Merel Spierings is Senior Researcher at The Conference Board ESG Center in New York. This post relates to Corporate Board Practices in the Russell 3000, S&P 500, and S&P MidCap 400: Live Dashboard, a live online dashboard published by The Conference Board and ESG data analytics firm ESGAUGE, in collaboration with Debevoise & Plimpton, the KPMG Board Leadership Center, Russell Reynolds Associates, and The John L. Weinberg Center for Corporate Governance at the University of Delaware.

Board Leadership

Board Chair Independence

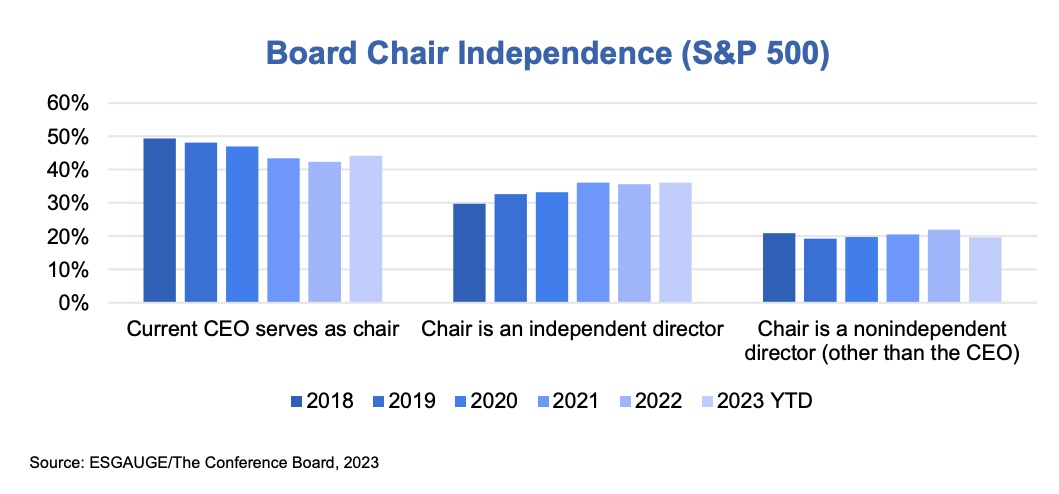

At larger companies, the trend toward board chair independence seems to have plateaued. Some 36% of S&P 500 firms have an independent chair, a percentage that hasn’t changed since 2021. At 44% of S&P 500 companies, the current CEO also serves as board chair (a slight increase from 42% in 2022), while at the same time, average shareholder support for proposals on CEO/chair separation remains around 30%. Finally, the share of chairs who are non-independent directors (other than the CEO) has remained at approximately 20%.

Boards generally take a nondoctrinaire approach to their leadership structures, with three-quarters of the S&P 500 considering leadership structure on a case-by-case basis. If boards have one person serving as board chair and CEO, however, they should consider how to assure institutional investors that the board is providing effective oversight. In addition to having a lead independent director (as 65% of S&P 500 companies do), a robust director-shareholder engagement program can serve that purpose.

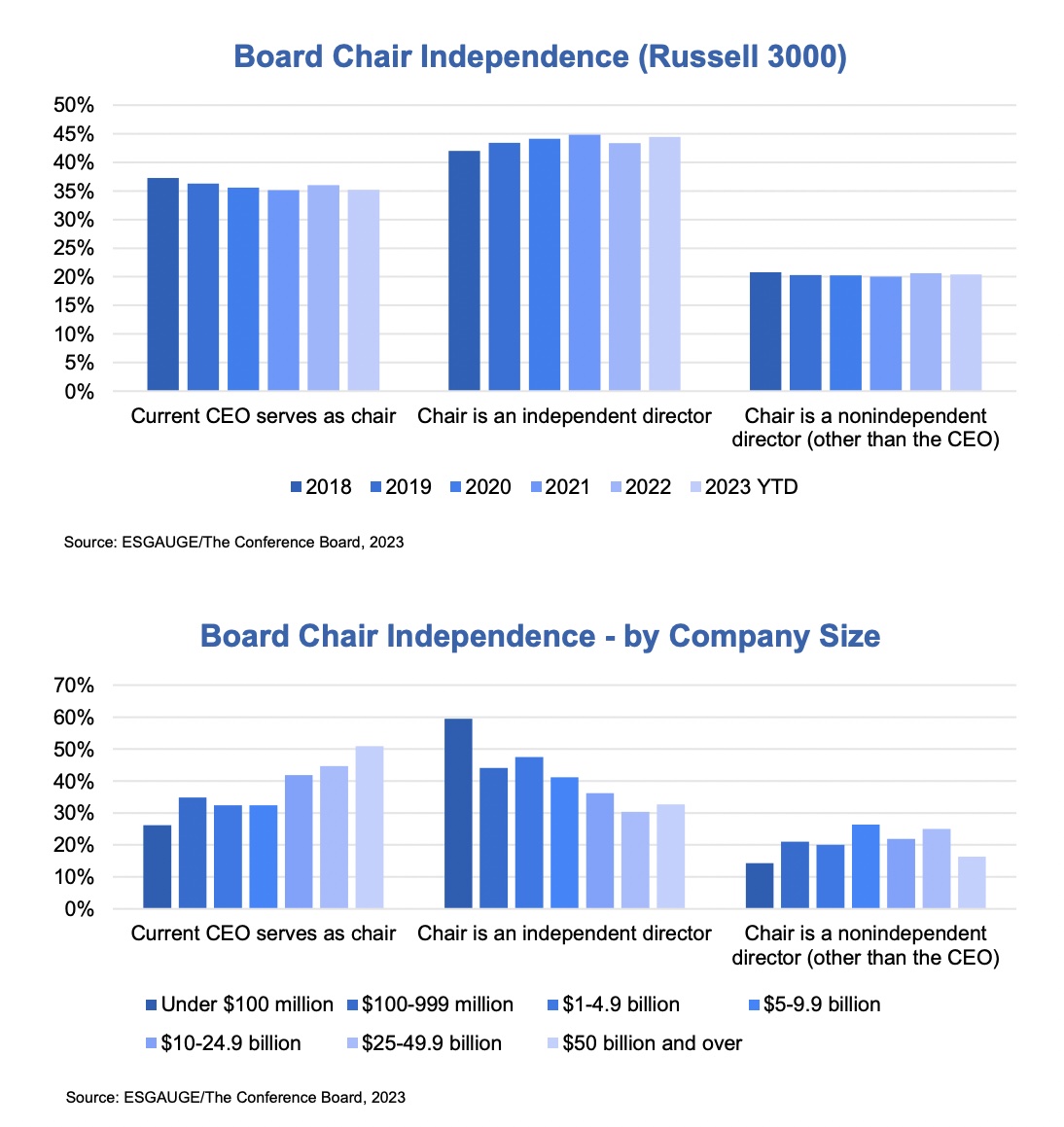

There’s a strong correlation between company size and board leadership model, with most of the largest companies combining the CEO/board chair role and most of the smallest companies having an independent board chair. As of August 2023, the CEO also served as chair at 51% of companies with annual revenues of $50 billion and over; for companies with annual revenues under $100 million, this percentage was only 26%. Conversely, 59% of the smallest companies reported having an independent chair, whereas for the largest companies this percentage was only 33%.

At smaller companies with limited resources, the CEO may wish to focus on managing the company and have a chair who focuses on the board and oversight. By contrast, large companies may place a premium on having a single individual who provides leadership for the company, can engage with all stakeholders, and is accountable for the company’s performance.

CEO/Board Chair Combination or Separation Policy and Rationale

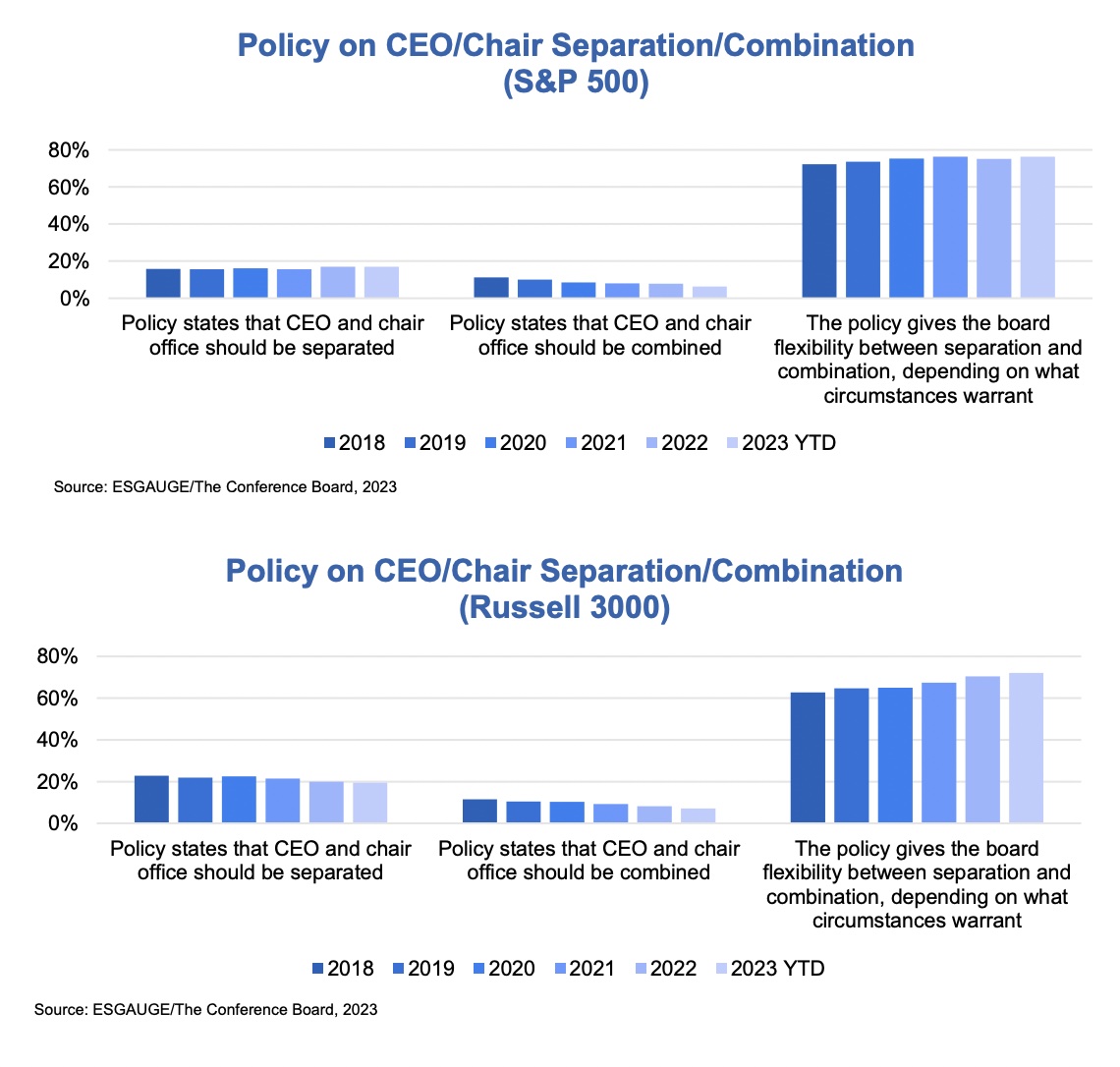

While virtually all companies have adopted a policy on board leadership, the percentage of policies that require the model of CEO/chair combination is declining and the share that give the board flexibility between CEO/chair separation and combination continues to grow. As of August 2023, 76% of S&P 500 companies provide that the board has the flexibility to determine its leadership structure considering the circumstances it faces, up from 72% in 2018. The Russell 3000 saw a more pronounced increase, from 63% in 2018 to 72% in 2023. Only 6% of S&P 500 and 7% of Russell 3000 companies have a policy that requires a CEO/chair combination, which is a decline in both indexes from 2018, when 11% of S&P 500 and 12% of Russell 3000 companies had such a policy. Finally, 17% of S&P 500 and 20% of Russell 3000 companies currently state that the CEO and chair role should be separated, compared to 16 and 23%, respectively, in 2018.

This trend underscores the growing recognition of the importance of flexibility in board leadership structures, allowing companies to align their governance practices more closely with their specific circumstances.

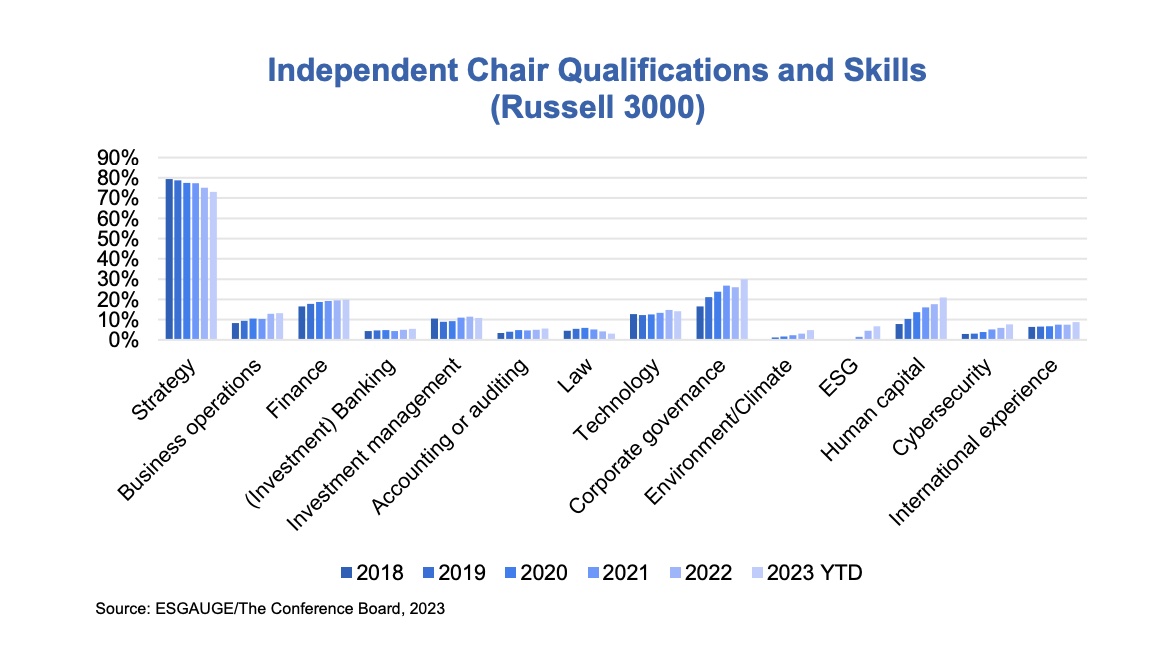

Independent Board Chair Qualifications and Skills

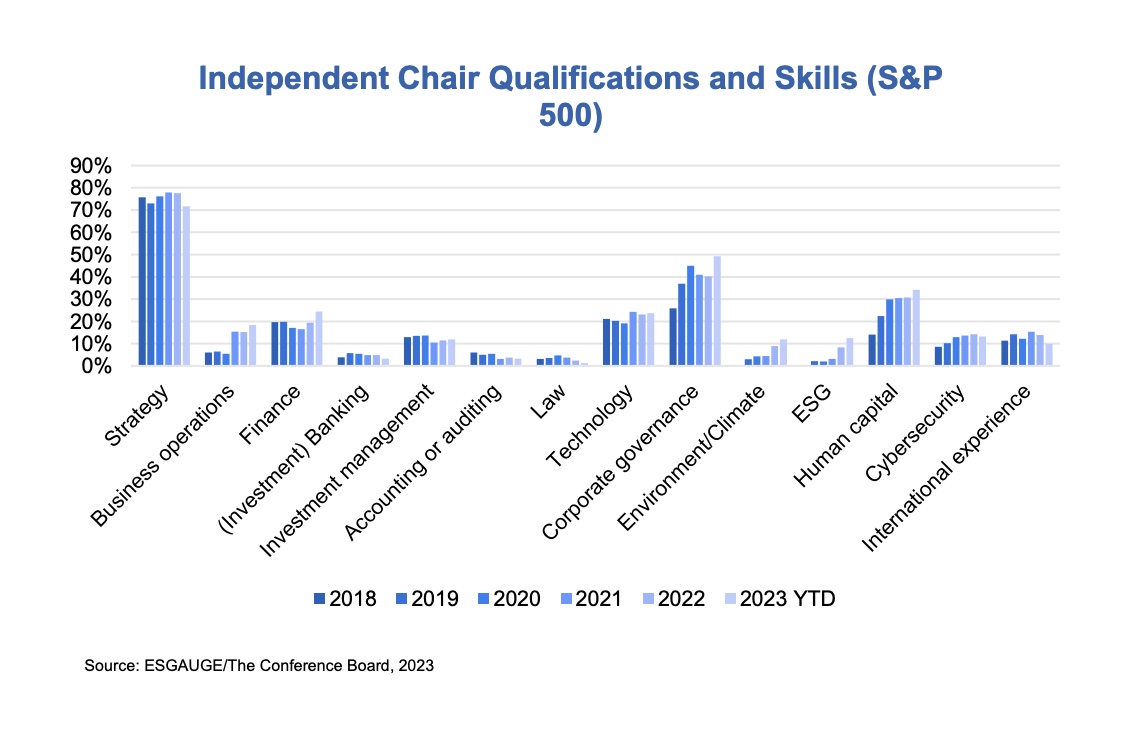

Business strategy is the most cited experience for independent chairs, but the percentage of chairs with such experience has declined. After increasing from 73% in 2019 to 78% in 2022, the share of S&P 500 board chairs with strategic experience (as reported in the proxy statement or other disclosure documents) had declined to 72% as of August 2023. For lead independent directors, the percentage increased from 75% in 2018 to 79% in 2021 but dropped to 74% in 2023. In the Russell 3000, the percentage has steadily declined for board chairs in recent years, from 79% in 2018 to 73% in 2023, and for lead independent directors from 72% to 66%.

Ensuring effective governance is at the heart of a board chair’s responsibilities. But as research by The Conference Board has underscored, the board is increasingly moving beyond a traditional governance role and becoming a strategic thought partner for management.[1] The decline of board chairs with strategic experience is troublesome as such experience enables independent board chairs to provide informed guidance on the company’s long-term strategy and overall direction, ensuring it remains competitive in a complex business environment. Even if the decline is due to underreporting of a competency that is taken for granted, it is still a matter of concern as it may attract shareholder activism.

Conversely, experience in key ESG areas, business operations, and finance has increased. Among S&P 500 chairs, reported experience in corporate governance saw the largest increase (from 26% in 2018 to 49% in 2023), followed by human capital (14% to 34%), ESG (0% to 13%), environment/climate (0% to 12%) and business operations (6% to 18%). Among Russell 3000 directors, experience in governance saw the largest increase as well (from 26% to 49%), followed by human capital (from 8% to 21%), ESG (0% to 7%), environment/ climate (0% to 5%), cybersecurity (3% to 8%), and business operations (8% to 13%).

Board Meetings

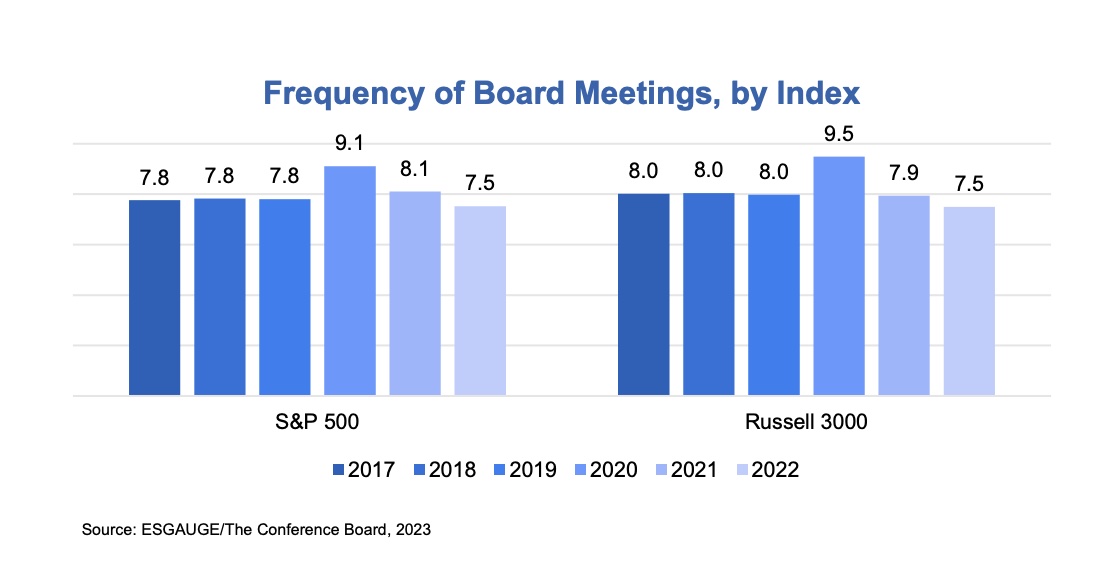

Frequency of Board Meetings

Despite increasing workloads, the average frequency of board meetings has dropped to below pre-pandemic levels. In 2022, S&P 500 companies held an average of 7.5 formal board meetings, not only down from 9.1 in 2020, when the pandemic began, but also down from 7.8 before the pandemic. Russell 3000 companies also held 7.5 meetings on average, down from 9.5 meetings in 2020 and from 8.0 meetings annually before the pandemic.

Several factors may be contributing to this trend:

- Boards are holding more informal calls. As our discussion with corporate governance leaders revealed, it’s now more common, as compared to the prepandemic period, for boards to hold informal board conference calls—between regularly scheduled board meetings—in which no board decisions or minutes are taken and that do not count as board meetings under SEC disclosure regulations.

- The flow of information has shifted. More information is being shared with the board through portals on an ongoing basis, and not just in connection with board and committee meetings.

The decline in the number of reported board meetings below 2019 levels may be a matter of concern to investors, unless it is explained that meetings are supplemented with other types of convenings. Moreover, apart from any potential investor concerns, boards should continue to ensure that enough of their board meetings are held in person. Given the importance of cultivating a culture of trust and respect among board members, there is no substitute for in-person, face-to-face interaction before, during, and after meetings.

Board Committees

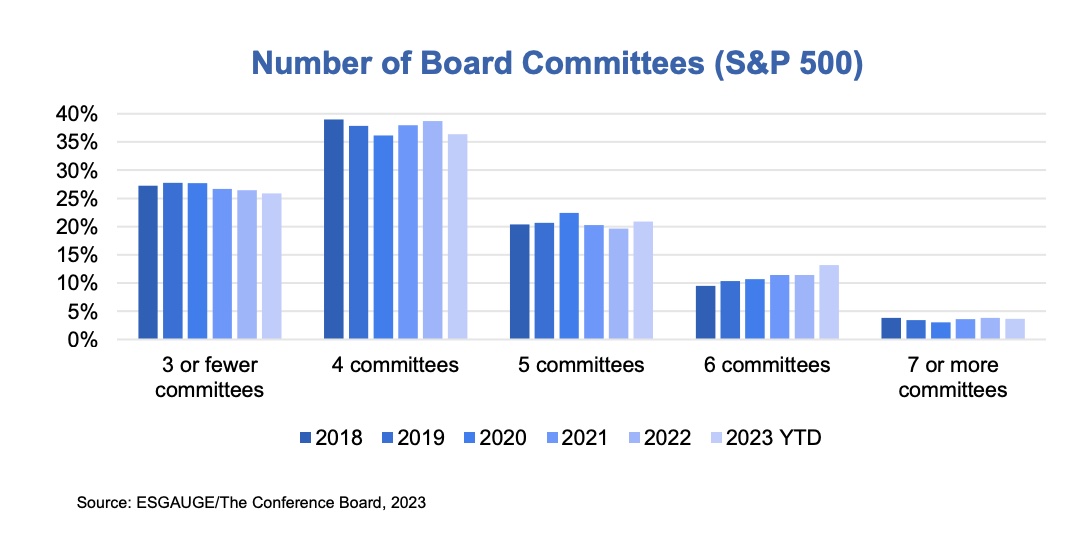

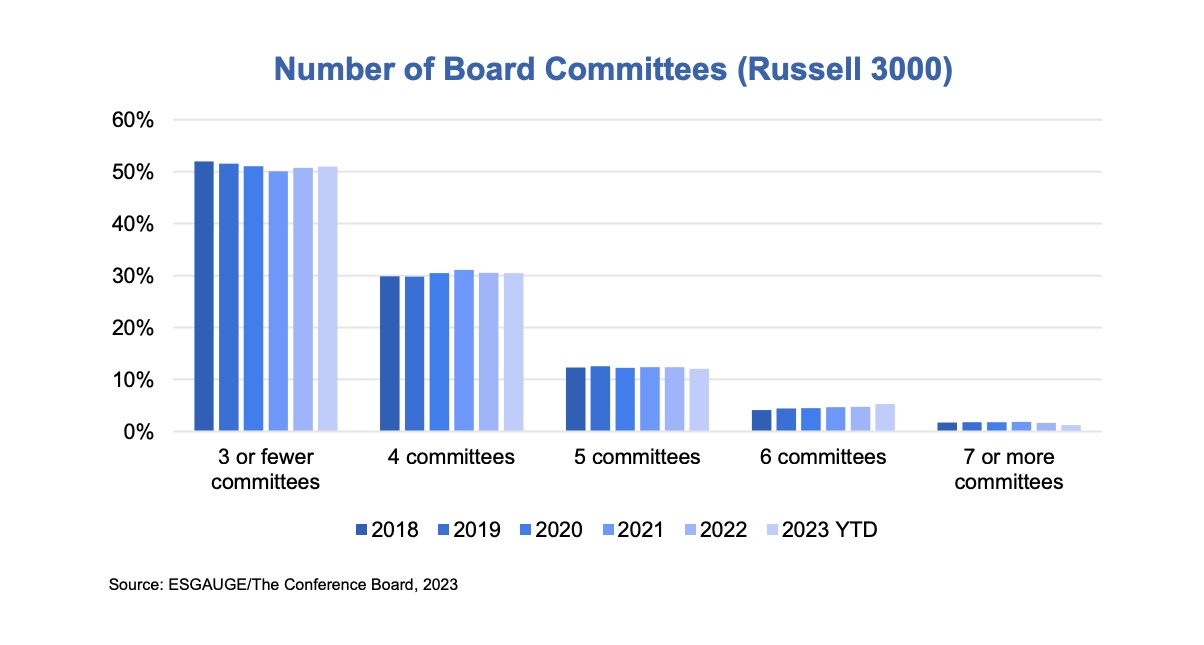

Number of Board Committees

While larger companies are most likely to have four board committees, smaller companies tend to have three or fewer. As of August 2023, 74% of the S&P 500 had more than three committees (13% had six committees, 21% had five, and 36% had four.) By contrast, 51% of the Russell 3000 had three or fewer committees. These percentages continue to be stable over time, although the percentage with six committees is steadily increasing in the S&P 500 (from 9% in 2018 to 13% in 2023).

Creating more board committees to accommodate the expanding array of board responsibilities can be beneficial. However, boards need to ensure they have enough qualified directors to serve on these committees, and the corporate secretary, working with the board’s leadership, needs to ensure that the committees do not operate in silos.

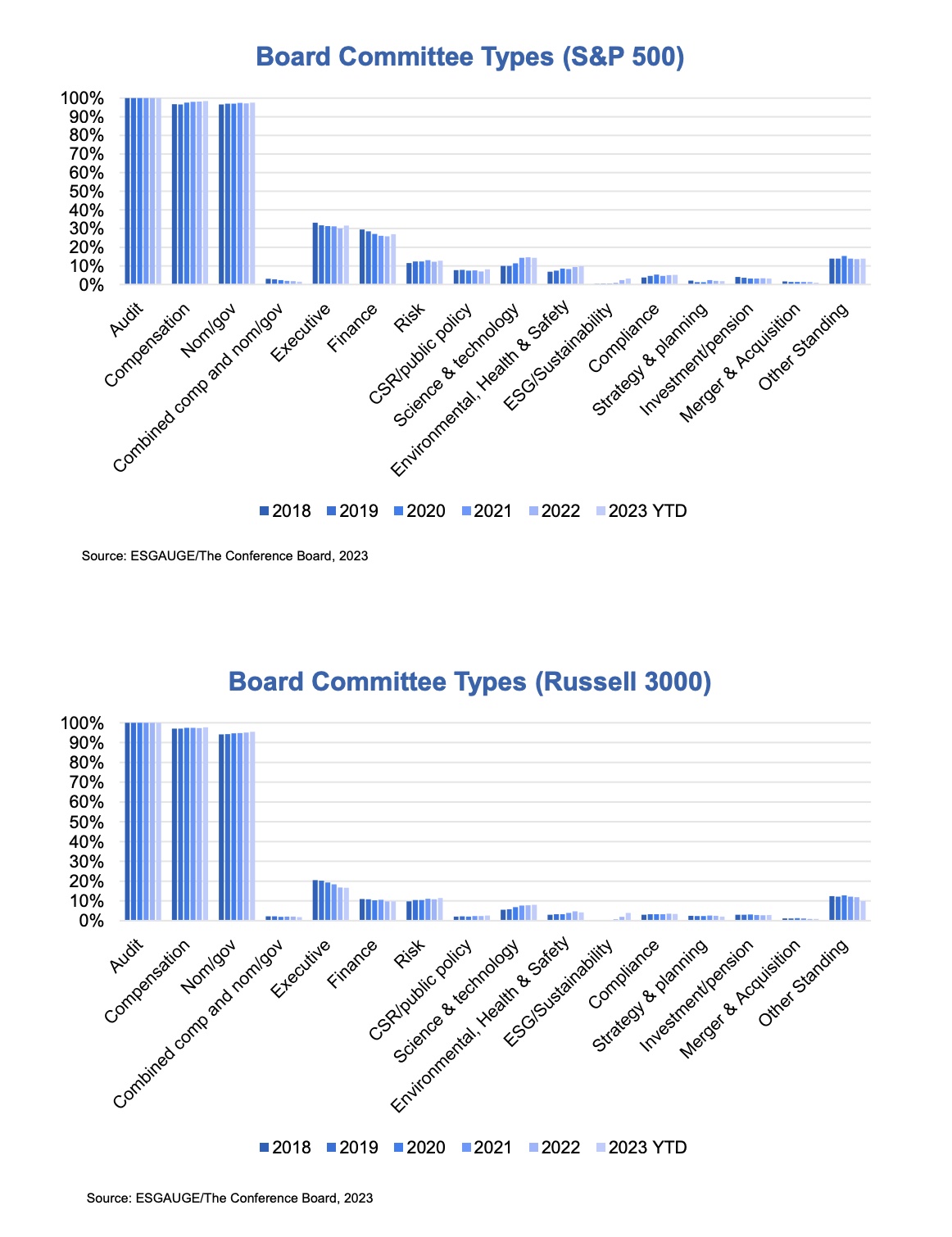

Board Committee Types

After the traditional audit, compensation, and nominating/governance committees, required by stock exchange listing standards, the most common standing committee of the board continues to be the executive committee. In the S&P 500, 32% of companies have such a committee (versus 17% of Russell 3000 companies). Other common board committees are the finance committee (27% of S&P 500 and 10% of Russell 3000 companies), science & technology committee (14% of S&P 500 and 8% of Russell 3000 companies), and risk committee (13% of S&P 500 and 12% of Russell 3000 companies). Only 3% of S&P 500 and 4% of Russell 3000 companies have established a sustainability or ESG committee.

The absence of stand-alone ESG/sustainability committees suggests that companies are allocating new responsibilities for ESG areas to existing committees. As they do, they should ensure those committees are adequately resourced to fulfill additional responsibilities.

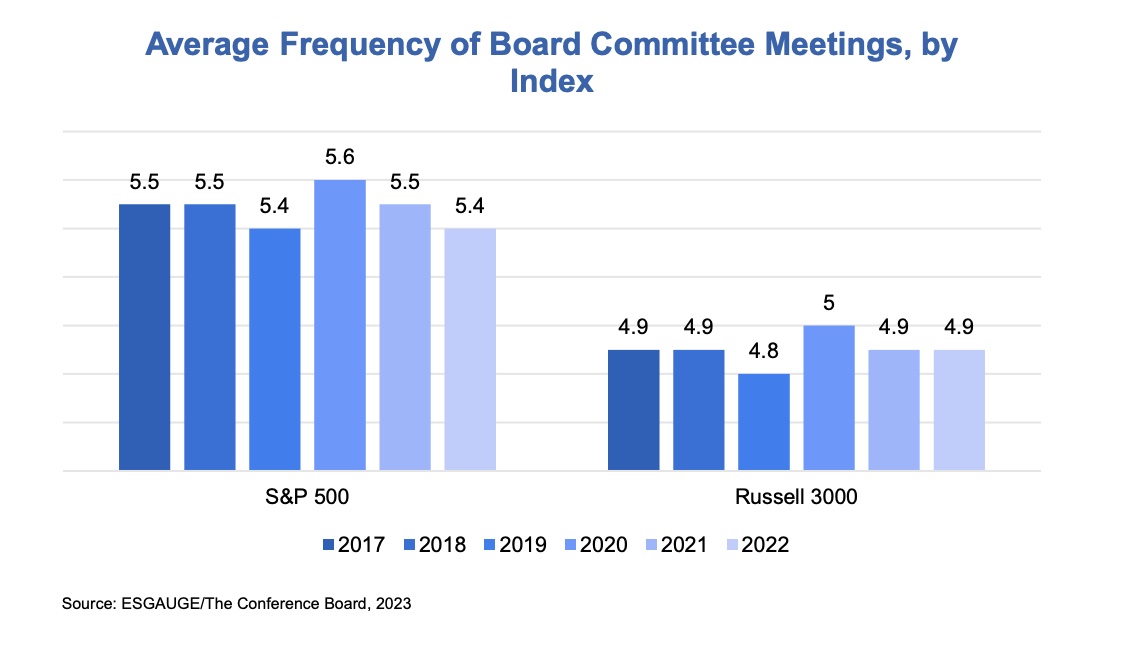

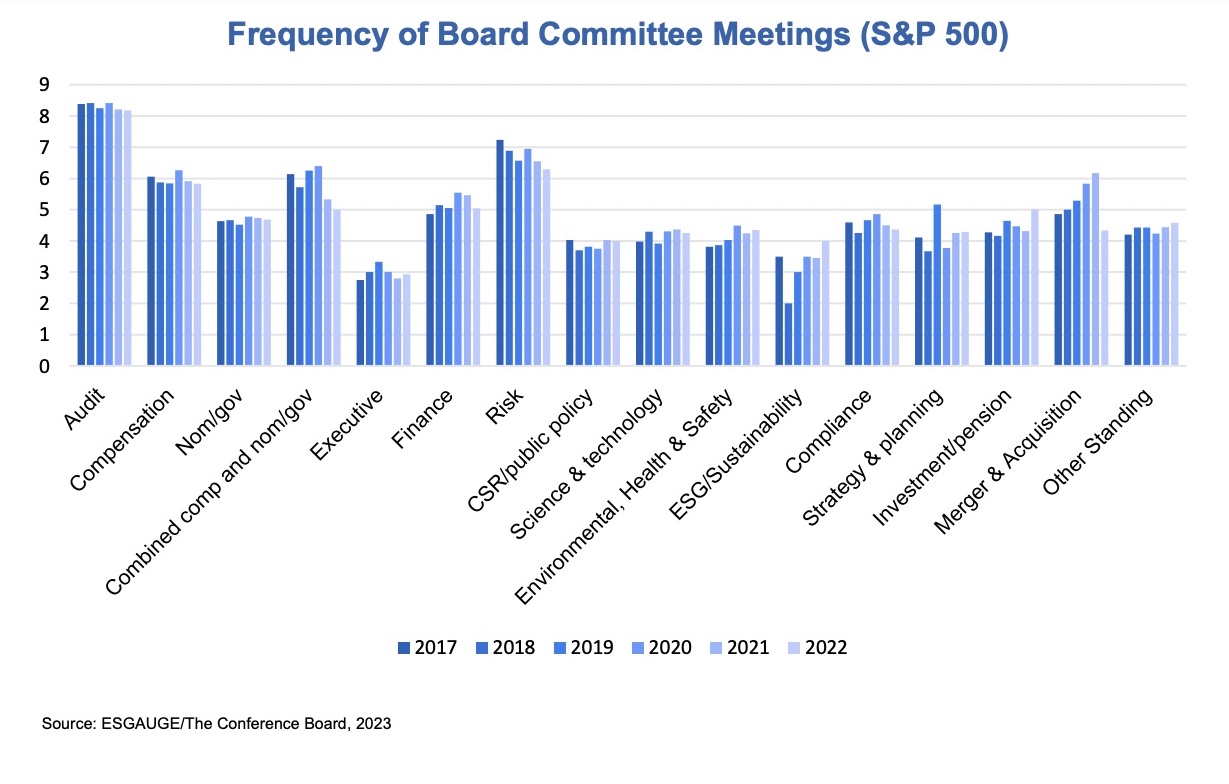

Frequency of Board Committee Meetings

The average frequency of board committee meetings has not changed significantly in recent years, despite the pandemic and increasing responsibilities. In 2022, in the S&P 500, each board committee held an average of 5.4 meetings per year, down from 5.6 in 2020 but the same as 2019. Russell 3000 companies held an average of 4.9 committee meetings, down from 5.0 in 2020 but similar to the frequency before the pandemic.

Just like the full board, committees are leveraging informal calls and board portals to share information and stay up to date on issues where no decisions need to be made.

Of all committee types, audit committees meet most frequently, followed by risk committees at larger companies, and combined compensation & nominating/governance committees at smaller companies.[2] In 2022, audit committees held 8.2 committee meetings on average in the S&P 500 and 6.8 meetings in the Russell 3000. Those numbers have been stable over time.

The average number of nominating/governance committee meetings has stayed stable over time as well in both indexes and is lower than that of several other committees. This may change as nominating committees are assuming greater ESG responsibilities.

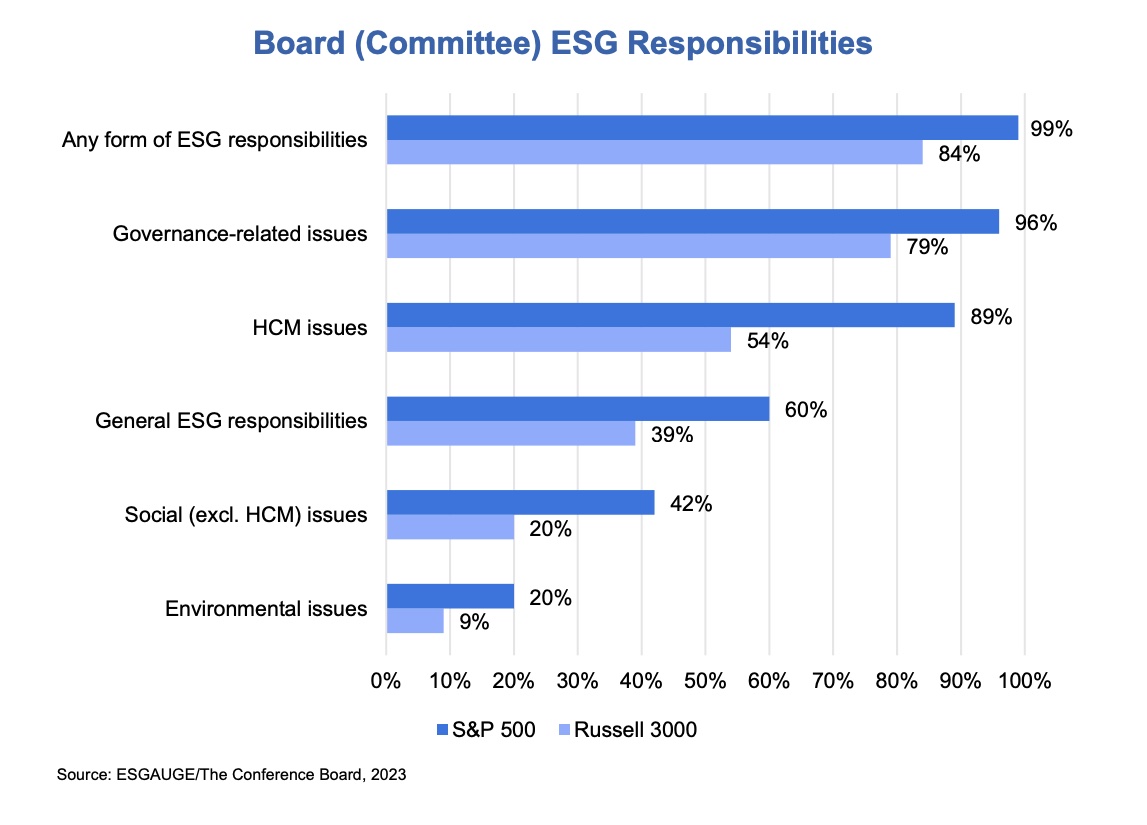

Allocation of ESG Responsibilities

Virtually all S&P 500 and 84% of Russell 3000 companies disclose assignment of ESG responsibilities to the full board and/or one or more committees. Most boards have assigned responsibility for governance (96% of S&P 500 and 79% of Russell 3000 companies) and HCM (89% and 54%, respectively). Only 20% of S&P 500 companies and 9% of Russell 3000 companies are assigning responsibility for environmental issues to the board and/or one of its committees.

With the EU and other jurisdictions increasing disclosure requirements relating to board oversight of ESG issues and with investors focusing on the board’s role in this arena,[3] boards should be prepared to assign responsibility for overseeing environmental issues in a manner that does not silo environmental topics but instead supports the integration of environmental goals with the company’s overall strategy and operations.

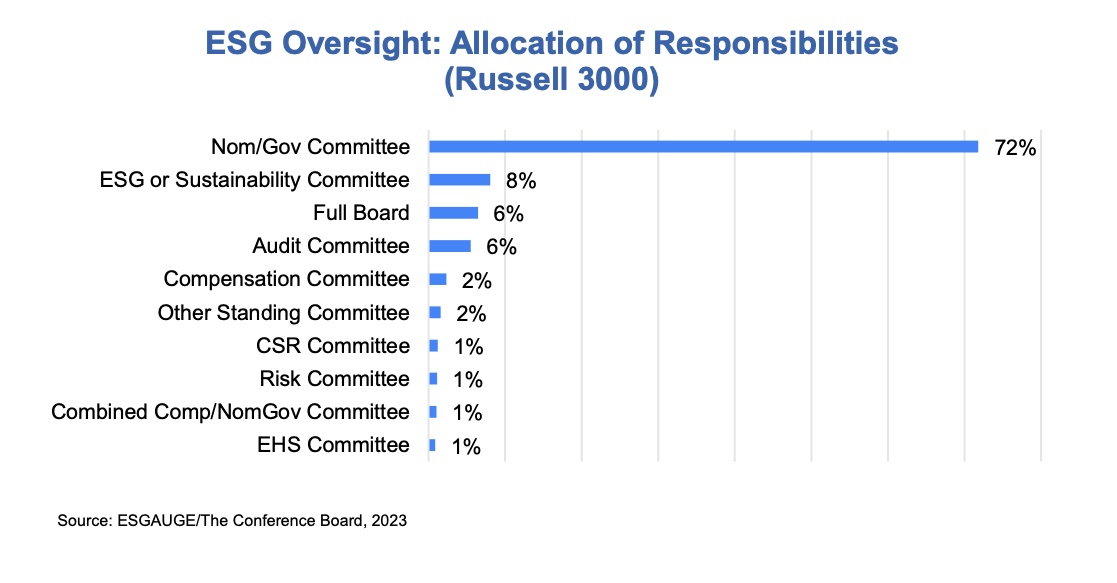

General ESG oversight responsibilities are most frequently allocated to the nominating/governance committee, but companies may want to address the role of the full board with respect to ESG. Of the firms in the Russell 3000 that have assigned responsibilities for ESG at the board and committee level, only 6% have given general ESG strategy and oversight to the full board. Most have allocated this area to the nominating/ governance committee (72%).

While committee responsibilities appropriately vary by company, the full board may be better equipped to oversee the integration of ESG and stakeholder interests into the company’s business strategy and operations. And even if boards are allocating ESG responsibilities to the nominating/governance committee only temporarily, they should consider whether that committee has the right composition and enough resources to fulfill its responsibilities effectively.

Conclusion

Boards are adapting to their expanding responsibilities by increasing the number of committees and by explicitly assigning ESG-related responsibilities in committee charters and other governance documents. They may want to bring that same spirit of flexibility and transparency to other aspects of how they are structured and operate. Indeed, boards that are not making changes should be able to articulate why their current approach is the most effective.

- Companies should ensure that their independent directors in leadership roles can directly engage with investors as appropriate. Major institutional investors are willing to vote against shareholder proposals if they are comfortable with board oversight. Especially at the 44% of S&P 500 companies that have a combined CEO/chair, it can be useful to put independent directors in leadership roles in front of investors on topics where boards play a critical independent oversight role.

- Boards may want to consider business strategy experience as an essential qualification for independent board chairs. Even as boards are increasingly expected to take on a strategic thought-partnership role, reported business strategy experience is declining among independent board chairs (from 78% in 2022 to 72% in 2023 in the S&P 500) and among lead independent directors (from 70 to 66%). If boards do not have a chair or lead independent director with experience in business strategy, they should be prepared to articulate why.

- Boards should take a fresh look at the frequency of their meetings as well as informal conference calls and communications to ensure they are able to address all the matters requiring the board’s attention. The average number of board meetings in the S&P 500 dropped below pre-pandemic levels of 7.8 meetings to 7.5 meetings per year in 2022. Given boards’ increasing responsibilities, investors may view the declining number of meetings with concern, unless the board is supplementing meetings with other types of convenings (and disclosing them) or is able to explain how it is keeping up with its workload.

- Just as companies are focused on board succession planning, they should also consider the succession process for key leadership roles such as the board chair/lead independent director and committee chairs. The average tenure for independent chairs in the S&P 500 grew from 4.7 years in 2018 to 5.5 years in 2023. While boards will likely want to avoid arbitrary term limits, it can help to have succession plans in mind for key board roles.

- With climate regulations becoming increasingly stringent, boards should allocate and codify responsibility for environmental issues. Only 20% of S&P 500 and 9% of Russell 3000 companies have disclosed the allocation of responsibility for environmental issues to the board and/or one of its committees. Yet, board oversight of these issues is essential for ensuring (future) legal compliance, managing risks and opportunities, and integrating environmental considerations into business strategy and operations.

- In light of the board’s evolving responsibilities, companies should take a fresh look at their committee structure. Seventy-four percent of S&P 500 companies have more than three standing board committees, with a growing number of companies exploring different approaches to address a heightened focus on ESG issues, stakeholder expectations, and regulatory requirements. In doing so, boards may want to consider how the full board and committees oversee the three main areas where the company executes its strategy: the marketplace, the workplace, and the public space.

- While general ESG oversight responsibilities are most frequently allocated to the nominating/governance committee, companies should address the role of the full board to ensure a strategic approach to ESG. Of the firms that have assigned responsibilities for ESG at the board/committee level, only 6% have given general ESG strategy and oversight to the full board. However, the full board might be better equipped to oversee the integration of ESG into the company’s strategy and operations than the company’s nominating/governance or other committee.

Time for a Radical Rethink of Board Structure?

Traditionally, corporate boards had three standing committees: audit, compensation, and nominating/governance, generally based on stock exchange listing standards created in the wake of the Enron and WorldCom scandals over two decades ago. At that time, regulators and stock exchanges were focused on the board’s role in exercising independent oversight of management.

But as has long been recognized, boards do much more than exercise independent oversight. They make decisions, provide advice as strategic thought partners for management, and increasingly engage with investors as well as, in some cases, with employees and communities.[4] As a recent report by The Conference Board points out, today’s boards need governance that is adequate to address not only regulatory requirements but also market forces such as the digital and sustainability transformations of industry.

Boards have sought to adapt by establishing more board committees, assigning more responsibilities to existing committees, and renaming committees. For example, 14% of S&P 500 companies now have a science & technology committee and 10% have an environmental, health & safety committee. It is now quite common for audit committees to be responsible for cybersecurity and, increasingly, for nominating/governance committees to be responsible for overall ESG oversight. And, as explicitly permitted by stock exchange listing standards, boards have renamed their nominating/governance committee and compensation committee to reflect changing responsibilities.[5] However, in some cases, these changes have resulted in a proliferation of committees that may be difficult to populate, given the relatively small size of boards (e.g., 38% of S&P 500 companies have five or more committees, while they have, on average, nine independent directors). This proliferation may also overload committees with responsibilities that may not suit the committee’s capacity and capabilities or blur responsibilities among committees.

While companies may not want to undertake a wholesale overhaul of their committee structure, they may at least—as a thought experiment—consider how the board can best fulfill its role as a truly strategic asset for the company, what specific responsibilities flow from that role, and how those responsibilities may best be allocated among the board and its committees.

Methodology and Access to Live DataThis report documents current practices on the leadership and structure of boards of directors at US publicly traded companies—including information on board chair independence, on the policy (and its rationale) on the separation or combination of CEO/board chair positions, on independent chair qualifications and skills, on the frequency of board meetings, and on the number and types of board committees. The analysis is based on recently filed proxy statements and complemented by the review of organizational documents (including articles of incorporation, bylaws, corporate governance principles, board committee charters, and other corporate policies made available in the Investor Relations section of companies’ websites). The report also presents key insights gained during a Focus Group discussion with in-house governance leaders. The project is conducted by The Conference Board and ESG data analytics firm ESGAUGE, in collaboration with Debevoise & Plimpton, the KPMG Board Leadership Center, Russell Reynolds Associates, and the John L. Weinberg Center for Corporate Governance at the University of Delaware. Data discussed in this report can be accessed and visualized through an interactive online dashboard at conferenceboard.esgauge.org/boardpractices |

Endnotes

1Merel Spierings and Paul Washington, The Roles of the Board in the Era of ESG and Stakeholder Capitalism, The Conference Board, Research Report, January 23, 2023.(go back)

2It must be noted, however, that only 2% of Russell 3000 companies have a combined compensation and nominating/ governance committee.(go back)

3Merel Spierings, 2023 Proxy Season Review: Navigating ESG Backlash and Shareholder Proposal Fatigue, The Conference Board, Research Report, October 18, 2023.(go back)

4Colin Carter and Jay W. Lorsch, Back to the Drawing Board: Designing Corporate Boards for a Complex World, Harvard Business Review Press, 2003.(go back)

5Per NYSE Listed Company Manual Section 303A: “Boards may allocate the responsibilities of the nominating/corporate governance committee [compensation committee] to committees of their own denomination, provided that the committees are composed entirely of independent directors. Any such committee must have a committee charter.”(go back)

Print

Print