Brenden P. Carroll and Stephen T. Cohen are Partners and Devon M. Roberson is an Associate at Dechert LLP. This post is based on a Dechert memorandum by Mr. Carroll, Mr. Cohen, Mr. Roberson, Jonathan Blaha, Kathleen Hyer, and Austin G. McComb.

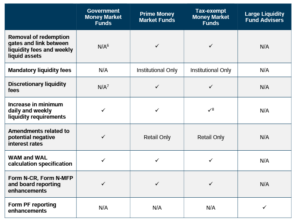

The Securities and Exchange Commission, by a vote of 3 to 2, approved significant changes to Rule 2a-7 and other rules that govern money market funds under the Investment Company Act of 1940 (Amendments) on July 12, 2023. [1] Among other things, the SEC:

- adopted a new mandatory liquidity fee framework under Rule 2a-7 for institutional prime and institutional tax-exempt money market funds in lieu of the proposed swing pricing framework;

- removed the redemption gate framework from Rule 2a-7, while preserving the discretion to impose liquidity fees for non-government money market funds (without regard to weekly liquid asset levels);

- substantially increased the required minimum levels of daily and weekly liquid assets for all money market funds;

- enabled stable net asset value (NAV) money market funds to institute a reverse distribution mechanism (RDM) or similar “share cancellation” mechanisms during a negative interest rate environment to maintain a stable $1.00 NAV per share; and

- enhanced the reporting requirements of registered money market funds on Form N-MFP as well as SEC-registered investment advisers to private liquidity funds on Form PF

The Amendments represent the most notable effort by the SEC to reform the money market fund industry since the series of reforms it adopted following the 2007-2008 financial crisis. The SEC originally proposed the current reforms in December 2021 (Proposal) [2] in response to the stresses experienced by money market funds in March 2020, when the onset of the COVID-19 coronavirus pandemic led to stresses in the broader short-term funding markets and substantial redemptions, primarily from institutional prime money market funds. Adopting money market fund reform became a more significant policy priority for financial regulators – both within and outside of the SEC – following the stresses in the banking sector in early 2023 that led to three regional bank failures. [3] Similar to the reforms following the 2007-2008 financial crisis, the Amendments attempt to respond to significant market events and reflect the SEC’s understanding of the roles of money market funds in the short-term funding markets and perception of their vulnerabilities during periods of market stress. In his opening remarks, SEC Chair Gensler stated that the Amendments “will make money market funds more resilient, liquid and transparent, including in times of stress.” Commissioners Hester M. Peirce and Mark T. Uyeda, who voted against the Amendments, expressed their disapproval of several aspects of the Amendments, including the mandatory liquidity fee framework, and suggested that the framework should have been re-proposed for additional public comment.

The SEC did not adopt elements of the Proposal that were most concerning to the industry, namely mandatory swing pricing for institutional money market funds [4] and a requirement for stable NAV money market funds to determine that their intermediaries are able to support a floating NAV. However, certain elements of the Amendments will likely increase costs to fund sponsors and have commercial implications for institutional money market funds that strike their NAVs at multiple times per day and/or offer same-day settlement. The Amendments also raise potential issues for money market fund boards of directors, service providers, intermediaries and investors. The SEC’s decision not to adopt the proposed swing pricing framework may also be a preview for the proposed rule that would require registered open-end funds (other than ETFs) to utilize swing pricing. [5] For example, in the Adopting Release, the SEC acknowledged the operational burdens associated with swing pricing (as highlighted by many fund sponsors that commented on the Proposal), and asserted that liquidity fees would still achieve “many of the benefits [the SEC was] seeking with swing pricing by allocating liquidity costs to redeeming investors in stressed periods.” This pivot may suggest flexibility in the SEC’s preference among potential anti-dilution mechanisms in the separate proposed swing pricing rulemaking for registered open-end funds (other than ETFs), though the Adopting Release conceded no ground with respect to the perceived need for an anti-dilution mechanism.

Summary of Reforms

This post provides an overview of the Amendments and their applicability to categories of money market funds, and then discusses each of the Amendments in more detail.

- Removal of Redemption Gates and the Tie Between the Weekly Liquid Asset Threshold and Liquidity Fees. The Amendments remove provisions in Rule 2a-7 that permit a money market fund to impose a temporary redemption gate. The Amendments also remove provisions in Rule 2a-7 that tied a money market fund’s ability to impose liquidity fees to its level of weekly liquid assets.

- Mandatory Liquidity Fee Framework and Discretionary Liquidity Fees. The Amendments require institutional prime and institutional tax-exempt money market funds to impose a mandatory liquidity fee when a fund experiences total daily net redemptions that exceed 5% of net assets based on flow information available within a reasonable period after the last computation of the fund’s NAV on that day (or such smaller amount of net redemptions as the board or its delegate determines), unless the fee is de minimis (i.e., is less than 0.01% of the value of the shares redeemed). The fee must be based on a good faith estimate, supported by data, of the costs the fund would incur if it sold a pro rata amount of each security in its portfolio to satisfy the amount of the net redemptions. If the costs of selling a pro rata amount of each security in a fund’s portfolio cannot be estimated in good faith and supported by data, the fund must impose a default fee of 1% of the value of the shares redeemed. Additionally, the board of a non-government money market fund or its delegate (e.g., the fund’s investment adviser) may require the fund to impose a discretionary liquidity fee (not to exceed 2% of the value of the shares redeemed) if it determines that such a fee would be in the best interests of the fund.

- Increase in Daily and Weekly Liquid Asset Requirements. The Amendments substantially increase the required minimum levels of daily and weekly liquid assets for all money market funds from 10% and 30% to 25% and 50%, respectively.

- Potential Negative Interest Rate Environments. Under the Amendments, a stable NAV money market fund will be permitted to reduce the number of its shares outstanding (i.e., share cancellation) to maintain a stable share price, in addition to its existing ability to convert to a floating NAV, in the event of a negative interest rate environment. Utilization of these measures will be subject to certain board determinations and disclosure requirements.

- WAM and WAL Calculation Specification. The Amendments will standardize the calculation of a money market fund’s WAM and WAL, by requiring funds to make these calculations based on a security’s market value, rather than based on the amortized cost of the security.

- Enhanced Reporting Requirements. Under the Amendments, money market funds will be required to file a report on Form N-CR if the percentage of total assets in daily liquid assets or weekly liquid assets falls below 12.5% or 25%, respectively. The SEC also added several new disclosure items to Form N-MFP, including certain information regarding large fund shareholders and additional data regarding portfolio securities sold during the reporting period.

- Form PF Amendments. The SEC adopted amendments to Section 3 of Form PF, the confidential reporting form for certain SEC-registered investment advisers to private funds, to require additional information on private liquidity funds, including certain information regarding asset turnover, liquidity management and secondary market activities, subscriptions and redemptions and ownership type and concentration.

Each of these Amendments is discussed in more detail below.

Removal of Redemption Gates and the Tie Between the Weekly Liquid Asset Threshold and Liquidity Fees

The SEC removed provisions in current Rule 2a-7 that permit the board of a non-government money market fund to impose a redemption gate (i.e., a temporary suspension of redemptions). Additionally, while the SEC retained the ability of a non-government money market fund’s board to impose liquidity fees on a discretionary basis and impose mandatory liquidity fees under certain circumstances (as discussed below), the Amendments untether the imposition of such fees from the fund’s level of weekly liquid assets.

Currently, Rule 2a-7 permits a non-government money market fund’s board to impose a liquidity fee of up to 2% on all redemptions or temporarily suspend redemptions for up to 10 business days in a 90-day period (i.e., a “redemption gate”), when the fund’s weekly liquid assets fall below 30% of total assets, if it determines such fee or gate is in the best interests of the fund. Additionally, Rule 2a-7 currently requires a non-government money market fund to impose a liquidity fee of 1% on all redemptions if its weekly liquid assets fall below 10% of its total assets, unless the fund’s board determines that the liquidity fee would not be in the fund’s best interests (or that a lower or higher fee (up to 2%) would be in the fund’s best interests). In both scenarios, under current Rule 2a-7, the board’s determination to impose a fee or gate cannot be delegated.

In the Adopting Release, the SEC noted that, during the market stresses experienced in March 2020, “even though no money market fund imposed a liquidity fee or gate, the possibility of their imposition after crossing the publicly disclosed 30% weekly liquid asset threshold appears to have contributed to investors’ incentives to redeem from prime money market funds.” The SEC also noted that the 30% weekly liquid asset threshold “contributed to incentives for money market managers to maintain weekly liquid asset levels above a 30% weekly liquid asset threshold, rather than use those assets to meet redemptions,” and that money market fund investors appeared to be more sensitive to the possibility of a redemption gate than a liquidity fee. [9] Due to these unintended consequences of the current liquidity fee/redemption gate framework, the SEC removed the ability of a money market fund’s board to impose a redemption gate under Rule 2a-7 altogether. [10] In addition, although the SEC retained the ability of a non-government money market fund’s board to impose liquidity fees on a discretionary basis, the SEC removed the tie between discretionary liquidity fees and a fund’s level of weekly liquid assets in order to “avoid predictable triggers that may incentivize investors to preemptively redeem to avoid incurring fees.” [11] Under the Amendments, a fund’s board will be permitted to delegate the responsibility to impose discretionary liquidity fees.

Discretionary Liquidity Fees

As discussed above, the SEC retained the ability of a non-government money market fund’s board to impose a discretionary liquidity fee (up to 2%) if it determines such fee is in the best interests of the fund, without regard to the fund’s level of weekly liquid assets. While a government money market fund is not required to consider the imposition of discretionary liquidity fees under the Amendments, it may choose to rely on the ability to impose discretionary liquidity fees provided that it: (i) complies with the requirements of Rule 2a-7; (ii) discloses the potential imposition of discretionary liquidity fees in its summary prospectus; and (iii) provides investors with prior notice. [12] By making the imposition of a discretionary liquidity fee subject solely to a best interest finding, the SEC intended to provide flexibility to determine when and under what circumstances the liquidity fee is appropriate and to “lessen the likelihood that sophisticated investors can preferentially predict when a fee is going to be imposed, thus reducing the potential for a run or other adverse effects.” [13]

In a departure from the Proposal, the SEC allowed a fund’s board to delegate determinations related to liquidity fees to the fund’s officers or investment adviser. Under current Rule 2a-7, a board’s determinations related to liquidity fees cannot be delegated. For the delegation to be proper, the board must adopt and periodically review written guidelines and procedures by which the delegate can make liquidity fee determinations, including guidelines for determining the application and size of liquidity fees. [14] According to the Adopting Release, the guidelines should specify how the delegate is expected to act with respect to any discretionary aspect of the liquidity fee framework. Additionally, under the Amendments, the fund’s board must periodically review the delegate’s liquidity fee determinations in connection with its oversight responsibilities. In the Adopting Release, the SEC stated that, by “[p]roviding boards with the ability to delegate the responsibility for administering discretionary liquidity fees to the fund’s adviser or officers,” the SEC “addresses the concerns [it] expressed in the proposal regarding potential delays in board action to impose a liquidity fee, which may create timing misalignments between an investor’s redemption activity and the imposition of liquidity costs.” [15]

Mandatory Liquidity Fee Framework

In lieu of the proposed swing pricing framework set forth in the Proposal, the SEC adopted a mandatory liquidity framework pursuant to which institutional money market funds must impose a mandatory liquidity fee when the fund experiences total daily net redemptions that exceed 5% of net assets. The Proposal would have imposed a mandatory swing pricing framework for institutional money market funds to allocate redemption costs to redeeming investors by requiring those funds to adjust their NAV per share downward by a “swing factor” when they experience any net redemptions during a “pricing period.” In the Adopting Release, the SEC acknowledged that swing pricing would introduce new operational complexity to institutional money market funds; and, indeed, many commenters on the Proposal were heavily opposed to the proposed swing pricing framework, in part due to these operational concerns as well as a belief that swing pricing would not have the intended effect of reducing redemptions from money market funds in periods of market stress, among other concerns. The SEC stated in the Adopting Release that it believes that “the mandatory liquidity fee will reduce operational burdens associated with swing pricing while still achieving many of the benefits [the SEC was] seeking with swing pricing by allocating liquidity costs to redeeming investors in stressed periods.” [16] The mandatory liquidity fee framework may nonetheless impose similar operational complexities, as discussed below. However, certain elements of the Amendments (e.g., the de minimis exception, the default 1% mandatory liquidity fee), as well as guidance in the Adopting Release on the use of “pricing grids” to calculate a mandatory liquidity fee that is required to be imposed, were designed to reduce operational complexities.

The mandatory liquidity fee framework set forth in the Amendments applies to all institutional prime and institutional tax-exempt money market funds, including institutional money market funds whose shares are not offered publicly. Some commenters on the Proposal suggested that privately-offered money market funds should not be subject to the proposed swing pricing framework, arguing these funds do not pose the same risks as publicly-offered funds due to their use as internal cash management tools. By declining to include an exception for such funds, privately-offered institutional money market funds (including those that are not registered under the 1940 Act in which registered funds invest in reliance on Rule 12d1-1 [17]) will be required to comply with the mandatory liquidity fee framework.

Determination of Net Redemptions

The Amendments require an institutional money market fund to determine, based on flow information available within a reasonable period after the last computation of the fund’s NAV on that day, whether the fund has experienced total daily net redemptions that exceed 5% of net assets (or such smaller amount of net redemptions as the board determines).

Under the proposed swing pricing framework, a money market fund would have been permitted to reasonably estimate the amount of net redemptions it experienced on a given day (or pricing period). Commenters on the Proposal noted that using estimates of flow data could present several challenges, as money market funds may not receive such data from intermediaries in time to calculate swing factors, and estimates could result in NAV errors and liability concerns. The mandatory liquidity fee framework therefore requires a money market fund to determine whether its net redemptions have crossed the 5% threshold based on actual flow data, rather than estimates.

The Amendments further require that such determination be made “within a reasonable period after the last computation of the fund’s [NAV].” [18] The Adopting Release notes that, in determining when to calculate its net flows, a money market fund should take into consideration when it typically receives flow information based on historical data and may also consider the amount of time needed to calculate and apply a liquidity fee (if required). The Adopting Release included the following example:

“if a fund generally receives substantially all of its flows by 5 pm and the process for determining the fee amount will take up to one hour, the rule would not require the fund to wait until 6 pm to calculate its net flows if, by 6 pm, the fund typically has an even larger percentage of its flows. Using the same example, it would not be reasonable for this fund to calculate its net flows at 3:30 pm, when it generally has less than a majority of its net flows by this time, given that the fund can reasonably expect, based on historical data, to have more net flow information by 5 pm and still be able to calculate and apply any fee as of that later time.” [19] (emphasis added)

The Adopting Release states that this approach is intended to allow a money market fund to continue to offer features like same-day settlement by giving the fund flexibility to calculate daily flows using the best information available. The Adopting Release acknowledges that this approach may result in false negatives and false positives, but states that the SEC believes that the associated risk is relatively low because: (i) institutional money market funds are generally not expected to apply a liquidity fee under normal market conditions under the de minimis exception, and therefore a “false positive” is unlikely to result in a fee being charged; and (ii) institutional money market funds are expected to experience net redemptions in periods of stress, and therefore a “false negative” is unlikely to occur.

In a change from the proposed swing pricing framework, the Amendments require money market funds that strike their NAV multiple times per day to calculate their net redemptions over all pricing periods in a given day, rather than analyzing net redemption activity for each pricing period. Additionally, a money market fund must calculate its redemptions at the fund level (i.e., for multi-class funds, not for each share class). The Amendments allow a money market fund to use a lower net redemption trigger for applying mandatory liquidity fees if the board or its delegate determines such lower amount is appropriate. The SEC stated in the Adopting Release that such lower threshold may be appropriate if a fund holds a greater proportion of its portfolio in less liquid investments or during periods of market stress.

Calculating Mandatory Liquidity Costs

The size of the mandatory liquidity fee to be charged must be based on a good faith estimate, supported by data, of the costs the fund would incur if it sold a pro rata amount of each security in its portfolio (i.e., a “vertical slice”) to satisfy the amount of the net redemptions. This calculation must take into account: (i) transaction costs; and (ii) for holdings that are not daily or weekly liquid assets, market impacts.

Transaction costs include spread costs, such that the fund is valuing each security at its bid price, and any other charges, fees and taxes associated with portfolio security sales, including any brokerage or custody fees that may be applicable. The SEC acknowledged in the Adopting Release that “the vast majority of money market funds already price portfolio securities at the bid price when striking their NAVs.” [20] Therefore, such funds may only need to calculate the other charges, fees and taxes when determining its transaction costs.

To calculate market impact costs, a money market fund must first establish a “market impact factor” for each security, which represents a good faith estimate, under current market conditions, of the percentage change in the value of the security if it were sold, per dollar of the security that would be sold if the fund sold a vertical slice of its portfolio to satisfy the amount of net redemptions. Once determined, the money market fund would then multiply the market impact factor by the dollar amount of the security that would be sold to satisfy its level of net redemptions. A money market fund does not need to calculate market impact costs for its holdings that are daily and weekly liquid assets. [21]

The Amendments allow a money market fund to make a good faith estimate of transaction costs and market impacts for each type of security with the same or substantially similar characteristics and apply those good faith estimates to all securities of that type in the fund’s portfolio, rather than analyzing each security separately. To determine whether securities are the same “type,” a money market fund may consider “the liquidity, trading and pricing characteristics” of a subset of securities as well as factors such as “issuance size, credit worthiness, number of other investors in the same issuance, maturity, industry and geographic region.”

Additionally, the Adopting Release offers guidance to money market funds regarding one potential method that can be used to simplify the calculation of market impact costs. The SEC noted in the Adopting Release that a money market fund could develop “pricing grids” using historical data “to model the reasonably expected price concessions a fund may need to make to sell different amounts of a security under different market conditions.” Under the SEC’s suggested approach, a money market fund using pricing grids would create different grids for various market conditions, including when the market is experiencing credit stress, liquidity stress, interest rate stress, or some combination of these conditions, as well as a grid for normal market conditions. According to the SEC, the grids should take into account differing market impacts based on the amount of the security sold. The SEC noted that the “grid” approach is only one method a money market fund can use to make good faith estimates of market impacts, and that if this approach is used, a fund “generally should review the grids periodically and update them to account for recent market data.”[22]

Applying the Mandatory Liquidity Fee

Once a money market fund has determined its liquidity costs, it must apply a mandatory liquidity fee. As discussed above, the amount of a fund’s liquidity costs is calculated based on a good faith estimate of the costs the fund would incur if it sold a vertical slice of its portfolio to satisfy the amount of net redemptions on any day where the fund has crossed the 5% net redemption threshold. When the liquidity fee is applied, however, the fee is charged to all (i.e., gross) redemptions that are entitled to a price calculated on that day, including redemptions requested during earlier pricing periods during the day or requests received after the final pricing period of the day, but deemed as accepted by the fund prior to the final pricing period. The mandatory liquidity fee is not subject to a cap or upper limit.

The Amendments contain an exception for when liquidity costs would be de minimis. In particular, if the amount of the mandatory liquidity fee would be less than 0.01% of the value of the shares redeemed (i.e., gross redemptions), the money market fund is not required to charge a fee. The SEC stated its belief that it generally expects liquidity costs to be de minimis for money markets funds during normal market conditions. However, as the fund’s liquidity costs are calculated only as a percentage of its gross redemptions rather than its net assets, a relatively small movement in liquidity costs could necessitate the application of a mandatory liquidity fee.

Applying the mandatory liquidity fee to all shares redeemed at a price calculated on a given day will have significant implications for funds that strike their NAV multiple times per day. The SEC noted in the Adopting Release that the Amendments will require funds that offer multiple NAV strikes per day to develop a method to charge liquidity fees to investors who redeemed earlier in the day, such as: (i) holding back a portion of the investor’s redemption proceeds until the end of the day when the liquidity fee determination is made; (ii) charging the fee amount against the investor’s remaining balance if the investor did not redeem the full amount of its shares; or (iii) developing a mechanism for taking back a portion of redemption proceeds that the investor has already received. The SEC acknowledged in the Adopting Release that this requirement could lead some funds to cease offering multiple NAV strikes per day for operational ease.

While the mandatory liquidity fee must be calculated to apply to all shares redeemed at a price calculated on the day the threshold is exceeded, the SEC noted that a money market fund may choose to apply the fee based on an investor’s net redemption activity for that day. This scenario would occur when an investor requests a redemption earlier in the day but returns excess cash back to the fund later in the day (or vice versa).

If the costs of selling a pro rata amount of each security in a fund’s portfolio cannot be estimated in good faith and supported by data, the fund must impose a default fee of 1% of the value of the shares redeemed. The SEC stated in the Adopting Release that it may be appropriate for a fund to rely on the 1% default fee “if a fund encountered unforeseen market conditions not contemplated in advance and the fund was not able to otherwise make a good faith estimate of its liquidity costs.”

The SEC explained in the Adopting Release that, if a money market fund receives additional flow information after determining that it crossed the 5% threshold, but before applying a liquidity fee, the fund may consider the impact of the additional flows when determining the amount of the liquidity fee.

The SEC also noted in the Adopting Release that there may be instances where a money market fund determines its net redemptions for the day do not exceed the 5% threshold (i.e., a false negative), only to receive more redemptions later in the day or the following day (although they are eligible to receive the NAV as of the last pricing time), pushing the fund above the 5% threshold. In this case, although the fund is not required to implement a liquidity fee for that day under the mandatory liquidity fee framework, the Adopting Release states that in this circumstance, “the fund should consider imposing a liquidity fee under the discretionary fee provision.” [23]

The operation of the mandatory liquidity fee framework can be visualized as shown in Figure 1.

Delegation and Board-Approved Guidelines

Similar to the discretionary fee framework discussed above, an institutional money market fund’s board is permitted to delegate determinations related to mandatory liquidity fees. The SEC noted in the Adopting Release that the implementation of the mandatory fee requirement is the responsibility of the money market fund’s board of directors. However, unlike the operation of liquidity fees under current Rule 2a-7, a money market fund’s board may delegate this responsibility to the fund’s investment adviser or officers, subject to written guidelines established and reviewed by the board and ongoing board oversight. The SEC noted that the written guidelines should specify how the delegate should act with respect to any discretionary aspect of the rule. [24] Additionally, the Amendments require the fund’s board to periodically review the delegate’s liquidity fee determinations in connection with its oversight responsibilities. [25]

Recordkeeping

Under the Amendments, a money market fund must maintain and preserve for six years a written copy of its board established guidelines for administering the liquidity fee requirement. In addition, the fund must maintain a written record of the board’s considerations and actions taken in connection with discharging its responsibilities related to the liquidity fee requirement, to be included in the board’s minutes.

The SEC also amended Rule 31a-2 under the 1940 Act to require a money market fund to retain records documenting how the fund’s board or its delegate determined the amount of any liquidity fee that has been charged. The recordkeeping requirement applies whether the fund has calculated a fee, applied the default fee of 1%, or determined the fee would be de minimis and therefore did not charge a fee on a given day.

Increase in Daily and Weekly Liquid Asset Requirements

The SEC increased a money market fund’s minimum daily liquid asset requirement from 10% to 25% and minimum weekly liquid asset requirement from 30% to 50% of its total assets. Tax-exempt money market funds, however, continue to not be subject to the minimum daily liquid asset requirement of Rule 2a-7. Consistent with the existing regulatory requirements, if a money market fund’s portfolio does not meet the minimum daily liquid asset or weekly liquid asset requirements set forth in the Amendments, the fund will not be able to acquire any assets other than daily liquid assets or weekly liquid assets, respectively, until it meets those minimum thresholds. Also as proposed, a money market fund will be required to notify its board within one business day and publicly file a report on Form N-CR if the percentage of its total assets in daily liquid assets or weekly liquid assets falls below 12.5% or 25%, respectively. The fund would then also be required to file an amended Form N-CR with a brief description of the facts and circumstances leading to such occurrence within four business days and provide the board with such information.

The SEC noted in the Adopting Release that these higher daily and weekly liquid asset requirements will be applied uniformly across all types of money market funds to reduce “the potential incentive for investors to flee from funds that might otherwise be perceived as holding insufficient liquidity during market stress events.” [26] However, these changes are expected to impact various types of money market funds differently. For example, the increased daily and weekly liquid asset requirements are not expected to significantly impact government money market funds, which are already required to invest 99.5% of their total assets in cash, government securities and/or repurchase agreements that are collateralized fully, many of which generally qualify as daily and weekly liquid assets under Rule 2a-7. Conversely, commenters and Commissioner Peirce expressed concern about the potential impact on investor demand for prime money market funds, because the increased minimum liquidity requirements could reduce the spread between prime and government money market funds. [27]

In connection with these changes, a money market fund is no longer required to stress test its ability to have at least 10% of its total assets in weekly liquid assets. Instead, the Amendments require a money market fund to itself determine the minimum level of liquidity it seeks to maintain during stress periods, periodically stress test its ability to maintain such minimum level of liquidity and report the findings of the stress tests to the fund’s board. The SEC explained in the Adopting Release that the removal of a bright line threshold for stress testing is designed to increase the utility of stress test results.

Potential Negative Interest Rate Environments

The SEC adopted certain amendments to address how stable NAV money market funds (which include government money market funds and retail money market funds) might continue to operate in a potential negative interest rate environment. Consistent with the Proposal, the SEC reiterated its views that it might be challenging or impossible for a stable NAV money market fund with a gross negative yield to continue to seek to maintain a stable NAV and that a stable NAV money market fund could convert to a floating NAV in such circumstances under the current rule. However, in a change from the Proposal, the Amendments allow a stable NAV money market fund (with negative gross yield caused by negative interest rates) the option to reduce the number of its shares outstanding to maintain a stable share price in lieu of converting to a floating NAV (i.e., “share cancellation” or RDM).

In order to implement the RDM, a stable NAV money market fund’s board must determine that reducing the number of the fund’s shares outstanding is in the best interests of the fund and its shareholders. This determination is not delegable and is required to be made by the fund’s board. The SEC set forth certain considerations for a fund’s board when making this determination, which generally include: (i) the capabilities of the fund’s service providers and intermediaries to support the equitable application of the RDM across the fund’s shareholders; (ii) state law limitations; [28] and (iii) tax implications for the fund and its shareholders. [29] The SEC noted in the Adopting Release that a fund’s board should review its determination that the RDM is in the best interests of the fund and its shareholders if circumstances change from its initial determination.

In addition, to address concerns that the use of an RDM by a stable NAV money market fund could result in investor confusion by causing investors to assume their investment in a fund is holding its value when it is not, the Amendments also require timely, concise and plain English disclosure about the fund’s RDM share cancellation practices and the impact of such practices on investors. Notably, if a stable NAV money market fund wants to retain the flexibility to rely on the RDM under Rule 2a-7, the fund must provide “advance notification” to shareholders through prospectus disclosure that details the fund’s intention to use share cancellation in a negative interest rate environment and the potential effect on shareholders. Although the SEC did not provide a specific timeframe for what qualifies as “advanced notification,” it explained in the Adopting Release that the prospectus disclosure must be provided before a fund begins to use the RDM and generally should be provided with “sufficient advance notice to allow an investor to take into account information about the fund’s possible use of share cancellation and the effects of that approach in the investor’s decisions.” The SEC noted that this disclosure must be included in a fund’s summary prospectus if a negative interest rate environment appears to be reasonably likely to occur in the near future. Additional disclosure is also required under the Amendments once a fund begins cancelling shares, including in each account statement to shareholders or in a separate writing accompanying each account statement. [30]

The SEC noted in the Adopting Release that fund disclosures should: (i) include a clear and prominent statement that an investor is losing money when the fund cancels the investor’s shares; and (ii) clearly and concisely describe the tax impact on shareholders. The SEC also urged funds to consider investor education efforts to help further mitigate investor confusion surrounding share cancellation and noted that funds should be mindful of the effect of the use of share cancellation on their financial disclosures. [31]

Although the Amendments will not require, as proposed, a stable NAV money market fund to determine that its financial intermediaries are able to process share transactions if the fund converts to a floating NAV, [32] the SEC provided guidance on how money market funds and financial intermediaries generally should prepare for the possibility of a stable NAV fund’s conversion to a floating NAV fund. For example, the SEC states that it believes that “stable NAV money market funds generally should engage with their distribution network in considering how they would handle a negative interest rate environment, as intermediaries’ abilities to move to a four-digit NAV and apply a floating NAV or to process share cancellations is an important consideration in determining an approach that is in the best interests of the fund and its shareholders.” [33]

WAM and WAL Calculation Specification

The SEC adopted amendments that will require money market funds to calculate the WAM and WAL of their portfolios using weightings based on the percentage of each security’s market value in the portfolio rather than based the amortized cost of each portfolio security. The SEC stated in the Adopting Release that money market funds currently use different approaches when calculating their WAM and WAL, and the specification is intended to reduce inconsistencies in the data reported to the SEC and provided on fund websites.

Enhanced Reporting Requirements

Form N-CR

Under the Amendments, a money market fund will be required to file a report on Form N-CR if the percentage of its total assets in daily liquid assets or weekly liquid assets falls below 12.5% or 25%, respectively. An initial Form N-CR must be filed within one business day of experiencing such a “liquidity threshold event” and must include the date of the liquidity threshold event and the levels of daily liquid assets or weekly liquid assets on that date. Within four business days of the event, the fund must file an updated Form N-CR that describes the facts and circumstances leading to the liquidity threshold event. The Amendments also mandate that Form N-CR must be filed in a custom structured data language. A fund will no longer be required to report the imposition of a liquidity fee (whether mandatory or discretionary) on Form N-CR.

Form N-MFP

The Amendments also add several new disclosure items to Form N-MFP. A money market fund must disclose the “type” [34] of each beneficial or record owner that owns more than 5% of any share class and the percentage owned. Under the Proposal, funds would have been required to disclose the name of those investors, but, in the Adopting Release, the SEC explained that it made this modification to address commenters’ concerns for investor privacy. Under the Amendments, institutional money market funds must also disclose the composition of their investor base by type (e.g., non-financial corporations, pension plans and other categories). The Amendments also add a new Part D to Form N-MFP, which requires prime money market funds (institutional and retail) to disclose the value of portfolio securities it sold or disposed of during the reporting period. Additionally, the Amendments require money market funds to report information about: (i) liquidity fees, including the date on which a liquidity fee is applied, as well as the amount and type of the liquidity fee (whether mandatory or discretionary); and (ii) share cancellation.

The SEC modified the scope of certain information already required to be disclosed on Form N-MFP. For example, the Amendments require additional information about repurchase agreement transactions and standardize how funds report certain information. Certain data points that are currently disclosed as of the end of the week or month must also be reported at the daily level, including the percentage of daily liquid assets and weekly liquid assets, NAV per share, shareholder flow data, and 7-day gross and net yields. Further, under the Amendments, a money market fund must indicate on Form N-MFP if it is established as a cash management vehicle for affiliated funds. The SEC also added new categories to the options funds may choose from when categorizing their portfolio investments on Form N-MFP, and also included conforming amendments regarding such categorizations for purposes of website disclosures.

Given the increased reporting requirements, many in the industry requested in their comment letters on the Proposal that money market funds have additional time to make monthly Form N-MFP filings, but the SEC decided to keep the deadline for filing set at 5 business days after the end of each month. For a filing that was already data intensive, this imposes additional operational costs on money market funds.

Form PF Amendments

The SEC adopted amendments to reporting by large liquidity fund advisers [35] in respect of the liquidity funds [36] that they manage in Section 3 of Form PF (Form PF Amendments), the confidential reporting form for certain SEC-registered investment advisers to private funds. According to the Adopting Release, liquidity funds “follow similar investment strategies as money market funds” in that they are managed with the goal of maintaining stable net asset value or minimizing principal volatility but are not subject to Rule 2a-7 and thus “may be more sensitive to market stress relative to money market funds.”

The SEC explained in the Adopting Release that the final amendments, while adopted largely as proposed, were modified to tailor the reporting to private liquidity funds and maintain consistency with the reporting requirements for registered money market funds under amended Form N-MFP, and the final amendments seek to enhance the SEC’s and the Financial Stability Oversight Council’s [37] ability to assess short-term financing markets and provide oversight of liquidity funds and their advisers. [38] The key Form PF Amendments to the reporting requirements are as follows:

- Operational Information. The Form PF Amendments replace questions regarding whether a liquidity fund uses certain methodologies to compute its NAV with a requirement that advisers report whether the liquidity fund seeks to maintain a stable price per share, and if so, to provide that price.

- Assets and Portfolio Information. The Form PF Amendments require advisers to report cash separately from other categories when reporting fund assets and provide an amended definition of “weekly liquid assets” to specify that the term includes “daily liquid assets” and require reporting of more granular information on each portfolio security (e.g., name of repo counterparty, description of unique identifiers, investment category) and U.S. government agency debt (e.g., coupon-paying note or no-coupon discount note).

- Additional Repurchase Agreement (“Repo”) Reporting. In addition to providing the name of the repo counterparty as discussed above, the Form PF Amendments require advisers to provide the clearing information for repos and will continue to allow aggregation of certain information if “multiple securities of an issuer are subject to a repo.” Currently, there is an ambiguity in reporting on portfolio securities as to whether advisers should report the repo counterparty, the clearing agency (in the case of centrally cleared repos), or both.

- Subscriptions/Redemptions. The Form PF Amendments require advisers to report the total gross subscriptions and total gross redemptions for each month of the reporting period.

- Financing Information. The Form PF Amendments require advisers to indicate whether a creditor is based inside the United States and is a “U.S. depository institution” or based outside of the United States for consistency with categories used by the Federal Reserve Board.

- Investor Information. The Form PF Amendments require advisers to provide specific information (e.g., investor type, percent of equity ownership) for each investor that beneficially owns five percent or more of the reporting fund’s equity. A new question is added on whether the liquidity fund is a cash management vehicle or not, and if such a vehicle, whether the fund is managed for an adviser’s (or its affiliates) other funds or accounts.

- Disposition of Portfolio Securities. The Form PF Amendments require advisers to report the gross market value of portfolio securities sold or disposed of prior to maturity for each category of investments of the liquidity fund.

- Weighted Average Maturity and Weighted Average Life. The Form PF Amendments also revise calculation methodologies for “WAM” and “WAL” by amending their definitions to “include an instruction to calculate these figures with the dollar-weighted average based on the percentage of each security’s market value in the portfolio” for consistency with reporting on amended Form N-MFP.

Compliance Dates

The effective and compliance date for the amendments to Forms N-MFP, N-CR, and PF is June 11, 2024. [39] The Effective Date for the remaining amendments is October 2, 2023 (based on an expectation that the Amendments will be published in the Federal Register on August 3, 2023). Upon the Effective Date, certain aspects of the Amendments, including the removal of redemption gates, the removal of the tie between liquidity fees and liquidity thresholds and the new provision allowing the use of RDM under certain circumstances, will go into full effect. Money market funds will be required to comply with the Amendments relating to discretionary liquidity fees, the increased daily and weekly liquid assets thresholds and WAM and WAL specification by April 2, 2024, however, money market funds may choose to rely on these provisions at any time after the Effective Date. Institutional prime and institutional tax-exempt money market funds will be required to comply with the mandatory liquidity fee framework by October 2, 2024, but similarly can choose to begin relying on these provisions of the Amendments after the Effective Date.

Conclusion

The Amendments represent the most notable effort by the SEC to reform the money market fund industry since the series of reforms it adopted following the 2007-2008 financial crisis. Although the SEC did not adopt a swing pricing framework, the Amendments will nonetheless have a significant impact on money market funds and their boards of directors, service providers, intermediaries and investors. For example, the Amendments will likely increase costs to fund sponsors and have commercial implications for institutional money market funds that strike their NAVs at multiple times per day and/or offer same-day settlement, potentially causing some funds to remove one or both of these features. Indeed, one of the two dissenting commissioners pointedly asked the SEC staff whether one of the goals was “to kill prime funds.” While the new mandatory liquidity fee framework was designed for institutional money market funds and their unique settlement practices, it remains to be seen whether, and to what extent, the Amendments will impact the proposed rule that would require registered open-end funds (other than ETFs) to utilize swing pricing. The pivot in approach for money market funds (from swing pricing to mandatory liquidity fees) may suggest flexibility in the SEC’s preference among potential anti-dilution mechanisms in this separate rulemaking, though the Adopting Release conceded no ground with respect to the perceived need for an anti-dilution mechanism. The SEC’s most recent regulatory agenda suggests that this other rulemaking continues to be a short-term priority for the SEC.

Endnotes

1See Money Market Fund Reforms; Form PF Reporting Requirements for Large Liquidity Fund Advisers; Technical Amendments to Form N-CSR and Form N-1A, Release No. IC-34959 (Jul. 12, 2023) (Adopting Release). The three Democratic Commissioners, Chair Gary Gensler and Commissioners Caroline A. Crenshaw and Jaime Lizárraga, voted in favor of the Amendments, whereas the two Republican Commissioners, Commissioner Hester M. Peirce and Mark T. Uyeda, voted against the Amendments. At times, this Dechert OnPoint tracks the Adopting Release without the use of quotation marks.(go back)

2See Money Market Fund Reforms, Release No. IC-34441 (Dec. 15, 2021). For further information regarding the Proposal, please refer to Dechert OnPoint, SEC Proposes New Round of Money Market Fund Reforms in Response to March 2020 Redemptions.(go back)

3See Sec’y of the Treas. Janet L. Yellen, Remarks at the National Association for Business Economics 39th Annual Economic Policy Conference (Mar. 30, 2023) (“If there is any place where the vulnerabilities of the system to runs and fire sales have been clear-cut, it is money market funds. … The structural vulnerabilities at the heart of money market and open-end funds aren’t new. In the banking sector, capital and liquidity requirements and federal deposit insurance reduce the likelihood of runs taking place. In case runs occur, access to the discount window helps provide buffers for banks. Yet the financial stability risks posed by money market and open-end funds have not been sufficiently addressed.”).(go back)

4For purposes of this OnPoint, an “institutional money market fund” is a money market fund that is neither a “government money market fund” nor a “retail money market fund” (each as defined under Rule 2a-7).(go back)

5See Open-End Fund Liquidity Risk Management Programs and Swing Pricing; Form N-PORT Reporting, Release No. IC-34746 (Nov. 2, 2022). For further information regarding the proposed rulemaking, please refer to Dechert OnPoint, SEC Proposes Mandated Swing Pricing, Hard Close and Fundamental Changes to Liquidity Rule.(go back)

6Under current Rule 2a-7, a government money market fund is permitted, but not required, to implement liquidity fees and/or redemption gates. In practice, almost all government money market funds have chosen not to opt into the current liquidity fee/redemption gate framework.(go back)

7Similar to current Rule 2a-7, a government money market fund will be permitted, but not required, to implement discretionary liquidity fees.(go back)

8Similar to current Rule 2a-7, a tax-exempt money market fund continues not to be subject to the daily liquid asset requirements under the Amendments.(go back)

9See Adopting Release, at Section II.A.1.(go back)

10Rule 22e-3 remains available to money market funds to suspend redemptions in order to facilitate an orderly liquidation of the fund.(go back)

11See id. at Section II.B.1. The Amendments would also amend the disclosure requirements under Form N-1A, including the standardized risk disclosure included in a fund’s summary prospectus, to reflect these changes.(go back)

12In 2014, the SEC stated that a government money market fund that chose to opt into the then-current liquidity fee/redemption gate framework “may wish to consider providing notice to shareholders,” and that the SEC believes that “at least sixty days written notice of the fund’s ability to impose fees and gates would be appropriate.” See Money Market Fund Reform; Amendments to Form PF, Release No. IC-31166 (July 23, 2014), at footnote 630 (2014 Adopting Release). (go back)

13See Adopting Release, at Section II.B.3.(go back)

14See amended Rule 2a-7(j).(go back)

15See Adopting Release, at Section II.B.3.(go back)

16See id. at Section II.B.1.(go back)

17Rule 12d1-1 permits a registered fund to invest in an unregistered money market fund without having to comply with the affiliated transaction restrictions in Section 17(a) and Rule 17d-1, provided that the unregistered money market fund satisfies certain conditions in Rule 12d1-1 (namely, the unregistered money market fund is required to (i) limit its investments to those in which a money market fund may invest under Rule 2a-7; and (ii) undertake to comply with all other provisions of Rule 2a-7).(go back)

18See amended Rule 2a-7(c)(2)(ii).(go back)

19See Adopting Release, at Section II.B.2.(go back)

20See id. (“This market practice effectively passes spread costs on to redeeming investors, which means that the proposed application of swing pricing when a fund has low levels of net redemptions would have had limited effect.”).(go back)

21See id. (“Also consistent with the proposal, and as reflected in the amended rule, we continue to believe it would be reasonable to assume a market impact of zero for the fund’s daily and weekly liquid assets, since a fund could reasonably expect such assets to convert to cash without a market impact to fulfill redemptions (e.g., because the assets are maturing shortly)”).(go back)

22See id.(go back)

23See id. It remains to be seen whether the SEC or its staff will issue further interpretive guidance or clarification in this area, as this statement could be read to suggest that a fund could impose a discretionary liquidity fee on redemption requests that have already been received by the fund or its transfer agent. Under current and amended Rule 2a-7, discretionary liquidity fees must be applied to all shares redeemed “once imposed.”(go back)

24These discretionary aspects include: (i) whether the fund will apply a fee to a shareholder based on the shareholder’s gross or net redemption activity for the relevant day for shareholders that both redeem and purchase shares of the fund on the same day; (ii) for funds with multiple NAV strikes per day, the method used to charge liquidity fees to investor who redeem at earlier pricing periods; (iii) the fund’s approach to determining when to calculate net flows for purposes of determining whether it has crossed the 5% threshold; and (iv) the time by which the fund will review its flow information for purposes of calculating the liquidity fee amount.(go back)

25See amended Rule 2a-7(j).(go back)

26See Adopting Release, at Section II.C1.(go back)

27See Commissioner Hester M. Peirce, Air Dancers and Flies: Statement on Adoption of the Latest Round of Money Market Fund Reforms, (July 12, 2023).(go back)

28In particular, a money market fund should consider whether RDM is permissible under its governing documents and otherwise consistent with state law.(go back)

29In considering the tax implications for the fund and its shareholders, the board generally should also consider: (i) the tax implications of share cancellation for the fund itself, including the impact on the tax character of the fund’s distributions; and (ii) the tax implications of share cancellation for a fund’s shareholders, including (a) whether investors understand, and will be able to comply with, their tax obligations; (b) the administrability of shareholder tax reporting by the applicable service providers; (c) whether share cancellation would cause adverse tax consequences for shareholders, as compared to using a floating NAV, and if those adverse consequences are justified by the benefits to shareholders; (d) the tax characterization of the cancellation (i.e., whether the cancellation causes the realization of losses or adjustments to tax basis); and (e) if the cancellation directly produces a loss, when shareholders would recognize that loss and how that loss would be reported by fund and its intermediaries. See Adopting Release, at Section II.D.(go back)

30See amended Rule 2a-7(c)(3).(go back)

31The SEC also noted in the Adopting Release that a fund “should consider effects on other information it provides and evaluate whether that information continues to present an accurate picture of the fund. For example, when calculating and providing the fund’s market-based NAV per share, the fund generally should use the number of shares outstanding it would have but for its use of share cancellation. We generally do not believe that it would be appropriate to use the actual number of shares outstanding the fund has under these circumstances because share cancellation would have the effect of inflating the fund’s market-based NAV per share.” See Adopting Release, at Section II.D.(go back)

32Under the Proposal, a stable NAV money market fund would have been required to determine that its intermediaries are able to continue processing its share transactions in the event that the fund converts to a floating NAV. Otherwise, the money market fund would have been required to prohibit the relevant financial intermediaries from purchasing its shares on behalf of other persons in nominee name.(go back)

33See Adopting Release, at Section II.D.(go back)

34Amended Form N-MFP includes the following “types” of investors: retail investor; non-financial corporation; pension plan; nonprofit; state or municipal government entity (excluding governmental pension plans); registered investment company; private fund; depository institution or other banking institution; sovereign wealth fund; broker-dealer; insurance company; and other.(go back)

35An adviser becomes a “large liquidity fund adviser” at $1.0 billion in regulatory assets under management attributable to liquidity funds and registered money market funds as of the end of any month in the prior fiscal quarter. Large liquidity fund advisers are required to report quarterly. See Form PF: General Instructions at Instruction 1.(go back)

36A “liquidity fund” is “[a]ny private fund that seeks to generate income by investing in a portfolio of short term obligations in order to maintain a stable net asset value per unit or minimize principal volatility for investors.” See Form PF: Glossary of Terms.(go back)

37The Adopting Release states that FSOC was consulted to ensure that the information reported continues to be useful in assessing systemic risk.(go back)

38Amendments to Form PF reporting for large liquidity fund advisers were initially proposed in January 2022 along with a broader set of amendments to Form PF. See Amendments to Form PF to Require Current Reporting and Amend Reporting Requirements for Large Private Equity Advisers and Large Liquidity Fund Advisers, Release No. IA-5950 (January 26, 2022); please refer to the Dechert OnPoint for additional information, SEC Proposes Amendments to Form PF. The SEC finalized rules in respect of other types of private funds in May 2023, but we can anticipate further rulemaking in this area as there is a joint proposal with the CFTC to amend Form PF that has yet to be finalized. See Form PF; Event Reporting for Large Hedge Fund Advisers and Private Equity Fund Advisers; Requirements for Large Private Equity Fund Adviser Reporting, Release No. IA-6297 (May 3, 2023); Form PF; Reporting Requirements for All Filers and Large Hedge Fund Advisers, CFTC and SEC Joint Proposed Rules, Release No. IA-6083 (Aug. 10, 2022).(go back)

39 Likewise, the Amendments to Rule 2a-7 regarding how funds categorize their portfolio investments for purposes of website disclosures adopted to align this disclosure with the changes to Form N-MFP will also be effective June 11, 2024.(go back)

Print

Print