Joseph Kalmenovitz is an Assistant Professor of Finance at the Simon Business School, University of Rochester. This post is based on his recent paper forthcoming in the Review of Financial Studies.

Summary

Regulation is a fundamental economic concept. It triggers heated political debates, and it is also constantly on the minds of business owners, who cite regulation as a major factor that affects capital structure, employment, and innovation. Despite its importance, there is surprisingly little research on the economics of regulation. Of course, many studies focus on cost-benefit analyses of specific rules. But little is known on how regulation as a whole impacts business decisions. In particular, missing is a rigorous measure that consistently quantifies the costs of a wide range of regulations. Consequently, it is difficult to evaluate different theories of regulation and explore empirically how regulation affects economic decisions. In this paper, I take one step in that direction. I measure the cost of compliance with all federal paperwork regulations, using machine-learning techniques and a novel administrative data set, and then study the impact of regulatory burden on key economic outcomes. The new measures I created, labelled RegIn, are posted on my website, and I invite scholars to use them for subsequent academic research.

Longer version

As of December 2020, federal agencies collectively impose 9,553 forms on the public: corporations must file tax returns, truck drivers record on-duty hours, patients and doctors fill out privacy forms, manufacturers report working conditions, and so on. The abundance of paperwork is reputed to impose heavy economic toll on companies. For example, a survey by a prominent trade association found that “[i]n ranking the most significant challenge to their business posed by federal taxes, the majority, 59 percent, picked administrative burdens […] before they even pay their actual taxes” (link). Less known is the fact that federal agencies are legally required to monitor the cost of compliance with each paperwork regulation. For example, as of April 2021, the Securities and Exchange Commission reports that companies spend 14.2 million hours every year to comply with the disclosure requirements in Form 10-K (annual financial statement). That includes the time it took to search for data, compile the materials, and review and file the form with the Commission.

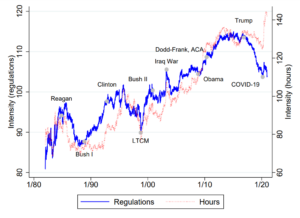

Since paperwork regulations are abundant and costly, and are also measured and monitored uniformly, they offer a unique opportunity to study the economics of regulation. To capitalize on this opportunity, I hand-collect information from the original reports prepared by federal agencies between January 1980 and December 2020. With that information, I can track the costs of compliance with each federal regulation individually, and with all federal regulations in aggregate. Specifically, I develop three measures which reflect the total regulatory intensity at any point in time: the number of active regulations, the estimated number of responses (“how much paperwork”), and the hours spent on compliance.

The new measures reveal novel stylized facts on the economic burden of regulation. Over the entire sample period, the public spent 292.1 billion hours on preparing and filing 2.24 trillion forms, to comply with 36, 702 regulations. In an average year, compliance consumes 3.2% of total working hours in the United States. Regulatory intensity has been declining since August 2016, and as of December 2020 has reached its pre-financial crisis levels of September 2008. Regulatory intensity increases during Democratic administrations, and it is negatively correlated with GDP growth and other economic indicators. Put differently, regulatory intensity is counter-cyclical: it increases (decreases) when economic conditions worsen (improve).

In the second part of the paper, I develop the primary measures of firm-specific regulatory intensity. Each company is subject to a different subset of regulations, and I capture this heterogeneity using supervised machine-learning algorithms. The methodology consists of three steps. First, I build a training sample for each company: a small set of regulations, split evenly between regulations that are relevant and irrelevant for that company. To construct the training samples, I compute the cosine similarity between the company’s 10-K report and each rule, and I select the rules with the highest and lowest cosine scores. For example, Boeing’s training sample includes safety regulations of the Federal Aviation Administration (relevant), and derivatives trading rules of the Commodity Futures Trading Commission (irrelevant). Next, I use the training sample to estimate a supervised machine-learning algorithm. The machine-learning algorithm identifies linguistic patterns of relevant and irrelevant regulations in the training sample, and then classifies the remaining regulations as relevant or irrelevant for that company. Finally, I calculate the company’s regulatory burden based solely on the regulations which are deemed relevant to that company. The three firm-specific measures, like the aggregate ones, represent the quantity of active regulations and the estimated costs of compliance in terms of responses and hours.

In the third part of the paper, I study the economic impact of regulatory intensity and present three sets of results. First, companies with heavy regulatory burden spend significantly larger fraction of their revenues on SGA (sales, general, and administrative) and COGS (cost of goods sold). Second, I investigate plausible responses to rising compliance costs. I find that regulatory intensity leads to more lobbying and less hiring. To finance the rising compliance costs, companies reduce cash holdings, issue new debt, and substantially increase their leverage. Third, cross-sectional tests highlight two possible mechanisms: budget constraints and uncertainty. Compliance costs could create budget pressures, forcing companies to prioritize compliance over other business activities. Moreover, the expansion of regulatory burden increases the legal uncertainty, incentivizing managers to postpone projects until the uncertainty would be resolved. Indeed, I find that the decline in capital investment is concentrated among financially constrained firms, which have little slack and must repurpose resources toward compliance, and among companies with irreversible investment opportunities, which are especially sensitive to uncertainty.

In sum, regulatory intensity leads to material adjustments of corporate policies. The regulatory burden increases overhead costs and the net present value of political investment, at the expense of other projects. These findings help validate the new measures but should not be interpreted as conclusive verdict against the value of regulation. First, causal inference is challenging because regulation is rarely imposed on companies exogenously. It resembles a cat-and-mouse game, where companies adjust their business models in response to regulatory actions, regulators initiate actions to address new developments among regulated companies, and both sides continuously interact with each other through lobbying, comment letters, and meetings. Second, many paperwork regulations will likely have significant positive externalities. Aviation safety rules protect travelers and air crews, and coal mines inspections protect workers, to mention just two examples. Full investigation of those benefits is beyond the scope of this paper, but they must be ultimately weighed against any potential costs. Thus, one should be cautious when drawing final conclusions from the empirical findings presented here.

There is a growing recognition of the need to better understand how regulation broadly affects economic activity. Against the backdrop of this important challenge, I make two contributions. First, I add a set of measures which seek to quantify regulatory burden. My approach has several advantages. First, it does not require companies to explicitly discuss regulation in their corporate filings. Instead, it is suffice to compare the vocabulary used by regulators to the one used by the company in its corporate filings. Second, it differentiates between regulation and deregulation (increase versus decrease). and more importantly between costly regulations and less-costly ones. This is important, because even if the firm mentions both Regulation X and Regulation Y, it does not mean that both regulations have the same impact on its operations. Third, the underlying data set is publicly available and updated continuously, which opens the door for future research. Fourth, the data set is flexible and can be adjusted for specific lines of research: the burdens can be calculated at various frequencies and for subsets of regulations and agencies.

The second contribution is to the literature on the economic impact of regulation. On one hand, public interest theories argue that regulation is a welfare-increasing institution designed to correct market failures, such as monopoly power and asymmetric information. The alternative theories, often known as public choice, private interest or regulatory capture, view regulation as a rent-seeking process where private actors advance their self-interests at the expense of the public good. I pursue a data-driven approach and estimate the impact of a large body of federal regulations on key company-level outcomes. Facing surging costs due to higher regulatory intensity, companies accelerate lobbying spending and pull resources away from capital investment and hiring. Further analysis highlights the role of budgetary constraints and legal uncertainty, which could amplify the economic impact of regulation. Combined, these results shed more light on the real effects of regulation and the underlying mechanisms.

Most importantly, the new RegIn measures helped spark a renewed interest in the economics of regulation. Since the paper was posted online, many studies have utilized RegIn to explore how regulation broadly affects economic activity. For example, does regulatory burden affects patent innovation and labor mobility (link)? Does it affect the firm’s exposure to uncertainty (link)? Does it affect the accuracy of analyst forecasts (link)? Lots remains to be done, and hopefully the new RegIn measure will help scholars venture into novel and exciting directions.

Print

Print