Jim Rossman is Global Head of Shareholder Advisory, Chris Ludwig is Managing Director, and Quinn Pitcher is Vice President- M&A and Shareholder Advisory at Barclays. This post is based on a Barclays memorandum by Mr. Rossman, Mr. Ludwig, Mr. Pitcher, and Michael Sun-Huang.

Observations on the Global Activism Environment in Q1 2024

| 1 | U.S. and APAC Campaign Activity Remains Steady as Europe Sees Slow-Down |

|

| 2 | Activists Continue to Effect Board Change; Universal Proxy Impacting Board Wins |

|

| 3 | Activists Focus on Board Change While M&A Takes a Backseat |

|

| 4 | New Legal Developments Disrupt the Activist Landscape |

|

Sources: Bloomberg, FactSet, Diligent Market Intelligence, 13D Monitor, press reports and publicly available data and sources. Market data as of 3/31/2024.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million due to depressed valuation at the time of campaign announcement (company was larger than $500mm in prior twelve months).

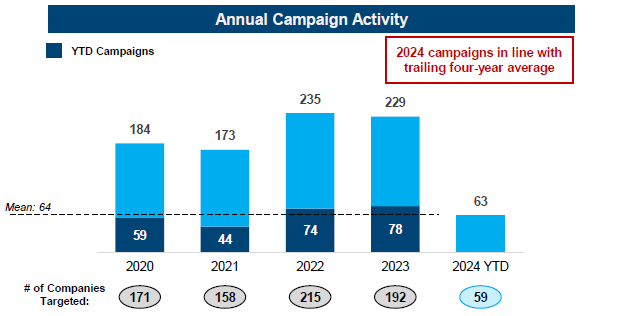

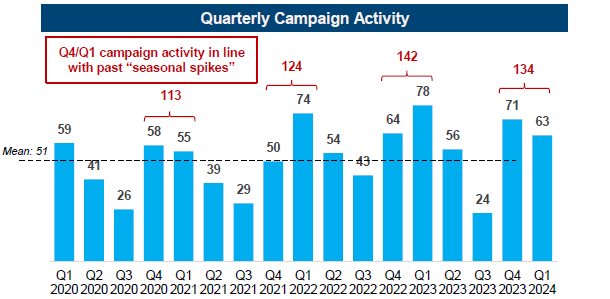

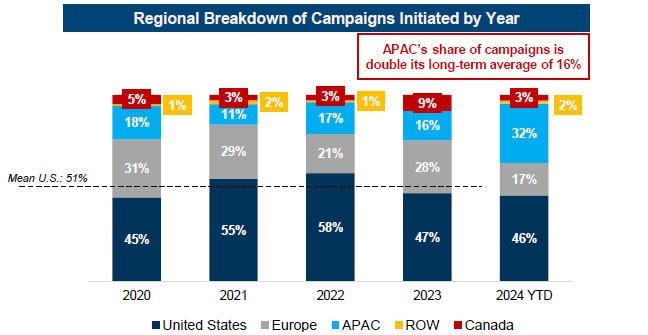

Global Campaign Activity

Campaigns launched have lagged the pace of 2022/23, driven by a decline in European activity as U.S. and APAC activity has remained in line with past years

Source: Bloomberg, FactSet, Diligent Market Intelligence, 13D Monitor, press reports and publicly available data and sources. Market data as of 3/31/2024.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million due to depressed valuation at the time of campaign announcement (company was larger than $500mm in prior twelve months).

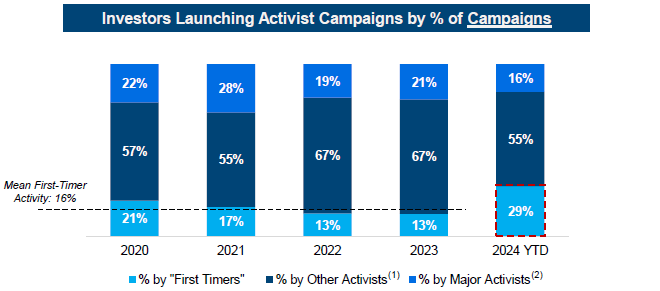

Global Activist Universe

A broader array of activists have targeted companies thus far this year, with nearly a third of campaigns coming from first-timers

Source: Bloomberg, FactSet, Diligent Market Intelligence, 13D Monitor, press reports and publicly available data and sources. Market data as of 3/31/2024.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million due to depressed valuation at the time of campaign announcement (company was larger than $500mm in prior twelve months).

- “Other” includes hedge funds, private equity funds, venture capital, individuals, family offices, long-only institutions, corporates and other miscellaneous activists.

- Leading activist hedge funds include: Cevian, Elliott Management, Icahn Associates, JANA Partners, Land & Buildings, Sachem Head, Starboard Value, TCI, Third Point, Trian Partners and ValueAct.

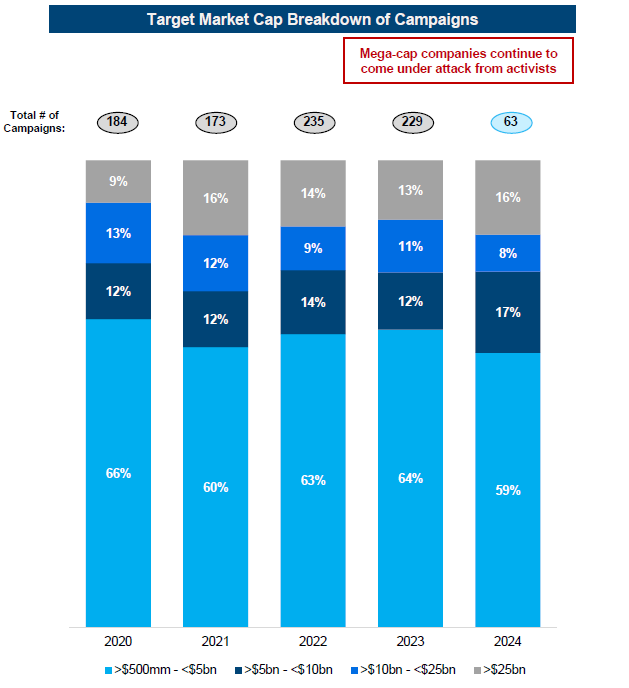

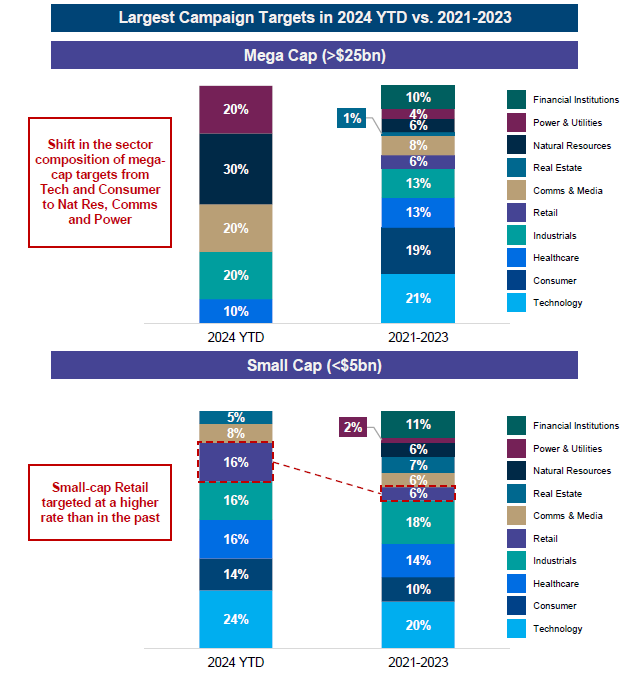

Activist Targets by Company Size

Source: Bloomberg, FactSet, Diligent Market Intelligence, 13D Monitor, press reports and publicly available data and sources. Market data as of 3/31/2024.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million due to depressed valuation at the time of campaign announcement (company was larger than $500mm in prior twelve months).

Notable Q1 Campaign Developments & Launches

Notable Launches

Notable Updates

Source: Bloomberg, FactSet, Diligent Market Intelligence, 13D Monitor, press reports and publicly available data and sources.

- Market Cap as of campaign announcement date, or as of initial date of disclosure. In the case of multiple activists, represents market cap as of earliest campaign announcement date or initial disclosure.

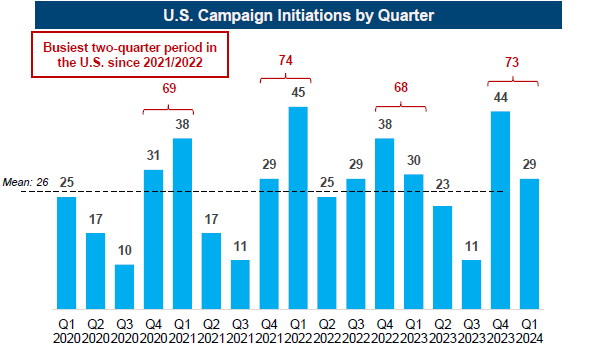

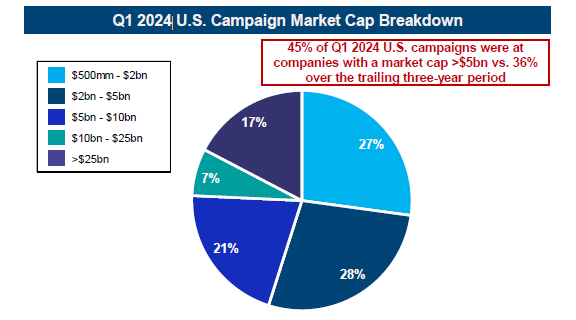

U.S. Campaign Activity

Source: Bloomberg, FactSet, Diligent Market Intelligence, 13D Monitor, press reports and publicly available data and sources. Market data as of 3/31/2024.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million due to depressed valuation at the time of campaign announcement (company was larger than $500mm in prior twelve months).

Print

Print