The Carrot and the Stick: Bank Bailouts and the Disciplining Role of Board Appointments

Harvard Corporate Governance

DECEMBER 21, 2023

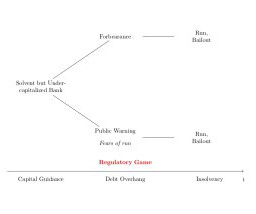

Normal 0 false false false false EN-GB X-NONE X-NONE Despite the well-publicized negative effect of bailouts on ex ante incentives, it is often practically infeasible for governments to avoid bailing out failing banks, especially if many banks fail together, i.e., in the presence of systemic risk. more…)

Let's personalize your content