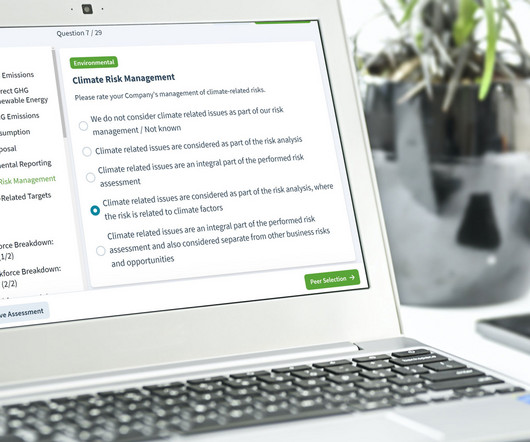

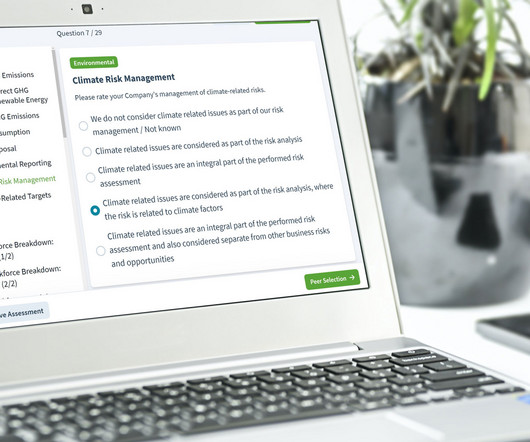

ValutECO is the New Groundbreaking ESG Tool for Sustainable Business Valuations

Valutico

APRIL 25, 2023

Valutico’s newly launched tool, currently in an ‘alpha’ trial phase, allows accountants, M&A consultants, investment managers, private equity professionals, and those in corporate finance to consider the impact of Environmental, Social and Governance (ESG) factors on a company’s value.

Let's personalize your content