Benjamin Colton is Global Head of Asset Stewardship, and Michael Younis is Vice President of Asset Stewardship at State Street Global Advisors. This post is based on their SSGA memorandum.

How We Engage

Our Asset Stewardship team has developed our Global Issuer and Stakeholder Engagement Guidelines to increase the transparency of our engagement philosophy, approach, and processes. This protocol is designed to communicate the objectives of our engagement activities and to facilitate a better understanding of our preferred terms of engagement with our investee companies. The protocol explains key engagement processes including:

- Methodology for developing our annual engagement strategy

- Information to include in engagement request emails

- Information on how to request R-Factor scores

- Our guidelines for engaging with investee companies

- Our guidelines for engaging with activist investors or investors directly connected

to Vote-No campaigns or shareholder proposals - Investor engagement protocol guidance

We review our Global Issuer and Stakeholder Engagement Guidelines annually as part of our strategic review process to ensure that our interactions with companies remain effective and meaningful. This includes reviewing indicators in our screening models and assessing emerging issues and trends.

Additionally, we take into account individual market nuances when evaluating practices or engaging on certain issues, as well as market practices and norms for engagement.

Escalation

The overall objectives of our stewardship approach are to identify financially material risks, and to encourage investee companies to adopt best practice disclosures and oversight to enhance long-term value for our clients. We use engagement as an opportunity to find alignment with our best practice expectations. Where engagement does not achieve the desired outcome, our escalation strategies may include:

- Writing to the board of the company to formalize our concerns and requests

- Supporting relevant shareholder resolutions that further our expectations

- In certain instances, voting against relevant board members

Our escalation process has been designed to promote governance, sustainability disclosure, and oversight of material risks at investee companies, taking into account individual market nuances.

Our escalation approach is adjusted for fixed income engagements where there is no ability to vote. Fixed income escalation may take the form of letter writing or direct engagement. While we believe our approach to equities is mature, we are continuing to develop our fixed income approach to ensure we engage across all asset classes we hold in the funds and mandates we manage.

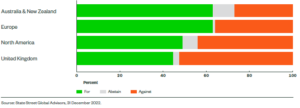

Breakdown of Engagements by Region in 2022

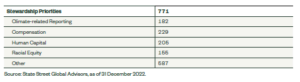

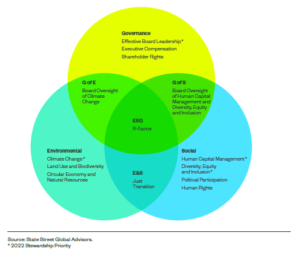

Engagement Across Stewardship Priorities

Measuring Engagement Success

Our stewardship activities are designed to have an impact on the availability and quality of company-specific and market-level disclosures and oversight of financially material risks. While measuring outcomes, which are often qualitative, can be difficult, we track our impact in a number of ways:

- Disclosure alignment (e.g., how many companies are aligned with our disclosure expectations)

- Company-specific successes (e.g., whether a particular company responded to our request to disclose information or improve specific oversight practices)

- Voting impact (e.g., how many companies met our disclosure and/or oversight expectations after we voted against management, including trends over time)

- Market impact (e.g., academic research on the impact of our Fearless Girl campaign)

Engagement Screening Process

Types of Engagement

In 2022, our team conducted more than 950 comprehensive engagements across more than 30 markets, with companies representing 49% of our AUM. We define a comprehensive engagement as a discussion between a company and the Asset Stewardship team; we report letter writing and other less formal engagements separately. We speak to company representatives and directors in three contexts:

Pre-General Meeting: Dialogues in advance of a company’s shareholder meeting where we seek more information about details of the proxy statement to inform our vote, often encouraging the company to improve a particular disclosure or oversight practice. These meetings are primarily initiated by the company, and the agenda is typically driven by the company focused on the resolutions up for shareholder vote.

Off-Season: Dialogues outside of the proxy season where we converse with companies about various other risks/opportunities. We prioritize companies with some outsized risk, e.g., a significant holding, a company exposed to controversy, a company that recently completed an initial public offering (IPO), or a company with which we have not engaged the past several years. These meetings are primarily initiated by the company, and the agenda is driven by both the company and State Street Global Advisors.

Engagement Campaigns: Dialogues in the off-season as part of our targeted engagement campaigns, focused on a particular topic and outcome. The intended outcomes are to either establish best practices or enhance the quality of disclosure on a particular topic. These meetings are initiated by State Street Global Advisors, and we drive the agenda consistently according to the relevant campaign.

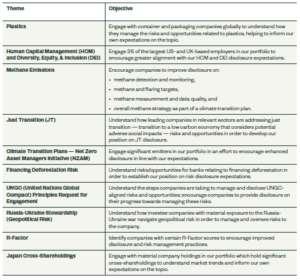

Summary of 2022 Engagement Campaigns

How We Vote

Leveraging the exercise of a key shareholder right, proxy voting provides a meaningful investor tool that we believe protects and enhances the long-term economic value of the holdings in our clients’ accounts. Our proxy voting decisions are made with the goal of maximizing shareholder value.

Breakdown of Proxy Voting by Region in 2022

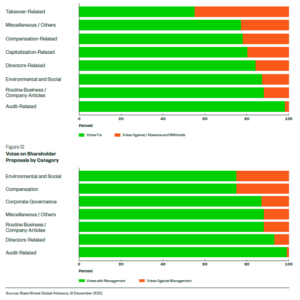

Votes on Management Resolutions by Category

Compensation Votes Manually Reviewed

In 2022, there were 22,216 proposals on compensation practices or policies across our global investment portfolios. This represented 11% of all proposals that we voted on in 2022. In 2022, State Street Global Advisors supported approximately 78% of pay-related proposals, compared to 79% in the previous year.

We rely on propriety, region-specific compensation screens to help identify and prioritize pay related proposals for further review. Consequently, we reviewed 3,674, or 17% of compensation proposals, up for a vote. Figure 13 provides a regional breakdown of pay proposals reviewed in 2022. State Street Global Advisors supported the compensation practices/policies at the screened companies 60% of the time. Our voting was complemented by 229 engagements on compensation in 2022.

Proxy Voting Choice

In 2022, we announced our proxy voting choice program, which offers eligible investors in certain pooled investment funds in the US and UK a range of voting policies that can be applied to the voting of shares held in those funds. Voting policies offered as part of this program are made available to investors through Institutional Shareholder Services (ISS).

Our clients in separately managed accounts also have the ability to either vote their own shares directly or delegate proxy voting of their shares to our Asset Stewardship team. With the addition of the proxy voting program, investors in more than 40% of the index equity assets managed by State Street Global Advisors (as of September 30, 2022) now have the ability to make choices regarding how shares held in the funds and separately managed accounts they own are voted. Similar to separately managed accounts, shareholders of pooled investment funds that are eligible for the new program can still choose to apply State Street Global Advisors’ proxy voting policy to their share of the fund.

In 2022, we voted at approximately 22,500 shareholder meetings on about 205,000 management and shareholder proposals. We vote in accordance with the program’s “Global Proxy Voting and Engagement Principles” and regional “Voting and Engagement Guidelines.” We publish these voting policies online and regularly update them with oversight provided by State Street Global Advisors’ ESG Committee.

There is an intentional window of one or two years between changes in many of our voting policies and changes in our vote execution to encourage companies to align with disclosure and oversight expectations during this period. We believe that this approach gives companies the needed time to react to our changes.

In advance of general meetings, companies and shareholder proponents often contact us to request engagements. If we believe a proxy proposal warrants discussion, we may accept the request. We may also reach out to companies, proponents, and/or opponents to ask for clarification prior to voting.

We typically leverage our pre-voting engagements to:

- Seek additional information about an issue on a proxy statement

- Give a company the opportunity to correct any misinformation

- Learn how a board oversees an issue, and/or

- Offer feedback to companies as appropriate about our perspective on the issue

About 70% of proposals are routine and voted automatically. The rest require manual review by our team. In the latter case, we assign an analyst who reviews the proxy statement, engages interested parties as needed, and seeks to arrive at a decision in accordance with our voting policy.

When We Refrain From Voting

When we deem appropriate, we may refrain from voting at meetings when:

- Power of attorney documentation is required

- Voting will have a material impact on our ability to trade the security

- Voting is not permissible due to sanctions affecting a company or individual

- Issuer-specific special documentation is required, or various market or issuer certifications

are required - Unless a client in a Separately Managed Account directs otherwise, State Street Global Advisors will not vote proxies in so-called “share blocking” markets (markets where proxy voters have their securities blocked from trading during the period of the annual meeting).

Additionally, we outsource any voting decision related to the State Street Corporation shareholder meeting, and other situations where we believe we may be conflicted from voting (for example, due to an outside business interest), to an independent fiduciary. When engaging the independent fiduciary, the team confirms that it has published proxy voting guidelines that describe how it will vote in clients’ best interests and is appropriately resourced to do so.

In 2022, we voted at 98.2% of the meetings where our clients had given us their authority to vote their shares. Our voting positions are monitored daily by our Asset Stewardship team via the ISS electronic voting platform. Using the same platform, we also track the progress of the vote submissions through to the relevant custodian bank or other intermediary responsible for the final submission of the vote to the issuing company.

Exercising Voting Rights

Pooled Fund Structure

Where a pooled fund fiduciary has delegated the responsibility to vote the fund’s securities to State Street Global Advisors, we vote those fund-owned securities in accordance with our voting policy and in a unified manner. Exceptions to this unified voting policy are:

- Where State Street Global Advisors has made proxy voting choices available to investors within a pooled fund, described in further detail above, in which case a pro rata portion of shares held by the fund attributable to investors who choose to participate in the proxy voting program would be voted consistent with the third-party proxy voting policies selected by the investors; and

- In the limited circumstances where a pooled investment vehicle managed by State Street Global Advisors utilizes a third party proxy voting guideline as set forth in that fund’s organizational and/or offering documents.

Segregated Accounts

Our separately managed account (SMA) clients can retain the right to vote their own shares or to delegate the voting authority to us, in which case we will vote in accordance with our voting policy. Where clients retain the right to vote their own shares, we do not apply our voting policies.

Stock Lending Policy

As a responsible investor and fiduciary, we recognize the importance of balancing the benefits of voting shares and the incremental lending revenue for the pooled funds that participate in State Street Global Advisors’ securities lending program (the “Lending Funds”). Our objective is to recall securities on loan and restrict future lending until after the record date for the respective vote in instances where we believe that a particular vote could have a material impact on the Lending Funds’ long-term financial performance, and the benefit of voting shares will outweigh

the forgone lending income.

Accordingly, we have set systematic recall and lending restriction criteria for shareholder meetings involving situations with the highest potential financial implications (such as proxy contests and strategic transactions including mergers and acquisitions, going dark transactions, change of corporate form, bankruptcy and liquidation). Generally, these criteria for recall and restriction for lending only apply to certain large cap indices in developed markets. State Street Global Advisors monitors the forgone lending revenue associated with each recall to determine if the impact on the Lending Funds’ long-term financial performance and the benefit of voting shares will outweigh the forgone lending income.

Although our objective is to systematically recall securities based on the aforementioned criteria, we must receive notice of the vote in sufficient time to recall the shares on or before the record date. In cases in which we do not receive timely notice, we may be unable to recall the shares on or before the record date.

Our Securities Lending for Proxy Voting Procedure is reviewed annually by the State Street Global Advisors Asset Stewardship team, Proxy Operations Group, and Securities Lending Group to determine whether any changes are necessary and whether it is working as intended.

How We Communicate Vote Decisions

We communicate our vote decisions in three primary ways:

Vote View: State Street Global Advisors’ final votes are published on our public Vote View platform in the quarter following the quarter when the shareholder meeting occurred.

Vote Bulletins: In some cases, including contentious or high-profile votes, our team may publish a “Vote Bulletin” to offer insight into our rationale. These are available under the “How We Vote” tab of our Report & Guideline Library.

Client Engagements: We regularly address clients’ requests to explain our rationale for votes on certain issues.

Proxy Voting Ballot Proposals

The ballots of public companies carried more than 450 different types of proposals in 2022, presented by management and shareholders. Below, we review the most common voting proposals and provide an overview of how we handled them.

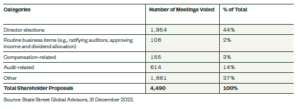

Shareholder Proposals

We support shareholder proposals when our analysis finds them to be in furtherance of our expectations for an investee company’s disclosure and oversight practices likely to promote long-term shareholder value for clients, and consistent with our approach of not attempting to dictate or micromanage business strategy.

We carefully review most shareholder proposals, including all environmental and social proposals. These proposals accounted for approximately 0.2% of the proposals we voted on in 2022.

Breakdown of Shareholder Voting Proposals in 2022

Voting on Environmental and Social Shareholder Proposals

We developed our Proxy Voting and Engagement Guidelines for Environmental and Social Issues with the goal of achieving a thoughtful approach to voting on complex proposals and to make our expectations transparent. We apply overarching guidance relevant to all environmental and social shareholder proposals and more granular guidance for categories where we anticipate a large volume of proposals. For environmental and social shareholder proposals, analysts consider:

- Materiality, as determined by SASB, our Stewardship Priorities, and/or our own analysis.

- Alignment with our published guidance for investee companies, which includes frameworks for evaluating proposals on the topics of climate disclosure, diversity disclosure, civil rights disclosure, pay equity disclosure, human rights disclosure, political contributions, lobbying and trade association alignment, human capital management disclosure, and environmental management disclosure.

- Whether the proposal is prescriptive, given that we avoid asking companies to change their operations or strategy.

- Board oversight effectiveness, as determined by engagements and disclosures.

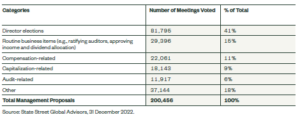

Management Proposals

Management mainly presents proxy proposals to elect directors, handle routine business, and seek approval for compensation. In general, when we vote against a director, we target the individual most relevant to the issue, such as the committee chair responsible for the area. We also have procedures for what to do when the relevant director is not up for election and for handling escalation. Below we provide a brief overview of how we handle common votes.

Director Elections accounted for 41% of total proposals in 2022. There are several scenarios in which we may take voting action against a director. They include:

- As outlined in our guidelines, there are a variety of governance-related reasons why we may vote against directors. These include lack of independence excessive average board tenure, directors attending less than 75% of board meetings, multiple problematic governance practices (such as a classified board or limited shareholder rights), and inadequate responsiveness to proposals supported by more than 50% of shareholders.

- As outlined in our applicable regional guidelines, scenarios in which we may vote against directors include inadequate board diversity and lack of disclosure in alignment with our expectations, including our published guidance on climate and diversity-related disclosures.

Proxy Contest insights are outlined on our website. In proxy contests, our analysts generally attempt to speak with the incumbent management and board as well as dissident shareholders.

Routine Items, such as approving dividends and financial statements, accounted for 15% of total proposals in 2022.

Compensation-Related Matters accounted for 11% of total proposals in 2022.

Breakdown of Management Voting Proposals in 2022

Measuring and Reporting Outcomes

Our team tracks several metrics to measure and report on the effectiveness of our program including voting impact, disclosure alignment, and company-specific successes. We report our outcomes and activities in our quarterly stewardship activity reports, vote bulletins, and Vote View. Our stewardship reporting is designed to fulfill our client and regulatory commitments.

Download the complete report here.

Print

Print