Sustainable investing is becoming a hot topic in financial economics. However, when it comes to the impact of divestment campaigns and related tactics on promoting sustainable investing, financial economists miss an important point. Many assume that shareholders can create impact only through “exit” (portfolio screening) or “voice” (shareholder engagement). Portfolio screening means that shareholders buy or sell shares to influence the cost of capital for companies. Shareholder engagement involves direct interactions with companies through dialogue, shareholder proposals, or voting. A debate has emerged within financial economics about which strategy is more effective in influencing companies. Yet, this debate misses that sustainable investors can go beyond exit or voice to influence companies.

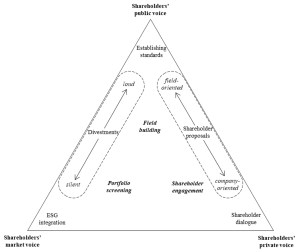

In a recent literature review, we show that shareholders can use different voices to influence companies. The first two voices are well understood by financial economists. One is the market voice of buying and selling shares, thereby exerting upward or downward pressure on the share price of companies. Market voice is the basis for portfolio screening (exit). The other is the private voice of directly interacting with companies, the basis for shareholder engagement (voice). Yet, shareholders also have a third voice, which we call their public voice. It allows shareholders to speak on issues not just to specific companies, but also to wider audiences, such as industries, regulators, or the public. The following figure illustrates the three types of voices that shareholders can use to influence companies.

Source: Marti et al 2023: The impact of sustainable investing: A multidisciplinary review, Journal of Management Studies

Acknowledging that shareholders can use their public voice allows us to reassess not only divestment campaigns but also a broader class of tactics that we call “field building.” It is a third strategy that shareholders can use to influence companies, in addition to portfolio screening and shareholder engagement. Field building is possible because companies always exist within fields. Fields are broader than “industries” because they include companies but also the stakeholders with which companies interact frequently (regulators, consumers, media, etc.). By interacting, actors within fields develop shared assumptions, norms, and rules that shape corporate behavior. Against this background, field building means that shareholders influence companies indirectly by influencing the (1) stakeholders and (2) assumptions, norms, and rules that surround companies (for a quick overview, see our new Harvard Business Review article in which we outline five field building tactics).

By underappreciating shareholder’s public voice and the associated field-building strategy, most financial economists end up dismissing divestment campaigns as ineffective. Papers such as Broccardo et al. or Berk and van Binsbergen assume that divestment campaigns work through shareholders’ market voice, that is, aim to exert pressure on the share price of companies. Yet, activists within these campaigns make clear that this is not what they try to achieve. They note, “Divestment isn’t primarily an economic strategy, but a moral and political one.” The goal of divestment campaigns is to shape the fields in which oil and gas companies operate. On the one hand, divestment campaigns try to influence key stakeholders that have an influence on this field, including policymakers, banks, and pension funds. On the other hand, by trying to stigmatize oil and gas companies, divestment campaigns try to influence the assumptions that the broader public has about this field.

In our literature review, we show that, in disciplines outside of financial economics, there is substantive evidence of the effectiveness of divestment campaigns and other field building tactics. For example, in an economic geography journal, Cojoianu et al. show that divestment campaigns in a country lead to lower capital flows to domestic oil and gas companies. In a business ethics journal, Ding et al. show that, when divestment campaigns received a lot of media coverage in a country, more shareholders from that country will divest. In a management journal, Ferns et al.reconstruct how the fossil fuel divestment campaign used analogies to the South African divestment campaign to stigmatize oil and gas companies.

That most financial economists dismiss the importance of divestment campaigns and other field building tactics is consequential because financial economists have a big influence on shareholder behavior. If financial economists dismiss field building tactics in their teaching and outreach, shareholders may also discard those approaches as ineffective even if other disciplines find substantive evidence for the impact of divestment campaigns and other field building tactics.

On a more positive note, there is one new working paper that goes beyond conventional wisdom in financial economics. In “Voice Through Divestment,” Marco Becht, Anete Pajuste, and Anna Toniolo acknowledge that “divested amounts were negligible when compared to the market capitalization of fossil fuel majors.” So, the market voice of shareholders is unlikely to create much impact, as argued by Broccardo et al. and Berk and van Binsbergen. Yet, Becht et al. then conceptualize the fossil fuel divestment campaign as a “narrative with impact,” that is, a story that can spread through social media and thereby influence many stakeholders and challenge widely held assumptions about fossil fuel companies. Specifically, by analyzing Twitter (now X) data, Becht et al. find that, when tweets about a divestment campaign go viral, they reduce the share price of fossil fuel companies. With this, Becht et al. showcase that shareholders can use their public voice to influence companies.

This post comes to us from Emilio Marti and Martin Fuchs at Erasmus University Rotterdam, Mark R. DesJardine at Dartmouth College, Rieneke Slager at Rijksuniversiteit Groningen, and Jean-Pascal Gond at City, University of London. It is based on their recent article, “The Impact of Sustainable Investing: A Multidisciplinary Review,” available here.

Sky Blog

Sky Blog