Natalie Cooper is Senior Manager at the Center for Board Effectiveness at Deloitte LLP; Bob Lamm is Independent Senior Advisor at the Center for Board Effectiveness at Deloitte LLP; and Randi Val Morrison is Senior Vice President and General Counsel at the Society for Corporate Governance. This post is based on a Deloitte memorandum by Ms. Cooper, Mr. Lamm, Ms. Morrison, and Carey Oven.

As the business environment continues to evolve in complexity, so does the oversight role of boards. At the same time, investor, regulator, and other stakeholder expectations of board involvement in certain aspects of the business, including aspects traditionally within management’s sole purview, are changing in ways that may blur the lines of responsibility between the two. Ultimately, management’s job is to manage, whereas the board’s role is to oversee. Effective oversight relies upon maintaining clear lines of responsibility between the board and management.

This Board Practices Quarterly presents findings from a survey of members of the Society for Corporate Governance on the board’s leadership structure, independence, and involvement in a number of business matters, including activities related to corporate strategy, human capital, risk and risk management, and operations.

Findings

Respondents, primarily corporate secretaries, in-house counsel, and other in-house governance professionals, represent 101 public companies of varying sizes and industries[1] and the findings pertain to these companies. The actual number of responses for each question is provided. Some survey results may not sum to 100% as questions may have allowed respondents to select multiple answers. Where applicable, commentary has been included to highlight differences among respondent demographics.

Access results by company size and type.

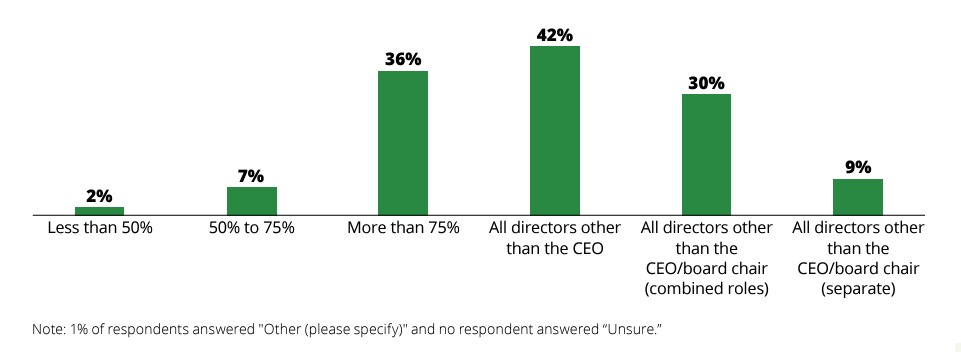

To facilitate independent board oversight of management and avoidance of conflicts of interest, some may advocate for a separation of the roles of the board chair and CEO and selection of an independent chair or, where there is a combined CEO/chair structure, appointing a lead director whose specific responsibilities are principally aimed at providing independent leadership to the board. Further, a majority independent board can promote independence from management so that directors can provide objective oversight.

Which describes your board leadership structure? [Select all that apply] (100 responses)

Which describes the representation of independent, non-executive directors on your board? [Select all that apply] (99 responses)

What practices does your company utilize to establish a mutual understanding among the board and management of their respective roles and responsibilities? [Select all that apply] (98 responses)

Companies commonly rely on their governance documents, such as corporate governance guidelines, along with other practices, to delineate board vs. management responsibilities. Notably, of companies with a lead director (46% of all companies), 55% have a lead director role description. In comparison, of those with a non-executive chair (16% of all companies), 23% have a description for that role.

Note: Shaded areas in the tables that follow highlight activities where there is ≥50% response rate.

Indicate the approval authority of your board with respect to the development/update of the following activities. [Select all that apply] (71 responses)

Among market caps, the greatest variations pertained to:

- Board committee approval required for:

–Succession plan for C-suite (or equivalent) other than CEO, reported by 32% of large-caps and 9% of mid-caps.

–Sustainability strategy, reported by 32% of large-caps and 11% of mid-caps.

–Code of conduct/ethics for below C-suite (or equivalent), reported by 13% of large-caps and 32% of mid-caps. - Board committee review only for compensation and benefits programs for workforce below C-suite (or equivalent), reported by 35% of large-caps and 54% of mid-caps.

- No board or board committee review or approval required for shareholder engagement strategy, reported by 32% of large-caps and 11% of mid-caps.

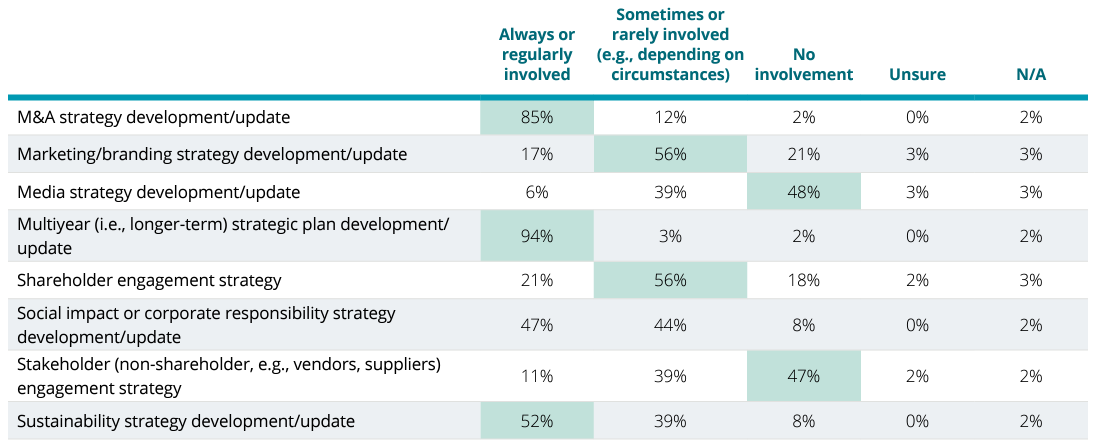

Which best describes the involvement of your board and/or board committee with respect to the following corporate strategy-related activities? (66 responses) (Note: This excludes required review and/or approval as part of the company’s governance guidelines or policies.)

Among market caps, the greatest variations pertained to:

- Board and/or board committee always or regularly involved in social impact or corporate responsibility strategy development/update, reported by 60% of large-caps and 35% of mid-caps.

- Board and/or board committee sometimes or rarely involved in M&A strategy development/update, reported by 23% of large-caps and no mid-caps. Comparatively, 77% of large-caps and 94% of mid-caps reported that their board or board committees are always or regularly involved.

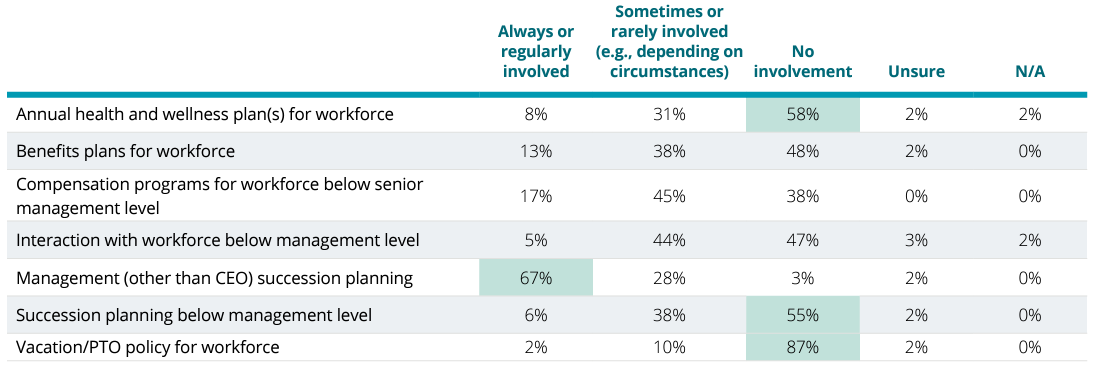

Which best describes the involvement of your board and/or board committee with respect to the following human capital-related activities? (64 responses) (Note: This excludes required review and/or approval as part of the company’s governance guidelines or policies.)

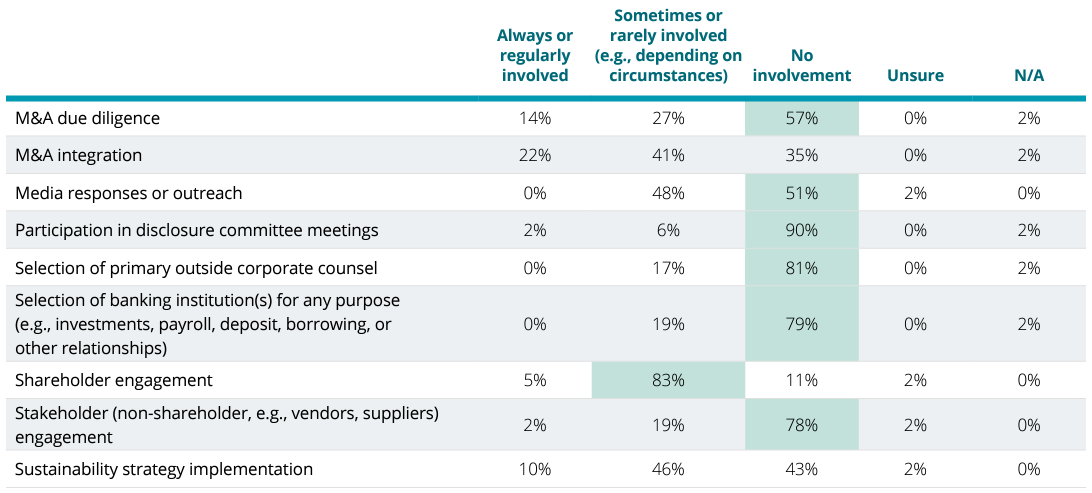

Which best describes the involvement of your board and/or board committee with respect to the following operations-related activities? (63 responses) (Note: This excludes required review and/or approval as part of the company’s governance guidelines or policies.)

Among market caps, the greatest variation pertained to:

- Board and/or board committee always or regularly involved in sustainability strategy implementation, reported by 21% of large-caps and no mid-caps.

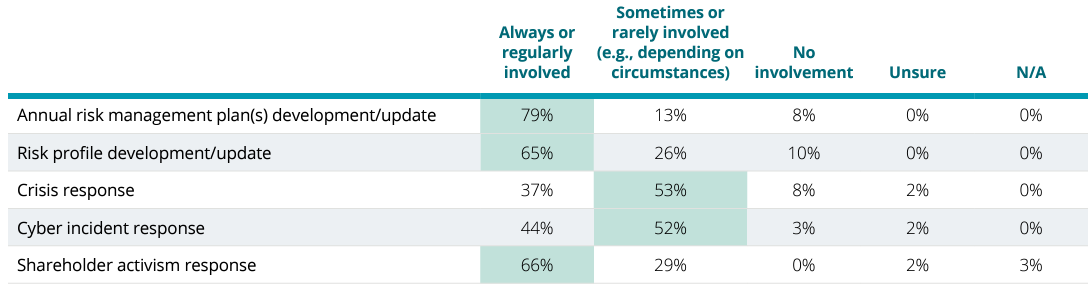

Which best describes the involvement of your board and/or board committee with respect to the following risk management/risk mitigation-related activities? (62 responses) (Note: This excludes required review and/or approval as part of the company’s governance guidelines or policies.)

Among market caps, the greatest variations pertained to:

- Board and/or board committee always or regularly involved in shareholder activism response, reported by 56% of large-caps and 77% of mid-caps.

- Board and/or board committee always or regularly involved in annual risk management plan(s) development/update, reported by 70% of large-caps and 87% of mid-caps

Endnote

1Public company respondent market capitalization as of December 2023: 42% large-cap (which includes mega- and large-cap) (> $10 billion); 51% mid-cap ($2 billion to $10 billion); and 8% small-cap (which includes small-, micro-, and nano-cap) (< $2 billion). Respondent industry breakdown: 26% financial services; 24% energy, resources, and industrials; 23% consumer; 15% technology, media, and telecommunications; and 13% life sciences and health care.

Small-cap and private company findings have been omitted from this report and the accompanying demographics report due to limited respondent population(go back)

Print

Print