Advisory services are one of the biggest growth opportunities for tax and accounting firms today. But for many, turning this opportunity into reality remains a challenge. Knowledge silos, unclear ROI, and a persistent talent shortages continue to get in the way. That’s why firms need more than just good intentions — they need an AI-powered solution that captures institutional knowledge, uncovers client insights that demonstrate value, and lifts the manual burden off of staff.

Ready to Advise is a scalable, AI-powered solution that helps accounting firms move beyond common barriers by standardizing workflows, surfacing tailored client insights, and empowering staff at every experience level to confidently deliver high-value advisory services.

Let’s take a look at why Ready to Advise is the AI innovation many firms have been waiting for — and how it turns potential into performance.

Jump to ↓

| Why many accounting firms are stuck in neutral |

| Introducing Ready to Advise: The pathway to scaling advisory services |

| Challenge #1: Advisory work is locked in the minds of senior staff, making it hard to delegate or scale |

| Challenge #2: Firms struggle to clearly demonstrate the value and ROI of advisory services |

| Challenge #3: Talent shortages and rapid tax law changes make it harder to deliver consistent service |

| Understanding the true impact of Ready to Advise |

| Are you Ready to Advise? |

Why many accounting firms are stuck in neutral

Despite the clear upside, many firms are struggling to scale their advisory practices. Two-thirds are actively searching for a solution to grow these services, aware that monthly client revenue could rise by as much as 50%. Yet 83% say time and talent remain major obstacles.

The root cause of the problem is that much of a firm’s strategic know-how is locked in the minds of senior staff, making it tough to delegate or replicate. Add to that the pressure of proving advisory ROI to clients and the relentless pace of regulatory change, and it’s easy to see why so many firms stay stuck in reactive, compliance-driven work.

Introducing Ready to Advise: The pathway to scaling advisory services

By solving the challenges that hinder many firms, Ready to Advise is an AI-powered tax planning advisory solution that helps your firm transition more of your business to strategic advisory services. Let’s take a look.

Challenge #1: Advisory work is locked in the minds of senior staff, making it hard to delegate or scale

Typically, specialized advisory knowledge lives solely in the minds of senior staff. These professionals are often stretched thin, making it difficult to delegate or standardize high-value services. Without a clear way to document and share their expertise across teams, firms struggle to deliver advisory services at scale — often using manual, ad-hoc processes that are difficult to replicate across teams.

How Ready to Advise helps: Our AI-powered platform combines advanced technology with trusted tax expertise to surface tailored tax planning opportunities and step-by-step guidance. This empowers staff at all levels to participate in advisory work, helping your firm scale strategic services consistently and efficiently.

Challenge #2: Firms struggle to clearly demonstrate the value and ROI of advisory services

While clients may appreciate strategic guidance in theory, many are still accustomed to transactional, compliance-focused engagements. Without data-driven insights or clear deliverables, your clients may hesitate to pay for services they don’t fully understand. This makes it difficult for firms to justify premium pricing or long-term advisory relationships.

How Ready to Advise helps: With client-ready reports and visuals, Ready to Advise clearly communicates both the projected and realized value of tax planning strategies. These insights help firms differentiate their offerings, justify pricing, and build stronger long-term advisory relationships.

Challenge #3: Talent shortages and rapid tax law changes make it harder to deliver consistent service

Recruiting and retaining professionals with the right mix of technical knowledge, business acumen, and communication skills is increasingly difficult. Meanwhile, the pace of tax legislation changes continues to accelerate, putting even more pressure on existing staff to stay up to date. For firms hoping to shift toward proactive, consultative services, these talent gaps create bottlenecks that make advisory work harder to deliver and scale consistently.

How Ready to Advise helps: By enabling senior advisors to delegate more confidently to junior staff and ensuring compliance with the latest tax legislation, Ready to Advise helps firms overcome bandwidth issues while maintaining high-quality client service.

Understanding the true impact of Ready to Advise

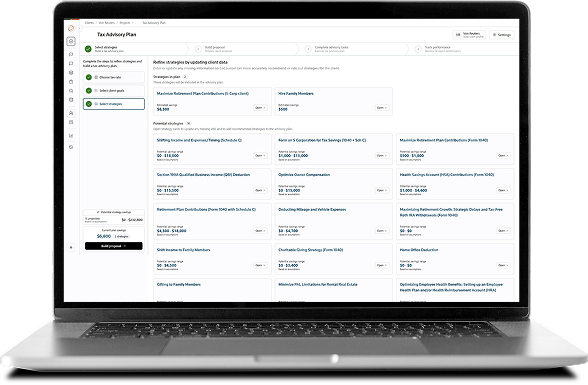

So, what does advisory at scale look like in practice? Imagine this: A staff member uploads a client’s tax return into Ready to Advise and within moments, they’re guided through a smart, strategic conversation tailored to uncover real advisory opportunities. With a few simple inputs, the platform analyzes the client’s unique situation and instantly generates polished, client-ready materials that clearly show the value of those recommendations.

That’s the power of Ready to Advise. By standardizing workflows, automating insight generation, and surfacing tailored client strategies, staff at all experience levels can confidently deliver consistent, high-impact advisory services through:

- Relevant tax strategies. Upload tax returns and supporting data to surface the most impactful tax planning strategies for that client’s unique context.

- Client-ready reports. Easily convey the value of a proposed advisory engagement, as well as the resulting impact of an engagement, to demonstrate where you can take the advisory relationship next.

- AI-guided advisory delivery. Empower less experienced staff to execute a client tax strategy efficiently and effectively by providing straightforward, step-by-step guidance and supporting resources powered by Checkpoint’s expert content.

- Q&A chat. Get rapid answers and citations to ad-hoc tax planning questions, grounded in Checkpoint’s expert content.

From surfacing client insights to generating presentation-ready value reports, Ready to Advise helps your firm unlock the time, talent, and tools they need to lead with strategy and grow stronger client relationships in the process.

Are you Ready to Advise?

Ready to Advise gives your firm a powerful competitive edge and enables you to scale advisory services, boost revenue, and meet evolving client expectations with confidence. In a fast-changing industry, adopting the right tools isn’t just an upgrade, it’s a strategic move.

See the difference for yourself and discover how Ready to Advise can help transform your practice into a future-ready advisory powerhouse.

|

|