Capital Structure in 5 Minutes

Auto Dealer Valuation Insights

DECEMBER 19, 2023

Family businesses are built on long-term capital investments. Capital structure refers to the mix of debt and equity financing used to make those investments.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Auto Dealer Valuation Insights

DECEMBER 19, 2023

Family businesses are built on long-term capital investments. Capital structure refers to the mix of debt and equity financing used to make those investments.

Exit Strategy

MARCH 31, 2022

The following chart from GF Data shows the average capital structure over the past 5 years for middle market business acquisitions. Over that time equity contributions have varied only slightly over that time, in the range of 46% to 49%. Overall there was a slight rise during COVID, but nothing major.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Andrew Stolz

AUGUST 6, 2020

Definition of Optimal Capital Structure. The optimal capital structure of a firm is the right combination of equity and debt financing. It allows the firm to have a minimum cost of capital while having the maximum market value. The lesser the cost of capital, the more the market value of the company.

Equidam

AUGUST 10, 2023

Guest post from an Equidam partner: Bianca Iulia Simion , Marketing Lead at SeedBlink As the world of startups continues to evolve and mature, navigating the intricacies of equity management has emerged as a critical aspect of successful entrepreneurship. This leads to confusion and potential conflict during fundraising rounds.

Reynolds Holding

FEBRUARY 7, 2024

In a recent paper, we make the case for a smart contract-based automated restructuring framework that can be used by any firm that issues equity and debt securities in tokenized form. Since it is now possible to administer capital structures on the blockchain, opening them up to smart contract automation has become a reality.

Auto Dealer Valuation Insights

MARCH 7, 2024

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded common… Source

Harvard Corporate Governance

JUNE 2, 2022

We do so by focusing on bank executives’ equity portfolio (i.e., stock and option) “vega,” which captures the sensitivity of their equity portfolio’s value to their firm’s stock return volatility.

Auto Dealer Valuation Insights

DECEMBER 1, 2023

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded common.

Scott Mashuda

JANUARY 9, 2024

Entrepreneurial business owners can gain a substantial competitive edge in the lower middle market by recognizing the benefits of balance sheet restructuring, particularly when private equity collaborates as a partner for a defined period of time or a family office serves as your evergreen business partner.

Auto Dealer Valuation Insights

AUGUST 25, 2023

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded.

Auto Dealer Valuation Insights

JUNE 23, 2023

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded.

Brian DeChesare

FEBRUARY 9, 2022

Ask the average student or professional in the finance industry about their long-term career goal, and they’ll usually say, “ private equity mega-funds. ”. Similar to middle market private equity , though, there are some definitional problems here. Definitions: What is a Private Equity Mega-Fund?

Auto Dealer Valuation Insights

MARCH 10, 2023

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded.

Equilest

JANUARY 8, 2023

describe the relationship between the capital structure of the firm and its value. . It is often used as a benchmark for evaluating the financial decisions of firms and has been influential in shaping how firms approach financing and capital structure. . . Suppose also the weighted average cost of capital is 10%.

Auto Dealer Valuation Insights

NOVEMBER 18, 2022

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded.

Auto Dealer Valuation Insights

AUGUST 26, 2022

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded.

Auto Dealer Valuation Insights

JUNE 3, 2022

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded.

Auto Dealer Valuation Insights

MARCH 17, 2022

Due to a variety of corporate structures (including master limited partnerships and Up-Cs) and complex capital structures (including preferred equity and non-traded.

Harvard Corporate Governance

OCTOBER 21, 2022

IPO Readiness: IPO Equity Awards. Tags: Equity offerings , Incentives , Inflation , IPO framework , IPOs , Shareholder value , Stock options. Considerations for Dual-Class Companies Contemplating M&A Transactions. Posted by Ian Nussbaum, Bill Roegge, and Meredith Klionsky, Cooley LLP , on Wednesday, October 19, 2022.

Andrew Stolz

AUGUST 6, 2020

The theory suggests that a company’s capital structure and the average cost of capital does not have an impact on its overall value. . It doesn’t matter whether the company raises capital by borrowing money, issuing new shares, or by reinvesting profits in daily operations. Definition of the Modigliani-Miller Theorem.

Brian DeChesare

JUNE 29, 2022

If you’re thinking about exit opportunities and can’t decide between private equity and hedge funds , activist hedge funds might be your solution. Similar to private equity firms, they operate on longer time frames, influence companies’ operations and finances, and might catalyze major changes, such as spin-offs or acquisitions.

Lighter Capital

FEBRUARY 13, 2024

Equity dilution is part of growing a successful startup. How to Prevent Excessive Equity Dilution in Your Startup 1. Bootstrap your way to early milestones If you can, focus on growing the business organically before you pursue equity funding. Take only as much capital as you need More isn’t always better.

Valutico

FEBRUARY 27, 2024

Different types of discount rates such as risk-free rate, cost of equity, or cost of debt, are used contextually in financial analysis. Cost of Equity: The cost of equity represents the return required by equity investors to compensate them for the risk of owning a company’s shares.

Brian DeChesare

MAY 3, 2023

And it values the company today based on the present value of its dividends and that potential future value (either the stock price or the Equity Value via the Terminal Value calculation). And Equity Real Estate Investment Trusts (REITs) must distribute almost all their Net Income, so the DDM can work well in REIT valuations.

Benzinga

APRIL 27, 2023

WPFH also committed to extend the same acquisition offer to the remaining common shareholders of Vezbi, holding a total of 3,513,034 shares, or 13 percent of the outstanding Vezbi shares, at the same exchange ratio, with the goal to acquire all of the equity of Vezbi.

Andrew Stolz

MARCH 20, 2020

Weight average cost of capital (WACC) is a calculation of a firm’s cost of capital which includes all sources of capital such as common stocks, preferred stocks, and bonds. A firm uses a mix of equity and debt to minimize the cost of capital. Difference Between Cost Method and Equity Method.

Benzinga

APRIL 27, 2023

WPFH also committed to extend the same acquisition offer to the remaining common shareholders of Vezbi, holding a total of 3,513,034 shares, or 13 percent of the outstanding Vezbi shares, at the same exchange ratio, with the goal to acquire all of the equity of Vezbi.

Andrew Stolz

AUGUST 5, 2020

The WACC is the average cost of raising capital from all sources, including equity, common shares, preferred shares, and debt. What Impacts the Weighted Average Cost of Capital? Formula: [Cost of Equity * % of Equity] + [Cost of Debt * % of Debt *(1 – Tax Rate)] + [Cost of Preferred Stock * % of Preferred Stock].

Reynolds Holding

OCTOBER 17, 2023

Over the past 30 years, private equity firms and hedge funds have reshaped the landscape of corporate ownership. By 2022, firms under private equity management employed over 11 million people, nearly 10 percent of the U.S. In a recent study, we explore whether the level or structure of compensation varies based on corporate ownership.

Valutico

APRIL 17, 2023

Determining a company’s “Cost of Capital” is vital in corporate finance and valuation, and the Weighted Average Cost of Capital (WACC) provides a specific way of doing so. The resulting WACC represents the average cost of all the types of capital a company uses to finance its operations.

Valutico

APRIL 12, 2023

Determining a company’s “Cost of Capital” is vital in corporate finance and valuation, and the Weighted Average Cost of Capital (WACC) provides a specific way of doing so. The resulting WACC represents the average cost of all the types of capital a company uses to finance its operations.

Valutico

APRIL 17, 2023

Determining a company’s “Cost of Capital” is vital in corporate finance and valuation, and the Weighted Average Cost of Capital (WACC) provides a specific way of doing so. The resulting WACC represents the average cost of all the types of capital a company uses to finance its operations.

Benzinga

FEBRUARY 6, 2024

(NASDAQ: ZFOX ) ("ZeroFox"), a leading provider of external cybersecurity, today announced that it has entered into a definitive agreement to be acquired by Haveli Investments, a technology-focused private equity firm, in an all-cash transaction with an enterprise value of approximately $350 million.

Lighter Capital

JANUARY 11, 2022

A debt warrant is an agreement in which a lender has a right to buy equity in the future at a price established when the warrant was issued or in the next round. This high upside potential — along with high risk — is why venture debt deals often feature stock warrants as part of their “risk capital” structure. Let's dive in.

Appraisal Rights

JANUARY 15, 2021

For example, in 2017 case SWS , changes to SWS’s capital structure as the result of cancelling debt in exchange for equity were part of the “operative reality” because the exercise of the warrants and debt cancellation was a known element of value as of the Merger Date and was not conditioned or contingent on the merger.

Class VI Partner

JULY 28, 2021

Balance Sheet A Balance Sheet is an accounting record for a company that lists a company’s assets, liabilities, and shareholders’ equity. In particular, a Buy-Sell Agreement will typically provide for what happens in the event that one of the shareholders leaves the business and he or she needs to dispose of an equity stake in the business.

Andrew Stolz

APRIL 3, 2020

The buyer (the “sponsor”) raises debt and equity to acquire the target. It borrows the majority of the purchase price and contributes proportionately small equity investment. The LBO ratios can go to 90% of debt and 10% of equity. A private equity firm aims a target return of around 20 – 25% (WallStreetMojo, 2018).

Simply Treasury

AUGUST 2, 2022

DEBRA Proposal (« Debt-Equity Bias Reduction Allowance). In early May, the European Commission unveiled its proposal for a "DEBRA" (Debt-equity bias reduction allowance) Directive, aimed at encouraging companies to finance their investments with equity and capital contributions, instead of resorting to loans (bank or other).

Value Scope

AUGUST 31, 2020

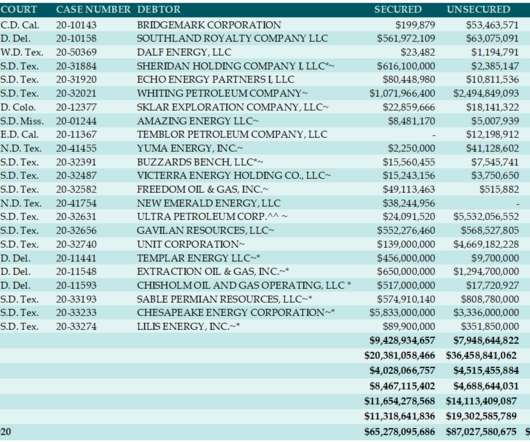

Commodities, including oil and gas, are far more volatile than other asset classes like fixed-income and equities. The cash flows we isolate are tested for their ability to support debt, the new capital structure of the restructured firm. Why is Energy Different? Conclusion.

Appraiser Newsroom

AUGUST 29, 2022

Tom has extensive experience with a variety of fixed income and derivative products, such as interest rate swaps/swaptions, structured products, credit/FX/commodity derivatives, bonds/loans, convertible debt, warrants, and allocation of enterprise/equity values across simple and complex capital structures.

Benzinga

APRIL 12, 2023

("BIP") (NYSE: BIP , TSX: BIP ), through its subsidiary Brookfield Infrastructure Corporation ("BIPC") and its institutional partners (collectively, "Brookfield Infrastructure"), jointly announce a definitive agreement for Triton to be acquired in a cash and stock transaction valuing the Company's common equity at approximately $4.7

Andrew Stolz

NOVEMBER 17, 2021

This usually happens when a company is making a deliberate and significant change to its capital structure. Finally, some lazy managers may use buybacks as a tool to manipulate short-term returns on equity and the stock price. A more rare case is where a company uses debt exclusively to buy back shares.

Reynolds Holding

DECEMBER 10, 2023

Different Buyback Rationales – and Their Implementation Objectives We will consider each of the three corporate finance-based rationales for buybacks, being investment, capital restructuring and excess capital return or dividend. Many, even most, investors wouldn’t immediately buy the final desired equity portfolio.

Valutico

DECEMBER 15, 2022

Equity Vs. Enterprise Multiples – Which To Use? The ratio is either related to the Equity Value or ratios related to the Enterprise Value. . An example of an equity multiple: Price / Earnings. This is because Enterprise Value consists of Debt + Equity but Equity Value only consists of Equity.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content