William Ferguson is Chairman at Ferguson Partners; David F. Larcker is the director of the Corporate Governance Research Initiative at Stanford Graduate School of Business and senior faculty of the Arthur and Toni Rembe Rock Center for Corporate Governance at Stanford University; and Brian Tayan is a researcher with the Corporate Governance Research Initiative at Stanford Graduate School of Business. This post is based on their recent paper.

We recently published a paper on SSRN, VICI Properties: Creating Value from the Ashes of Caesar’s Demise, that examines the corporate governance changes that took place with the formerly bankrupted property assets of Caesar’s Entertainment to illustrate the potential impact that thoughtful governance choices can have on corporate performance.

Case studies of corporate governance often focus on failures—bankruptcies, fraud, terminations, and lawsuits. From these, consultants and researchers offer a post-mortem perspective on how failure could have been avoided if only certain best practices were adhered to. Recommendations are then cobbled together to help other corporations avoid a similar outcome.

Much rarer (and much harder to find in financial press accounts) are clear-cut examples of corporations where a careful selection of governance features played an important role in positioning the company for subsequent financial and operating success. Such stories are not salacious enough to drive media viewership, even though they are instructive to practitioners who aim to improve the performance of their organizations.

VICI Properties—a publicly traded REIT that emerged out of the post-bankruptcy ashes of Caesar’s Entertainment—offers an interesting example in which the eventual controllers of the assets were able to design critical corporate governance features de novo with the purposeful intention of creating a system that would add significant value to their ownership securities. In this post, we can learn important lessons about how appropriate governance choices can change the course of a corporation and establish a foundation for long-term success. In particular, we will focus on the role governance can play in creating stakeholder trust in situations in which trust had earlier been broken.

Caesar’s Entertainment Operating Company

Caesar’s Entertainment traces its history through two famous properties: Harrah’s Bingo Club of Reno, Nevada (founded in 1937) and Caesar’s Palace, a landmark property on the Las Vegas Strip (opened in 1966). By the early 2000s, both Harrah’s and Caesar’s were substantial publicly traded gaming corporations with properties across the U.S. The two combined in 2005 when Harrah’s acquired Caesar’s for $9.3 billion, later assuming the Caesar’s name in 2010 (see Exhibit 1 for a timeline).

Caesar’s financial troubles began soon after the combination, when private equity firms Apollo Global Management and TPG Capital teamed up to purchase the company in a take-private deal valued at $27.8 billion. While the deal included the assumption of $10.7 billion in existing Harrah’s debt, the private equity firms contributed only $6.1 billion of equity capital, financing the rest with $11 billion of new debt.

The timing of the acquisition was unfortunate. Although the deal was announced in late 2006, it did not close until January 2008 because of lengthy regulatory approval processes in the gaming industry. By the end of the year, financial markets seized up and the economy slid into recession. Vacations to high-profile casino destinations dried up, especially among the very profitable (to casino operators) large-dollar gamblers. Both Las Vegas and Atlantic City entered an extended period of overcapacity, leading to a string of bankruptcies in the industry.

Caesar’s was caught in the downdraft. To stave off Chapter 11, the company’s equity owners engaged in a series of complex internal transactions in an attempt to shield certain assets from creditors and salvage residual value for themselves. The company even reentered the public markets by issuing a sliver of equity ($16 million, or less than 2 percent of equity value) in order to establish a public price as the basis for future debt-for-equity exchanges. The efforts did not work. In 2015, Caesar’s placed its operating subsidiary (Caesar’s Entertainment Operating Company) in bankruptcy. The company’s high leverage and complicated ownership structure made the bankruptcy proceedings messy and contentious.

By 2016, the company’s junior creditors agreed to a restructuring deal, which called for the separation of Caesar’s assets into two separate companies. One retained the Caesar’s name and included the gaming operations (casino ownership and hotel management) of the company. The second—ultimately named VICI Properties—held the physical properties and would operate as a real estate investment trust (REIT). Junior creditors received debt and equity securities of both entities.

The return of the gaming operation to the public markets was a straightforward affair. In October 2017, the bankrupt operating subsidiary (Caesar’s Entertainment Operating Company) was merged into the publicly traded parent company (Caesar’s Entertainment Acquisition Company).

The situation for the real estate investment trust was entirely different. VICI owned property leased to a single tenant—Caesar’s—but was otherwise independent of Caesar’s in governance, management and access to capital. VICI was a new gaming REIT in a nascent REIT category without the proven track record necessary to attract widespread investor interest. Most of VICI’s original owners were looking to exit their investment—not provide additional capital. VICI had no natural investor base and no readily available pool of capital to access at a time when it was highly levered, without a board, without a CEO, without a track record, and without a strategy.

The Implementation of Governance at VICI Properties

Board of Directors

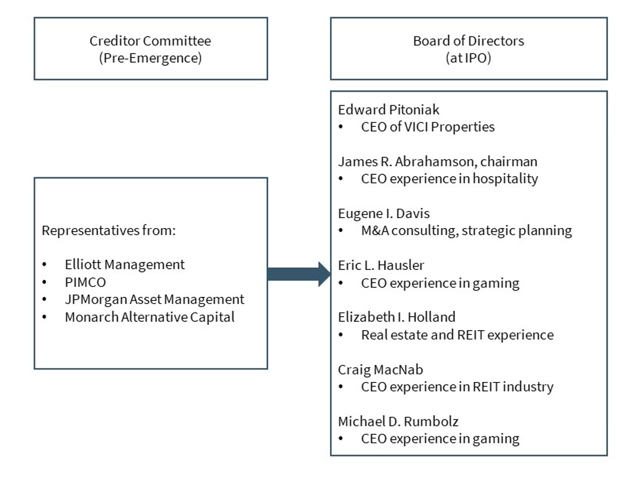

The first priority out of bankruptcy, during what was known as the “pre-emergence period” of roughly February 2017 through September 2017, was to transition fiduciary oversight from a committee of creditors to a board of directors, one with different investment horizons and objectives.

While in Chapter 11, the company’s assets were overseen by a committee of creditors under court supervision, consisting of hedge funds that held distressed debt in the company. These investors had purchased first-lien and junior debt obligations at substantial discounts to face value. Their primary objective was the recovery of value. The resolution of bankruptcy meant that their investment horizon was near completion. By contrast, the post-bankruptcy board of directors would be responsible for building long-term equity value.

The reorganization plan called for a seven-member board. To meet New York Stock Exchange listing requirements, a majority of these were required to be independent. Furthermore, directors had to meet suitability standards for the gaming industry. To build credibility with the investment community, the steering committee responsible for selecting board members placed a heavy emphasis on recruiting individuals with hospitality, gaming, and REIT experience. (Following the IPO, in January 2018, an additional board member was brought on with finance and investment experience.) These individuals were tasked with reviewing, challenging, and ultimately approving company strategy. They were also chosen for credibility with the external investment community (see Exhibit 2). The hedge fund representatives who steered the company out of bankruptcy stepped down from their oversight positions prior to the emergence of the REIT in early October 2017.

Over the ensuing four months between emergence and IPO, the VICI board faced the daunting challenge of establishing credibility with equity and credit investment communities at a time when the company was still burdened by the reputational stain of bankruptcy, an overly levered balance sheet, and reliance on only one tenant. The board faced simultaneous challenges of building a management team, settling on a strategy, and developing governance practices that could balance action with risk management. Board chair James Abrahamson recalls the situation:

“We did not have the time or the capacity to develop or execute a risk-free strategy. We needed to quickly establish a strong board culture, sound governance practices and a highly effective board-management relationship that could act decisively and quickly to fix our problems and seize every opportunity we could generate.”

Leadership

The board of directors selected Edward Pitoniak as CEO. Pitoniak was first recruited as a director and slated to become chairman. During the board formation process, he stood out for leadership characteristics important for the company’s success and was asked to be CEO. Among his attributes were strategic vision, an ability to communicate, consensus-building, negotiating skills, trustworthiness, and integrity. He was seen as being a straight-shooter and likeable. While Pitoniak had prior real-estate experience in the hospitality industry, he did not have a gaming background.

His first priorities were to develop a strategy and recruit an executive team. At the same time, he had to build credibility with Wall Street and develop an investor base to support the company’s near- and long-term capital requirements.

John Payne, who served as chief executive of Caesar’s Entertainment Operating Company while in bankruptcy, became president of VICI. Samantha Gallagher, with deep experience in real estate and capital markets, was brought in as general counsel. David Kieske, who had a long career at real-estate investment bank Eastdil, became chief financial officer (see Exhibit 3). The senior management team was responsible for strategy development, governance design and implementation, identifying acquisition targets, building and maintaining relations with tenants, capital raising, and financial management.

In time, they were recognized by the investment community for the quality of their leadership. According to a recent sell-side equity research report, “While we really like the assets, it is the VICI team which we think will make a difference. … We continue to hold VICI’s management team in high regard.”

According to another analyst:

VICI’s management team is a core group of individuals who are very clear about what they want to do, who act in the interest of shareholders. They have made big decisions with conviction. Other companies can get twisted up in capital allocation decisions. VICI is clear in their thinking. The quality of the assets, the simple straightforward structure, and the economics all work well.

Strategy

VICI was structured as what the real-estate industry calls a triple-net REIT. As lessor, VICI is not responsible for operating the properties it owns. Instead, tenants execute and pay for service operations (hotels and casinos) and also pay applicable real-estate taxes, insurance, and maintenance costs. VICI collects rents. Triple-net lease companies offer safe and consistent cash flow (assuming the tenant pays rent on time) and so are relatively low-risk investments. In order to offer attractive returns, they require new investment and careful structuring and accessing of capital (debt and equity) at a cost that is lower than the income yield of the property being acquired.

VICI’s strategy was to pursue consolidation of gaming properties under the triple-net lease structure. Most major gaming companies own their underlying real estate. VICI offers these companies an avenue to become asset-light: Sell the property to VICI in a sale-and-lease-back agreement in exchange for a large cash infusion. The gaming company can argue in favor a higher market multiple because of its asset-light status, while VICI shareholders receive rental income on a pass-through basis that avoids the extra layer of corporate taxation.

VICI’s management team was well-connected and highly seasoned in real-estate transactions. To capitalize on its market opportunity and diversify away from its tenant concentration problems, VICI wanted to grow quickly. Capital markets in U.S. real estate are extremely deep, and VICI sought to capitalize on its position before alternative players (in private equity or other public REITs) followed its strategy.

Cost of Capital

Before VICI could grow, Pitoniak and the VICI Team had to address and correct VICI’s extraordinarily high debt levels. Pre-emergence, VICI had debt equal to 10.5 times its expected first-year EBITDA. Pitoniak spent much of the pre-emergence period meeting with VICI’s original investors and discussing the need to reduce debt. Many of these investors were willing to accept a debt-for-equity swap that ended up lowering VICI’s debt prior to emergence from 10.5 times to 8.5 times debt-to-EBITDA. According to Pitoniak:

“This was still too high a level of debt if we had any hope of executing a successful IPO. We needed to further lower our debt-to-EBITDA ratio before our IPO, and the only way to escape the problem of over-leverage was to grow out of it by acquiring more EBITDA and doing so with equity. But who would give us equity, and for what?”

Around the same time, Caesar’s approached VICI about purchasing the real estate of Harrah’s Las Vegas for $1.1 billion, with a very short year-end closing period. The opportunity was too attractive to turn down but VICI was not in a capital position to finance the acquisition with debt. Instead, VICI convinced equity holders to agree to provide $1 billion in new equity. Management credibility was critical to convincing equity investors to accept dilution. Management successfully argued that deleveraging would

give the company a more viable path to future growth. VICI’s leverage ratio was reduced to 6.8 times EBITDA—a high ratio but suitable enough to allow the company to go public in January 2018.

Pitoniak explains:

“I look back on those weeks in the fall of 2017, and I’m amazed our board was able to perform under the crazy pressure. … As a management team, we were under tremendous time pressure to get the Harrah’s Las Vegas deal documented and funded, but the board also had to learn how to work together and make critically important decisions in a live-fire situation. There are many different ways we could’ve failed out of the gate, but I think the key reason we didn’t is because the board and management team learned to work together and, with our chair Jim Abrahamson’s leadership, learned how to listen to each other. … Any one of us could have argued that the urgency of the situation meant we needed to run roughshod over good governance or risk-management practices, but we were determined to get those things right.”

In early January 2018, just weeks before the IPO, board and management team faced another test when competitor MGM Growth Properties (controlled by MGM) made an unsolicited offer to buy VICI. VICI’s board ultimately rejected the bid, determining that VICI’s strategic plan had the potential to deliver superior shareholder value if the company stayed independent. (In 2021, VICI wound up buying MGM Growth Properties for $17.2 billion.)

Over its four-plus year period as a public company, VICI engaged in a series of accretive acquisitions. VICI funded these acquisitions with a higher-than normal portion of common equity than commonly used in deal structures. Over-equitization allowed the company to deleverage as it grew. The quality of the assets it acquired was demonstrated during the COVID-19 shutdown. In spring and summer 2020, when other commercial real estate firms were forced to offer rent concessions to tenants, VICI collected 100 percent of its rent on time. Its gaming tenants did not want to forfeit their prime locations.

In recognition of the progress VICI made to improve its capital structure, credit rating agencies Standard and Poor’s and Fitch upgraded the company to investment-grade status in April 2022—a notable achievement coming less than five years out of bankruptcy.

Investor Base

VICI leadership felt that successful implementation of its strategic plan required an investor base with an ability to understand and see value in gaming real-estate assets. “What we really stressed to the first investors we met with,” says Pitoniak, “is that if they learned about VICI at a faster rate than other fund managers, they had the opportunity to create what we called ‘cognitive arbitrage,’ getting into VICI earlier because they understood the VICI story earlier.”

VICI’s investor development strategy had two key elements: First, targeting those real-estate focused investment managers (often referred to as “dedicated REIT investment managers”) who are willing to invest in early-stage opportunities. Second, targeting sell-side analysts who had the strongest followings among the dedicated REIT managers. VICI’s board contributed to the development and execution of this strategy, particularly board member Craig MacNab, who brought to the VICI board decades of experience as an accomplished and widely respected REIT CEO. According to MacNab:

“In VICI’s early years I thought it was critically important that both analysts and investors understood that VICI was a REIT, not a gaming company. To drive that understanding, I felt it was vital that we get as much sell-side analyst coverage as we could from REIT analysts, not gaming analysts.”

Consistent performance built the company’s reputation among the investment community such that it was readily able to raise both debt and equity capital to fund acquisitions. To this end, when the company announced in March 2021 that it reached an agreement to acquire the Venetian Resort from Las Vegas Sands for $4.0 billion, the company’s stock price actually increased on the deal—despite going to market the same day to raise $2 billion in new equity through a forward sales agreement to fund the acquisition.

Over four-plus years, VICI raised nearly $30 billion in debt and equity capital to fund acquisitions. In the process, the company transitioned its shareholder base from one dominated by distressed-debt hedge fund owners to one of the most-owned REITs by dedicated REIT investors (see Exhibit 4). In the process, VICI has generated total returns (dividends plus capital appreciation) of over 80 percent since IPO, compared with approximately 40 percent for the MSCI REIT Index and 50 percent for the S&P 500.

“Our compensation committee, with the guidance of Craig Macnab (as chair), designed an executive compensation program that enables and incentivizes us, as executives, to take a longer-term approach to value creation,” says Samantha Gallagher, VICI’s Executive Vice President and General Counsel. “We aren’t rewarded for absolute transactional activity or for actions that generate short-term benefit but uncertain long-term consequences. We’re rewarded only for transactions that are accretive on a per share basis and for generating longer-term total return.”

Compensation

Executive compensation design is a key element of corporate governance. At VICI, there are two notable features of this important choice. The first is that CEO Ed Pitoniak, although receiving higher total compensation than other named executive officers, receives a lower base salary than president and COO John Payne. This structure is a legacy of the fact that Payne had a long operating history at Caesar’s where he earned a salary consistent with the gaming sector. One insider explained, “Ed accepted a lower salary than John, and his considered judgement is to keep it at a lower level. … Ed’s ego is such that he can handle this.”

The second notable feature has to do with the multi-year time frames of the incentive compensation programs. The annual cash bonus at VICI is awarded based on two-year (rather than one-year) growth in cash flow per share. This structure was selected to create better alignment between shareholders and the executive officers. Because regulatory approval takes a long time in the gaming industry, a two-year bonus structure means that the executive team does not receive compensation credit for an acquisition until it closes and the positive economics show up in the income statement. Were a one-year plan adopted, executives would receive cash bonuses for closing deals before shareholders saw the benefits of higher cash flows from those deals. The long-term equity incentive program is based on rolling three-year performance cycles, with the key performance metrics being absolute total shareholder return and relative shareholder return versus the MSCI REIT index. New LTIPs are awarded each year.

Multi-year incentive programs require greater patience before the executive receives incentive-award payments, but they are ultimately rewarded well for those efforts if they create value for shareholders.

Governance and Bylaws

Finally, VICI sought to implement a shareholder-friendly governance structure. This goal was embraced during the pre-emergence period by the distressed debt investors who recognized that the best way to maximize the return of their investment was to create a governance structure favorable to the public market investors who would ultimately buy VICI. To this end, VICI implemented board features, pay elements, and shareholder rights that are generally well-received by market participants. VICI management also deliberately makes itself available to shareholders to increase transparency and communication with its shareholder base (see Exhibit 5). In recognition of VICI’s efforts, real-estate investment research firm Green Street ranked VICI fourth for governance quality out of a group of almost 100 REITs in the U.S. in 2021.

Summary

The core real estate assets of VICI were resurrected from the ashes of a messy and contentious bankruptcy. Working from a “blank slate,” the company assembled a high-quality board and leadership team, developed a strategy for long-term growth, and transitioned its shareholder base to a group of investors willing to support that strategy through new equity raises and steady deleveraging as the company grew through a series of acquisitions of premier gaming properties. The result is that less than five years after emerging from Chapter 11, VICI has garnered a market capitalization of $30 billion and enterprise value (debt plus equity) of $45 billion—larger than the enterprise value of the entire Harrah’s operation at the time of its leveraged buyout—while at the same time restructuring its balance sheet from practical insolvency to investment-grade rating. VICI’s track record demonstrates how thoughtful choices around corporate governance and leadership can position a company for future success.

Why This Matters

- The story of VICI Properties started with the separation of real-estate assets out of a disastrously structured private-equity deal and evolved into the creation of a highly successful REIT in the gaming industry. What role did governance choices play in this outcome? Does the ultimate success of VICI demonstrate the contribution that governance choices can make toward financial performance, or is it simply a case of responsible financing decisions?

- An important step in founding VICI was the selection of a board of directors with deep industry and financial expertise to oversee long-term value creation. How critical is board quality among publicly traded companies in general and REITs in specific? Does the time horizon of the board matter for creating significant equity value?

- Insiders and outsiders alike credit much of VICI’s success to its management team. At the same time, many governance experts debate the contribution of the CEO and senior executives to long-term performance. How much do these executives matter to corporate success? How important are intangible leadership qualities, such as vision, communication, and consensus-building?

- A central objective of VICI coming out of bankruptcy was the transition of its investor base away from distressed-debt hedge fund investors to a dedicated group of knowledgeable real estate (REIT) investors. Does the composition of the shareholder base contribute to the performance of the company through a reduction in the cost of capital? It is true that hedge fund investors are short-term oriented, while dedicated institutional and retail investors care more about the long term? Could VICI have achieved its acquisition track record with an investor base heavily comprised of hedge fund owners?

- VICI has been recognized by third-party observers for governance quality—in particular board structure and bylaw provisions that are favorable to common shareholders. What role, if any, does governance quality play in the long-term performance of a company? Does it simply make skeptical investors “more comfortable” with the board and management, or does it tangibly contribute to value creation?

The complete paper is available for download here.

Exhibit 1: Timeline: Significant Milestones in Evaluation of Caesar’s Entertainment and VICI Properties

2005: Harrah’s acquires Caesar’s for $9.3 billion.

2006, Dec: Apollo and TPG agree to take Harrah’s private for $27.8 billion.

2008, Jan: Apollo and TPG complete acquisition.

2008, Dec: Junior creditors of Harrah’s exchange debt for longer dated maturities at approximately 50 cents on the dollar.

2009: Harrah’s initiates first of a string of internal transactions to shield retain value for equity owners.

2010: Harrah’s changes name to Caesar’s Entertainment.

2012: Caesar’s Entertainment Acquisition Corp. returns to public market through initial public offering of less than 2 percent of shares.

2013: Caesar’s explores restructuring deal with junior creditors.

2015: Caesar’s Entertainment places operating subsidiary (Caesar’s Entertainment Operating Company) in bankruptcy.

2016, Sep: Junior creditors agree to restructuring deal. Deal includes separation of operating company and real estate trust with land and building assets. Junior creditors to receive equity and debt in both entities.

2017, Feb-Sep: Governance structure of VICI Properties is established.

2017, Oct: VICI Properties formally separated from Caesar’s Entertainment Operating Company.

2017, Oct: Caesar’s Entertainment Operating Company emerges from bankruptcy through merger with Caesar’s Entertainment Acquisition Company.

2017, Nov: Caesar’s Entertainment completes sale of Harrah’s Las Vegas (land and buildings) to VICI Properties.

2018, Jan: VICI Properties completes initial public offering.

2018, Jun: VICI Properties to buy Margaritaville Resort and Casino from Penn National Gaming for $376 million.

2018, Nov: VICI Properties to buy Greektown from JACK Entertainment for $700 million.

2019, Apr: VICI Properties to buy Jack Cincinnati Casino for $745 million and lease to Hard Rock International.

2019, Jun: VICI Properties to buy three gaming properties for $278 million and lease to Century Casinos.

2019, Jun: Eldorado Resorts to buy Caesar’s Entertainment for $17.3 billion. VICI Properties to buy various Harrah’s properties from Eldorado and Caesar’s for $1.8 billion.

2019, Oct: VICI Properties to buy Jack Cleveland Casino and Jack Thistledown Racino from JACK Entertainment for $843 million.

2020, Jun: VICI Properties and Eldorado enter into $400 million mortgage for Caesar’s Forum and agree to sale of 23 acres near Las Vegas strip for approximately $100 million.

2021, Mar: VICI Properties to buy Venetian Resorts from Las Vegas Sands for $2.25 billion.

2021, Aug: VICI Properties to buy MGM Growth Properties for $17.2 billion.

2022, Apr: Standard & Poor’s and Fitch Ratings upgrade VICI Properties to investment-grade credit status.

2022, Jun: VICI Properties added to Standard & Poor’s 500 Index

Source: Research by the authors.

Exhibit 2: Board of Directors

Source: Creditor committee representatives provided by VICI Properties. Board of directors at IPO from VICI Properties, Form S-11A, Filed Jan 22, 2018.

Exhibit 3: Profiles of the Senior Executive Team

Edward Pitoniak: Chief Executive Officer

- Initially considered by creditor committee to be board chair, they became so impressed with him that he was asked to be CEO.

- Strong background in hospitality

- Both organizational and board leadership experience

- Track record in turning around and generating strong returns for shareholders

- Exceptional leadership skills and developing strong relationships with investors.

John Payne: President and Chief Operating Officer

- Well-respected and connected people in the gaming industry

- Well-known to VICI tenants

- His relationships have been critical to VICI’s ability to buy assets

- With strong executive leadership, he is the only holdover from Caesar’s to remain with VICI

David Kieske: Chief Financial Officer

- Solid M&A and IPO experience (former Eastdil investment banker)

- Hospitality and gaming experience

- Deep industry relationships important for sourcing and consummating deals

- Understands adjacencies to gaming

Samantha Gallagher: General Counsel

- Former REIT general counsel with solid understanding of industry

- Well-positioned to executive IPO, oversee future growth

- Outstanding strategic advisor to board and CEO

- Regulatory and governance strength

Source: Interviews by the authors

Exhibit 4: Transition of VICI Investor Base

Source: VICI Properties

Exhibit 5: VICI Governance and Bylaw Provisions

Source: VICI Properties, Form DEF-14A, Filed March 14, 2022

Print

Print