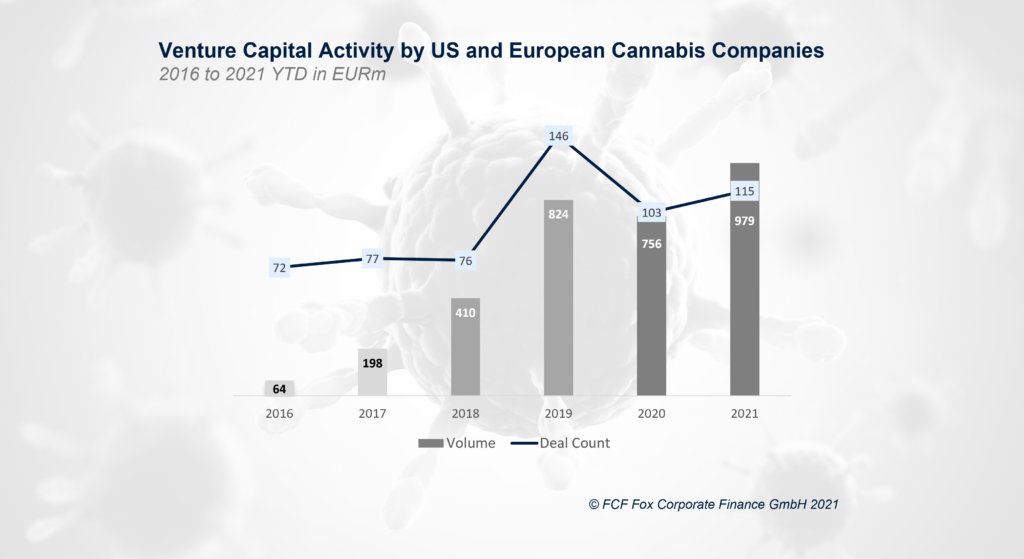

Investment into US and European cannabis companies have been continuously increasing over the past years.

Whereas 72 venture capital transactions were conducted in 2016, the number of transactions in 2021 (YTD) have increased by almost 60 percent to 115. A significant peak in 2019 can be attributed to the first-ever congressional vote on federally legalizing cannabis and a widespread amount of cannabis reform legislation in twenty-seven US states.

In addition, US and European companies from the cannabis space were able to attract significantly higher volumes in the last five years. The overall transaction volume increased from 64m in 2016 to 979m in 2021 (YTD), being almost fifteen times as high.

About FCF Life Sciences

FCF Life Sciences advises leading healthcare companies in Europe on financing transactions (equity, debt, and licensing) with regional and international investors. Our team consists of science-driven industry and finance experts with a strong track record in managing financing processes. We thrive to maximize the efficiency in the fundraising process and increase its closing probability.

Learn more about FCF Life Sciences, click here.

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here: