costs, mitigating shareholder-creditor agency conflicts. At the same time, dual holders monitor management more actively and effectively, thereby reducing shareholder-management agency problems. Notably, these benefits are predominantly driven by the dual holding families that encourage cooperation. As such, our work contributes to the literature on the relationship between corporate governance and mutual funds, and the growing literature on the implications of dual ownership.

Print

Print