Do Activists Beat the Market?

Harvard Corporate Governance

AUGUST 1, 2023

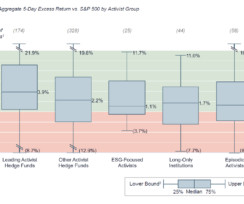

In other words, not all activists are the alpha generators that they are made to seem, and the majority do not deliver on their campaign promises of outperformance beyond an immediate “pop.” Our empirical review included campaigns waged between 2018 and H1 2023 at U.S.

Let's personalize your content