Capital Structure in 5 Minutes

Auto Dealer Valuation Insights

DECEMBER 19, 2023

Family businesses are built on long-term capital investments. Capital structure refers to the mix of debt and equity financing used to make those investments.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Auto Dealer Valuation Insights

DECEMBER 19, 2023

Family businesses are built on long-term capital investments. Capital structure refers to the mix of debt and equity financing used to make those investments.

Andrew Stolz

AUGUST 6, 2020

Definition of Optimal Capital Structure. The optimal capital structure of a firm is the right combination of equity and debt financing. It allows the firm to have a minimum cost of capital while having the maximum market value. The lesser the cost of capital, the more the market value of the company.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

JANUARY 31, 2024

Posted by Sanjai Bhagat and Henry Laurion, University of Colorado Boulder, on Wednesday, January 31, 2024 Editor's Note: Sanjai Bhagat is Professor of Finance, and Henry Laurion is Assistant Professor of Accounting at the University of Colorado Boulder Leeds School of Business. This post is based on their SSRN working paper. more…)

Harvard Corporate Governance

SEPTEMBER 27, 2023

Posted by Joseph Kalmenovitz (University of Rochester), on Wednesday, September 27, 2023 Editor's Note: Joseph Kalmenovitz is an Assistant Professor of Finance at the Simon Business School, University of Rochester. This post is based on his recent paper forthcoming in the Review of Financial Studies.

Equilest

JANUARY 8, 2023

The Modigliani-Miller theorem is a fundamental principle in finance that . describe the relationship between the capital structure of the firm and its value. . Their work was groundbreaking at the time and has had a lasting impact on finance. - Are they useful in Business Valuation? Let's discuss. Why is that?

Reynolds Holding

FEBRUARY 7, 2024

Since it is now possible to administer capital structures on the blockchain, opening them up to smart contract automation has become a reality. The tokenisation of traditional debt and equity securities is an important growth area and promises enhanced liquidity and access to capital for many smaller and medium sized enterprises.

Andrew Stolz

AUGUST 6, 2020

The theory suggests that a company’s capital structure and the average cost of capital does not have an impact on its overall value. . It doesn’t matter whether the company raises capital by borrowing money, issuing new shares, or by reinvesting profits in daily operations. Definition of the Modigliani-Miller Theorem.

Harvard Corporate Governance

FEBRUARY 2, 2024

Huber, Latham & Watkins LLP, on Tuesday, January 30, 2024 Tags: enforcement , ESG , Greenwashing , litigation , regulation , Stakeholders , Value chain Accounting Information and Risk Shifting with Asymmetrically Informed Creditors Posted by Tim Baldenius (Columbia University), Mingcherng Deng (City University of New York), and Jing Li (Hong Kong (..)

Scott Mashuda

JANUARY 9, 2024

Equity Restructuring : Attract new equity partners, like private equity, to optimize capital structure and support growth initiatives. One of the primary objectives of balance sheet restructuring in M&A is to optimize the capital structure of the combined entity.

Musings on Markets

JANUARY 11, 2024

The six classes that I prepped for in those two years ranged from banking to investments to corporate finance, and while I have never worked harder, much of what I teach today came out of those classes. In 1984, I moved on to the University of California at Berkeley, as a visiting lecturer, teaching anything that needed to be taught.

Benchmark Report

JULY 21, 2023

EBITDA is used to evaluate a company’s profitability of its core operations by removing items dependent on capital structure, such as interest, Correctly calculating adjusted EBITDA is essential in an M&A transaction, and all parties must be familiar with the adjustments.

Harvard Corporate Governance

JULY 8, 2022

The Proposed SEC Climate Disclosure Rule: A Comment from Twenty-Two Professors of Law and Finance. Tags: Bankruptcy , Capital formation , Capital structure , Distressed companies , Hedge funds , Institutional Investors , IPOs , REITs. Posted by Lawrence A. Posted by William Ferguson (Ferguson Partners), David F.

Appraiser Newsroom

APRIL 24, 2024

She has performed valuations for purposes including financing, financial reporting, estate and gift tax planning, tax appeal, litigation, and eminent domain. Samantha Albert | Mercer Capital Samantha Albert is a vice president with Mercer Capital.

Lighter Capital

FEBRUARY 13, 2024

Explore non-dilutive capital sources Growth can sometimes be too anemic to show the traction you need to woo investors and raise equity at the terms you want. Explore alternative funding sources beyond venture capital, like debt financing that won’t dilute your equity. Get Capital to Grow. Got Revenue? Keep Your Equity.

Valutico

APRIL 17, 2023

Determining a company’s “Cost of Capital” is vital in corporate finance and valuation, and the Weighted Average Cost of Capital (WACC) provides a specific way of doing so. These costs are then combined into a “weighted average” which represents the overall cost of financing a business.

Valutico

APRIL 17, 2023

Determining a company’s “Cost of Capital” is vital in corporate finance and valuation, and the Weighted Average Cost of Capital (WACC) provides a specific way of doing so. These costs are then combined into a “weighted average” which represents the overall cost of financing a business.

Valutico

APRIL 12, 2023

Determining a company’s “Cost of Capital” is vital in corporate finance and valuation, and the Weighted Average Cost of Capital (WACC) provides a specific way of doing so. These costs are then combined into a “weighted average” which represents the overall cost of financing a business.

Benzinga

FEBRUARY 6, 2024

A special committee of the ZeroFox board conducted a thorough evaluation of capital structure alternatives, which included multiple discussions and interactions with a number of financial and strategic partners," said Todd Headley, Lead Independent Director of the ZeroFox Board of Directors.

Benzinga

MARCH 1, 2024

"The proceeds from the sale of our Tower business will provide Shentel with additional growth capital to support the planned expansion of our Glo Fiber line of business to approximately 600,000 homes and business passings by the end of 2026. We are pleased to add these purpose-built broadband telephony towers to our growing portfolio.

Reynolds Holding

DECEMBER 10, 2023

As a capital allocation decision, share buybacks intersect all three of the main corporate finance activities of investing, financing, and dividends [1]. The point being that although the logic for each of these rationales is distinct, the very act of doing a share buyback influences the whole of the corporate finance ecosystem.

Auto Dealer Valuation Insights

MAY 16, 2023

Investing, personal finance, and business decisions are typically taught as a math-based field, where data and spreadsheets dictate your family business’ next move. But as Morgan Housel teaches us in his book The Psychology of Money, there is theory, and then there is reality.

Value Scope

AUGUST 31, 2020

This is how we use it in finance, economics, etc. The cash flows we isolate are tested for their ability to support debt, the new capital structure of the restructured firm. , which can be “stókhos” or “stóchastikos” in English. 9 One definition of the word is “to guess,” which is why some lawyers think it is speculative.

Lighter Capital

JANUARY 11, 2022

At Lighter Capital, our Investment Team encounters a lot of questions from startup founders about the features of our financing solutions, such as early payoff provisions, minimum return requirements, warrants, debt covenants , and even whether we require a personal guarantee. How do warrants work? Let's dive in.

Andrew Stolz

AUGUST 5, 2020

What Impacts the Weighted Average Cost of Capital? The optimal capital structure of a company is the proportion of debt and equity financing that maximizes the company’s value while minimizing the cost of capital (WACC). The lower the cost of capital, the higher the present value of future cash flows.

RNC

DECEMBER 15, 2022

Finances of the Business. The working capital required to operate the business and how much is required to make improvements on the capital per year also affect the valuations. The net worth, capital structure, and debt are taken into consideration. The General Economic Conditions.

Valutico

FEBRUARY 27, 2024

Weighted Average Cost of Capital (WACC): WACC is the average rate of return a company is expected to provide to all its investors, including equity and debt holders. It is calculated by weighting the cost of equity and cost of debt based on their proportions in the capital structure.

Harvard Corporate Governance

JANUARY 11, 2024

Some of these discrepancies are due to: Threshold amounts that seek to limit the number of adjustments to only those that are materially above a certain dollar amount (i.e., expenses or benefits above $5.0

Andrew Stolz

APRIL 3, 2020

Leveraged Buyout (“LBO”) is a quite common term in Corporate Finance field. It refers to acquiring a company (or its part) and financing it with debt. Financing spin-offs – when a company decides to sell a part of the company and the deal is financed by debt; Private deals – when e. Capital Structure of an LBO.

Andrew Stolz

NOVEMBER 17, 2021

When I started in finance, buybacks were almost unheard of; now, companies prefer to distribute cash through buybacks. This usually happens when a company is making a deliberate and significant change to its capital structure. Consider research done by Kroen (2021) that shows that since about 1998, U.S.

Sun Acquisitions

JUNE 15, 2022

Business valuation, according to the Corporate Finance Institute , is the “process of determining the present value of a company or an asset.”. Your business’ capital structure makeup. How much is your business worth? It’s not how much you think or hope the business is worth. Future earnings. Company assets.

Reynolds Holding

JUNE 28, 2022

In another set of tests, we examine changes in banks’ asset level, capital structure, lending activity, and performance after the May 22, 2018, passage of the EGRRCP Act. The costs of conducting a stress test and disclosing the results range between $150 million and $250 million (LaCapra, 2014; Sterngold, 2015; Tracy and Turner, 2015).

GCF Value

NOVEMBER 18, 2020

The business valuation will also likely consider additional factors: The capital structure of the business Prospects for future earnings The market value of physical assets. If you are pursuing SBA-backed financing, a specific set of valuation guidelines will apply to meet the SBA’s standard operating procedures.

GCF Value

AUGUST 8, 2023

If you are pursuing SBA-backed financing, a specific set of valuation guidelines will apply to meet the SBA’s standard operating procedures. Lenders: A prospective lender may request a valuation to support a loan for a business acquisition, partner buy-out, or to refinance debt.

Reynolds Holding

APRIL 17, 2022

Investors are willing to finance an innovation project when early results from the project – revenue trends, user growth, clinical trial data – reliably indicate future profits. The most innovative part of the economy, the venture capital (VC) market, has evolved structures to address these agency problems. But there’s a catch.

Simply Treasury

AUGUST 2, 2022

In early May, the European Commission unveiled its proposal for a "DEBRA" (Debt-equity bias reduction allowance) Directive, aimed at encouraging companies to finance their investments with equity and capital contributions, instead of resorting to loans (bank or other). DEBRA Proposal (« Debt-Equity Bias Reduction Allowance).

Benzinga

APRIL 12, 2023

Brookfield Infrastructure intends to maintain Triton's existing investment grade capital structure, uphold the highest operating and customer service standards for the benefit of Triton's customers and stakeholders, and help grow the business, aided by Brookfield Infrastructure's substantial access to long-term private capital.

Reynolds Holding

MAY 10, 2023

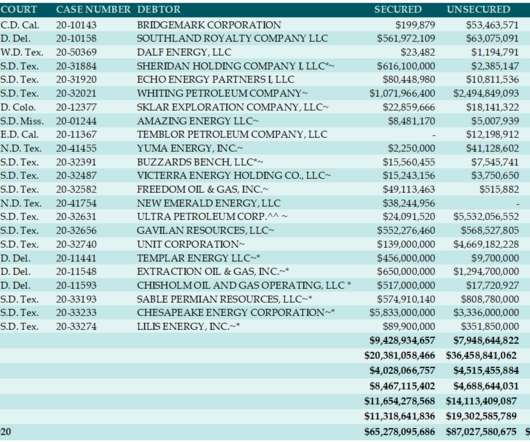

Importantly, a de-SPACed company’s inability to access additional capital outside of bankruptcy does not mean that incremental liquidity will be unavailable in bankruptcy. Debtor-in-possession (DIP) financing is often available. Longer-term strategic options. million under secured credit agreement $2.5

Brian DeChesare

FEBRUARY 9, 2022

Ask the average student or professional in the finance industry about their long-term career goal, and they’ll usually say, “ private equity mega-funds. ”. Deal Complexity / Technical Skills: You’ll get more experience building models, completing due diligence, and working on deals with complex capital structures at these firms.

Benzinga

JULY 10, 2023

Financing Structure: The transaction was financed through a $25.0 As part of the transaction, the principal owners of Barnhart received $19.25 million of the purchase price in the form of SMGI common stock, received $5.0 million of SMGI preferred stock and received a $3.0 million promissory note from SMGI.

Simply Treasury

MARCH 25, 2020

After the 2008 Global Finance Crisis, everyone thought they saw the worst. Medicine terminology used by finance too. Contamination and contagion are also terms borrowed by finance from medicine. But isn't it just "monetary financing," which when rates at zero stop, will be a problem? Will it pass this full-scale test?

Harvard Corporate Governance

MAY 2, 2022

When Google went public with a dual-class capital structure in which shares owned by the founders confer greater voting rights than shares issued to public investors, its cofounders, Larry Page and Sergey Brin, sent shareholders a letter promising to provide them with high-quality information about the company.

Appraiser Newsroom

JULY 5, 2022

Anastis Anastasiou , MBA is a Director in the Forensic & Litigation Consulting segment at FTI Consulting , with an expertise in forensic finance, valuation, dispute advisory and financial investigations. Mr. Anastasiou specializes in digital assets and decentralized finance (“DeFi”).

Appraiser Newsroom

FEBRUARY 16, 2022

He has over 21 years of experience in corporate finance, specializing in business and securities valuations, real options and derivative valuations, and risk management. Bob Bartell, CFA , is president of corporate finance for Kroll. Harris Antoniades, Ph.D., Baker is also a representative of Independent Investment Bankers Corp.,

Musings on Markets

FEBRUARY 27, 2023

The "Right" Financing Mix Is there an optimal mix of debt and equity for a business? In that case, the optimal debt ratio for a company is the one that maximizes value, not necessarily the one at which the cost of capital is minimized. Do companies optimize financing mix?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content