Will Arnot is Senior Editorial Specialist at Diligent Market Intelligence (DMI). This post is based on DMI’s recent special report, Investor Stewardship 2023. Related research from the Program on Corporate Governance includes Stealth Compensation via Retirement Benefits and Paying for long-term performance (discussed on the Forum here) both by Lucian Bebchuk and Jesse M. Fried; and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay (discussed on the Forum here) by Jesse M. Fried.

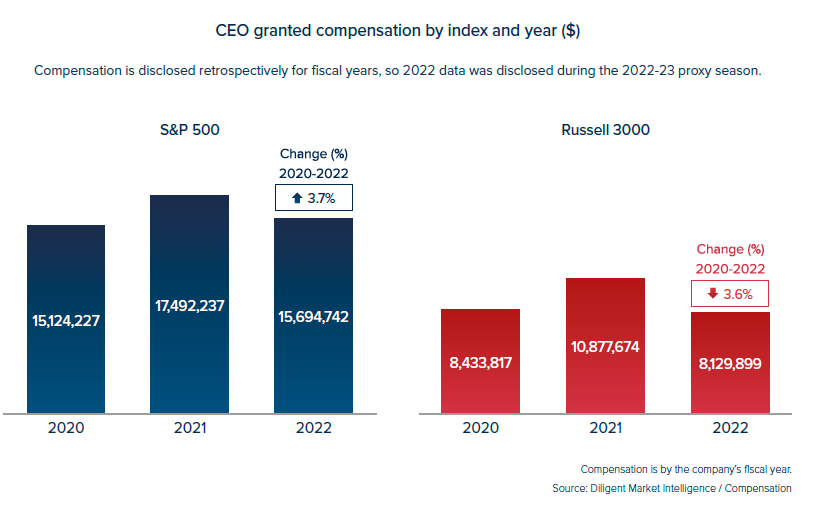

2023 marked the first time in four years S&P 500-listed issuers awarded compensation packages based on a down market. In 2022, the S&P 500 index’s total return was -19.4% and companies generally responded as investors would expect, with average granted compensation for companies in the index decreasing to $15.7 million in 2022, down from $17.5 million in 2021.

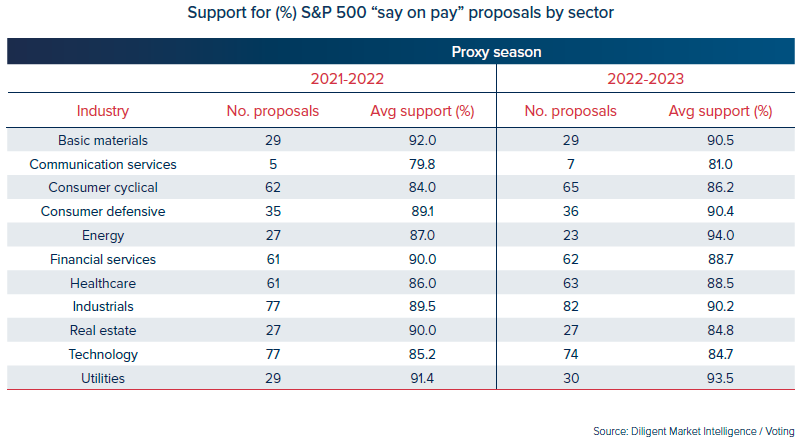

Despite these tough market conditions, investors responded positively to more modest CEO payouts. 2023 marked the first proxy season in five years where support for advisory “say on pay” proposals at S&P 500 companies increased in comparison to the previous year. Proposals of this kind received 92.1% support on average in 2017, bottoming out at 87.7% average support in 2022. 2023, however, bucked the trend, with “say on pay” resolutions winning 88.9% average support, according to Diligent Market Intelligence’s (DMI) Voting module.

“You’re seeing the fruits of the labor of company engagements,” Brian Valerio, senior vice president at Alliance Advisors, told DMI in an interview. “Companies have been engaging with shareholders to understand their compensation philosophies and craft plans that align with company needs,

but also drive value for investors.”

Constructive criticism

In 2023, issuers seemed to take stock of shareholder claims that executive pay needs to be more closely aligned with performance and shareholder experiences.

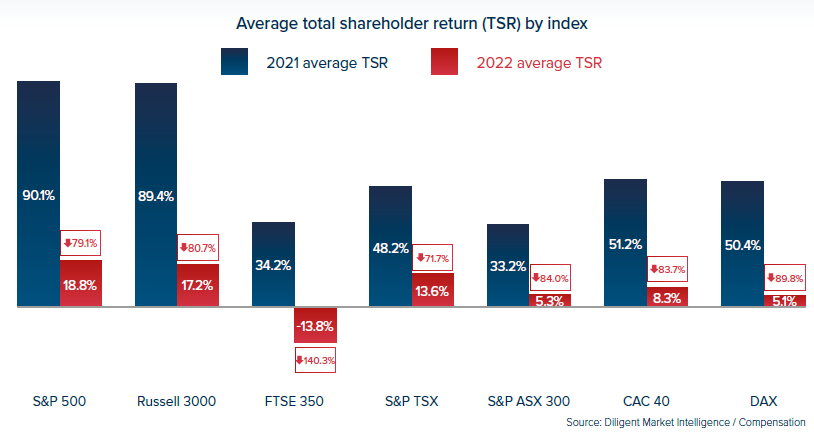

Average total shareholder return (TSR) for S&P 500 companies fell to 18.8% in 2022, compared to 90.1% a year prior, while Russell 3000 TSR declined by 80.7% to 17.2% in 2022. This decline brought CEO compensation closer to the levels seen in 2020, where S&P 500 CEOs earned $15.1 million on average, according to DMI’s Compensation module.

A shift away from one-time awards contributed to the increase in investor backing for pay plans. In BlackRock’s 2023 season review, the world’s largest fund manager noted that companies used out of plan awards “less frequently than in previous years, with the number decreasing to 323 from a high of 427 in 2022.”

One of the biggest increases in support for “say on pay” plans this season was seen at technology giant Intel, where the company previously faced pushback due to significant one-time equity awards.

Intel’s 2023 pay plan was opposed by just 8.1% of votes cast, compared to 65.9% a year prior. BlackRock was among the many investors to oppose the 2021 pay plan, noting in a voting bulletin that CEO Patrick Gelsinger’s 2021 one-time equity award and base pay were “misaligned with shareholders’ long-term interests.”

Similar situations presented themselves at both CenterPoint Energy and JP Morgan Chase’s 2023 annual meetings, where “say on pay” plans won higher support than seen in previous years, after CEOs took 63% and 59% cuts in granted pay, respectively.

Bruce Kistler, managing director at Okapi Partners, told DMI in an interview that, following a year of “very low” support for pay plans in 2022, the resurgence in 2023 was a natural bounce back attributable to more companies returning to “normal” compensation practices.

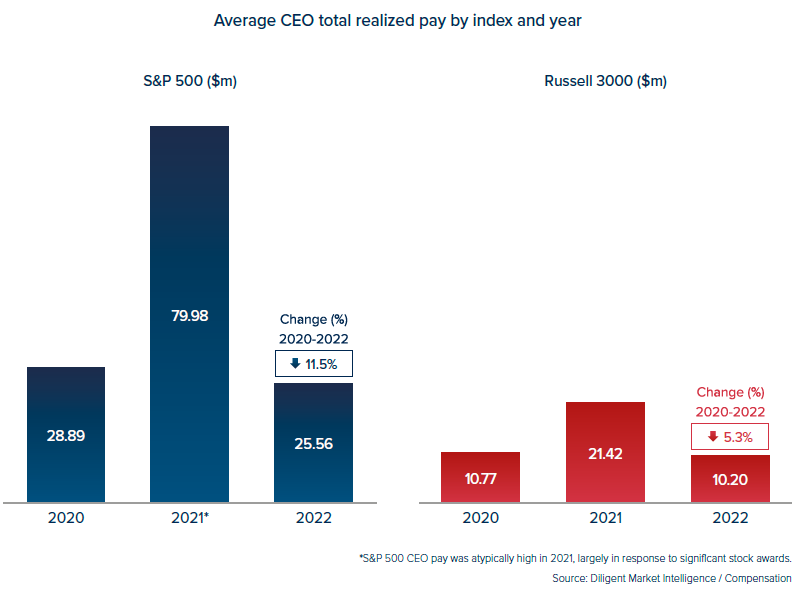

In 2022, the realized compensation of S&P 500 CEOs also declined, reflecting market volatility and broader stakeholder experiences. CEOs saw realized pay drop by 68% to $25.6 million, compared to $79.9 million in 2021. Russell 3000 pay also declined, with total average CEO realized pay declining by 52.4% to $10.2 million in 2022, compared to $21.4 million a year prior.

Easy as SEC

While both investors and issuers alike have been keen to understand how the Securities and Exchange Commission’s (SEC) new Pay versus Performance disclosure rules will impact “say on pay” support in the U.S., some industry members think that the rule has made minimal impact on the 2023 season and will play a larger part come 2024.

The rule, which was adopted in August 2022, requires U.S.-listed companies to disclose specified executive pay for the past five fiscal years. Issuers are also required to report TSR, net income and between three and seven financial or nonfinancial measures considered when aligning executive

pay to company performance.

When asked about the impact of the rule on pay plans, Valerio of Alliance Advisors told DMI it was “a little too early to tell. Companies recognize that they need to comply with this, but it hasn’t really been a frequent discussion topic during engagements with investors, as it is not something that

shareholders seem to be interested in discussing.” The rule has, however, encouraged companies to be more thoughtful about how to disclose and report on pay, especially in regard to metrics used to evaluate pay plans and corporate performance.

“CEOs saw realized pay drop by 68% to $25.6 million, compared to $79.9 million in 2021.”

“These disclosures likely would have had significantly more value 10+ years ago when they were originally contemplated under Dodd-Frank. However, many investors and advisors have developed and refined their own models since then,” Kistler of Okapi noted. “I think where [the rule] may have helped is pushing some companies that have traditionally spent less time speaking to metric selection rationale to rethink that and spend more time on this.”

In Vanguard’s U.S. 2023 season review, the fund manager revealed it supported 95% of U.S. management pay proposals, thanks to companies being more open about “how they planned to modify their disclosures” to aid investor decisionmaking, which it attributed to the new legislation.

Print

Print