Southwest Airlines Meltdown and Your Investment Decision

Come Fly With Me (Soon?)

As the calendar turns to 2023, I pray you aren’t reading this stuck in an airport waiting for lost luggage. Last week, Southwest Airlines (NYSE: LUV) experienced significant disruptions and canceled thousands of flights following a winter blast smacking a large swath of the country.

The rub? Southwest was more or less alone in its cancellations. According to FlightAware, over 90% of U.S. flight cancellations were Southwest. On December 28, Southwest canceled more than 2,500 flights. The other big domestic carriers had canceled less than 50 apiece. It appears Southwest does not have “clearance, Clarence.”

Once I shook off the thought of being stranded in an airport with my three small children (iPads, anyone?), I read a piece dissecting the meltdown. Underinvestment in system-critical operations popped up as a key culprit, and it reminded me of the “Invest or Not to Invest” decision that faces family businesses.

So how do you make rational investment and capital expenditure decisions? Do you acquire a new business or modernize? What is a good investment? Below we discuss two key areas to address these questions: identify investments available to your business and evaluate your available investment opportunities.

Where Do We Invest?

So, what could Southwest have done? According to Southwest Chief Operating Officer Andrew Watterson, in a statement, the company’s scheduling software is seriously outdated.

“We had aircraft that were available, but the process of matching those Crew Members with the aircraft could not be handled by our technology,” Watterson said. “In our desired state, we have a solver that would be able to do that very quickly and accurately. Our system today cannot do that.” Southwest CEO Bob Jordan also reiterated the company’s need to modernize its IT and systems operations.

So, what about your business? Successful family businesses are built over time, and building well requires investment. A given dollar of cash flow generated by your business has two possible destinations: It will either be returned to capital providers—distributions—or reinvested in the business. Reinvested funds remain in the business with the expectation that the retained investment will generate returns that contribute to capital appreciation.

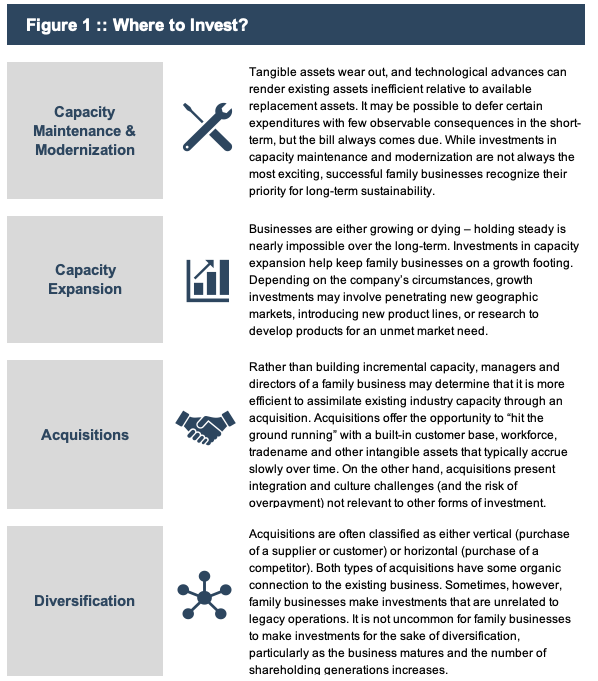

Investment can take different forms for a family business, as detailed in Figure 1.

How Do We Choose?

Southwest currently faces a simple, but likely not easy, choice in where to invest. Bringing its scheduling software into the 21st century is a start, as well as investing in its phone systems and other critical IT infrastructure. The company also faces staffing issues similar to other airlines and is hiring aggressively to beef up its headcount. In Southwest’s case, the investment choice has more or less been made for them after Department of Transportation’s Pete Buttigieg made his rounds on the cable news circuit chastising the company.

How do you make your investment decisions, hopefully with less public backlash? We see that your family businesses can make good investments by focusing on four areas: market opportunity, strategic fit, financial vetting, and success monitoring. We detail these areas in Figure 2 below.

Please Prepare for Landing

Making capital investments is easy. Making good ones is hard.

There is always a system refresh needed, plant expansion to build, or a competitor to buy. It takes careful consideration and a clear process to distinguish your reinvestment options, analyze them, and make good decisions.

Identifying your options and asking the right questions can get you and your business off the ground and moving in the right direction.

If you are experiencing some “turbulence” en route to your final destination, give one of our professionals a call to discuss your investment options and decision-making process in confidence.

Family Business Director

Family Business Director