Jared A. Ellias is the Scott C. Collins Professor of Law at Harvard Law School. This post is based on his recent paper.

Congress gave distressed companies a powerful set of tools to deal with financial distress, namely Chapter 11 of the United States Bankruptcy Code. But these tools are thought to come with a cost in the form of damages sustained by the business, which we commonly refer to as the “indirect costs of bankruptcy.” For example, bankruptcy filings are thought to hurt the relationship between a firm and its workforce. When Hertz filed for Chapter 11 in 2020, it warned that, for the duration of the bankruptcy proceeding, “our employees will face considerable distraction and uncertainty and we may experience increased levels of employee attrition.” In other words, the design of bankruptcy law, with its highly public federal court hearings, creates a trade-off: firms may benefit from accessing the tools that Congress provided to resolve financial distress, but at the cost of, among other things, reducing the firm’s ability to retain, motivate and attract a value-maximizing workforce. As a result of this fear, among other fears of business damage, companies often delay and avoid filing for bankruptcy due to concerns that it would damage the business even if the tools of bankruptcy law might be helpful in resolving financial distress.

In my new working paper, “Employee Bankruptcy Trauma,” I study new sources of data – social media data – to learn more about how employees react to the decision of their employers to file for Chapter 11. There are reasons to be skeptical of the prevailing narrative that workers respond negatively to a bankruptcy filing. After all, Chapter 11 firms are nearly always suffering from financial distress prior to any bankruptcy filing, and the experience of employees may not change after a court filing. Indeed, the employee experience could very well improve as employers obtain the powers of a Chapter 11 debtor, such as borrowing new money and paying bonuses. Moreover, there are reasons to be suspicious that firms like Hertz might opportunistically deploy the specter of mass employee departure to pressure bankruptcy judges into agreeing to quick bankruptcy cases, and as such, less judicial oversight.

My approach is to look for evidence of employee responses to Chapter 11 bankruptcy filings in social media data, which offer initial, albeit imperfect, insights. I build a new dataset that combines two social media data sources – online employee reviews and employee work history from social media profiles – to learn more about how employees react to their employer’s Chapter 11 filing. I use a combination of manual coding, machine learning and statistical analyses to look for evidence supporting the prevailing view that bankruptcy filings damage the firm.

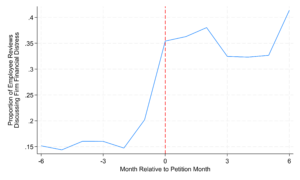

Using employee reviews, I document a battery of new facts about how employees review their employer after a Chapter 11 filing. I use a combination of hand-coding and machine learning to study the text of a dataset of 1.7 million employee reviews. The data tell a nuanced story: while reviewing employees do not appear to downgrade their employer after it files for bankruptcy relative to pre-bankruptcy reviews of the same firm, the content of their reviews change significantly. In a firm fixed effects regression framework, I find that reviews left by employees immediately after a bankruptcy filing are about 18 percentage points more likely to complain that their employer is financially distressed compared to reviews immediately prior to the filing, which is consistent with the view that the publicity around a bankruptcy filing increases the salience of a firm’s financial condition for employees. Among other changes in review content, they are also more likely to note that the firm is performing poorly, to complain about the firm’s corporate culture and to express frustration with the firm’s underinvestment in needed resources. The Figure below shows the proportion of employee reviews that discuss firm financial distress in the 12 month period around the petition month. As the Figure shows, the increase around the bankruptcy filing is substantial.

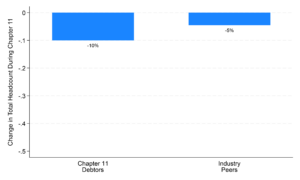

Next, using social media data, I look for evidence that employees flee Chapter 11 firms. Using public social media profiles, I first observe that financially distressed firms have a significantly higher rate of employee attrition, and that Chapter 11 status is associated with a higher rate of attrition in the cross-section even after controlling for firm financial distress. As the Figure below shows, focusing on Chapter 11 firms, attrition appears to begin to increase in the year prior to bankruptcy and then sharply spike after the firm enters bankruptcy protection.

In fact, the median reorganizing Chapter 11 firm loses roughly 10% of total headcount (aggregate departures net of new arrivals) by the time it leaves bankruptcy protection. Firms filing for Chapter 11 are typically in shrinking industries, but the median industry peer sheds a smaller proportion of workers (-5%) over the same period that the Chapter 11 firm is reorganizing in bankruptcy court.

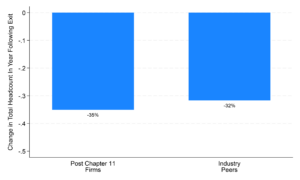

Finally, I also look for evidence that a bankruptcy filing could be associated with lasting damage, a possibility I refer to as “lingering bankruptcy trauma.” The basic idea is that the reputational taint of bankruptcy could linger and discourage employees even after the firm formally reorganizes in Chapter 11. I find instead that firms appear to stabilize post-bankruptcy: controlling for firm financial condition, employees of firms that reorganized in bankruptcy do not appear to be more likely to complain that their firm is currently distressed or was distressed in the past. Reviewing employees also appears to sharply reduce their complaints about corporate culture after their employer leaves bankruptcy. Additionally, observed attrition falls in line with industry peers. In sum, bankruptcy filings do appear to bring relief to the employees of struggling firms, but only after the company emerges from bankruptcy.

Taken together, the evidence in the study tells a nuanced story. I observe a workforce response to bankruptcy, as employees of Chapter 11 debtors appear to become much more likely to complain about firm culture and the firm’s financial struggles as compared to employees of the same firm prior to the Chapter 11 filing. This sentiment shift may partially explain a sharp spike in observed employee departures immediately after the bankruptcy filing. However, viewed in fuller context, this spike appears to be a continuation of a steady rise in employee departures that begins, on average, a year prior to bankruptcy, suggesting that workforce response to bankruptcy is more a story of continued flight from firm financial distress than an abrupt shift following a federal bankruptcy filing. Further, it appears that successful reorganizations are associated with the firm returning to levels of attrition consistent with industry norms and that employee discussion of financial distress diminishes, suggesting that bankruptcy law’s powerful tools for reorganizing translates into the workplace.

For more, please read the paper which is available here.

Print

Print