This update provides an overview of the major developments in federal and state securities litigation since our 2023 Mid-Year Securities Litigation Update:

FILING AND SETTLEMENT TRENDS

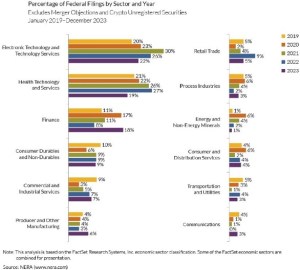

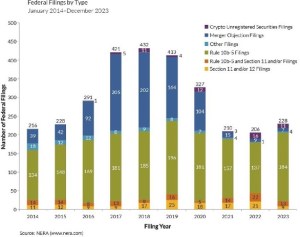

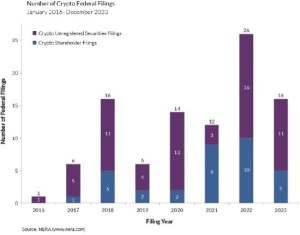

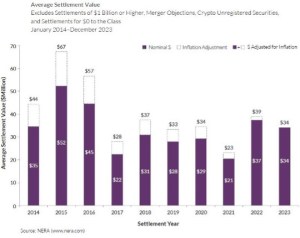

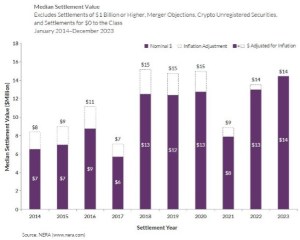

Data from a recent NERA Economic Consulting (“NERA”) study illustrates several trend changes. Federal securities litigation filings in 2023 increased compared to filings in 2022 and 2021. At the same time, “Health and Technology Services” and “Electronic Technology and Technology Services” filings—which represented over 50% of filings last year—decreased significantly on a relative basis. Cryptocurrency filings also decreased, from 26filings in 2022 to 16 filings in 2023. Meanwhile, “Finance” sector filings increased to 18%, and “Producer and other Manufacturing” sector filings doubled on a relative basis. Settlement values—excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than

$1 billion or $0 to the class—stayed relatively consistent. The average settlement value decreased from $37million to $34 million, while the median settlement value increased from

$13 million to $14 million.

A. Filing Trends

Figure 1 below reflects the federal filing rates from 1996 through 2023 (all charts courtesy of NERA). 228 federal cases were filed in the past year. This is a slight increase in filings compared to 2022 and 2021, but still nowhere near the number of filings in the peak years of 2017-2019. Note, however, that this figure does not include classaction suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

B. Mix Of Cases Filed In 2023

-

Filings By Industry Sector

The distribution of non-merger objections and non-crypto unregistered securities filings, as shown in Figure 2 below, had some slight variations this year compared to previous

years. Notably, the “Health and Technology Services” sector percentage was the lowest it has been in the last five years, dropping from 27% to 19% in the past year. “Electronic Technology and Technology Services” filings also decreased compared with the two prior years. Thus, while “Health and Technology Services” and “Electronic Technology and Technology Services” filings accounted for over 50% of filings in both 2021 and 2022, that total decreased to 41% this year. Meanwhile, “Finance” sector filings increased steeply on a relative basis,from 8% to 18%, and filings related to the “Producer and Other Manufacturing” sector doubled on a relative basis from 3% to 6%.

2. Merger Cases

As shown in Figure 3 below, there were seven merger-objection cases filed in federal court in 2023. This continues the downward trend of merger objection filings, beginning in 2020.

3. Cryptocurrency Cases

Figure 4 below illustrates the trends in cryptocurrency filings in federal court from 2016 through 2023. This past year, there were 11 crypto unregistered securities filings and five crypto shareholder filings, matching the numbers for 2018. The number of both types of crypto filings decreased from 2022, with the number of crypto shareholder filings cut in half and the number of crypto unregistered securities filings decreasing by 31%.

C. Settlement Trends

As reflected in Figure 5 below, the average settlement value in 2023 reached $34 million, dropping compared to the average value in 2022 of $37 million. (Note that the average settlement value excludes merger-objectioncases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class.)

As for median settlement value, Figure 6 shows that the value remained relatively even for 2023 at $14 million.This median value has been consistent over the past 5 years, excluding the low outlier in 2021. (Note thatmedian settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

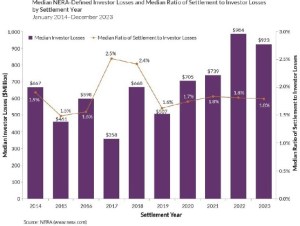

Finally, as shown in Figure 7, Median NERA-Defined Investor Losses decreased slightly in 2023 to $923 million from $984 million in 2022. This remains relatively high compared to prior years. The Median Ratio of Settlement to Investor Losses continued to hold steady at 1.8% for the third straight year.

This post comes to us from Gibson, Dunn & Crutcher LLP. It is based on the firm’s memorandum, “Securities Litigation 2023 Year-End Update,” dated February 22, 2024, and available here.

Sky Blog

Sky Blog