Jeffrey Sonnenfeld is Senior Associate Dean for Leadership Studies and Lester Crown Professor in the Practice of Management, and Steven Tian is Research Director of the Yale Chief Executive Leadership Institute at the Yale School of Management. This post was prepared for the Forum by Professor Sonnenfeld and Mr. Tian. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) and Dancing with Activists (discussed on the Forum here) both by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Leo E. Strine, Jr.

Fred Allen once described the media business with the quip, “imitation is the sincerest form of….television”. But ISS, The New York Times, and other cheerleaders of Nelson Peltz/Trian Partners’ activist campaign challenging Disney CEO Bob Iger all seem to miss that Iger towers over his media peers in genuine financial performance, in stark contrast to his underperforming activist challengers. It is a veritable tale of two cities in measuring up the financial track record of Bob Iger against Nelson Peltz.

Of course, the question of both Bob Iger and Nelson Peltz’s financial track records have become a surprisingly contentious area of dispute as the proxy contest nears its grand finale. Both sides have stepped into overdrive, with dozens of glossy 100+ page slide decks and white papers released from all vantage points.

As Disney shareholders begin to cast their ballots on the eve of the Annual Meeting two weeks from now, on April 3rd, it can be hard to separate fact from fiction in comparing the genuine financial track records of Nelson Peltz and Bob Iger. But the factual evidence speaks loud and clear. While Nelson Peltz has a long history of value destruction, Bob Iger’s nearly two decades as Disney CEO has been marked by genuine value creation.

Let’s examine Peltz’s performance first. According to Lauren Thomas and Cara Lombardo at The Wall Street Journal, and corroborated by The Financial Times, Trian’s five-year annualized returns through September 30 trailed the S&P by 4 percent annually. Trian’s underperformance relative to the S&P 500 apparently extends far back beyond five years. Trian was actually terminated by Disney as one of the external investment managers used by Disney’s pension funds in 2021, after Trian had underperformed the S&P 500 by more than 5% on an annualized basis over eight years, dating back to 2013.

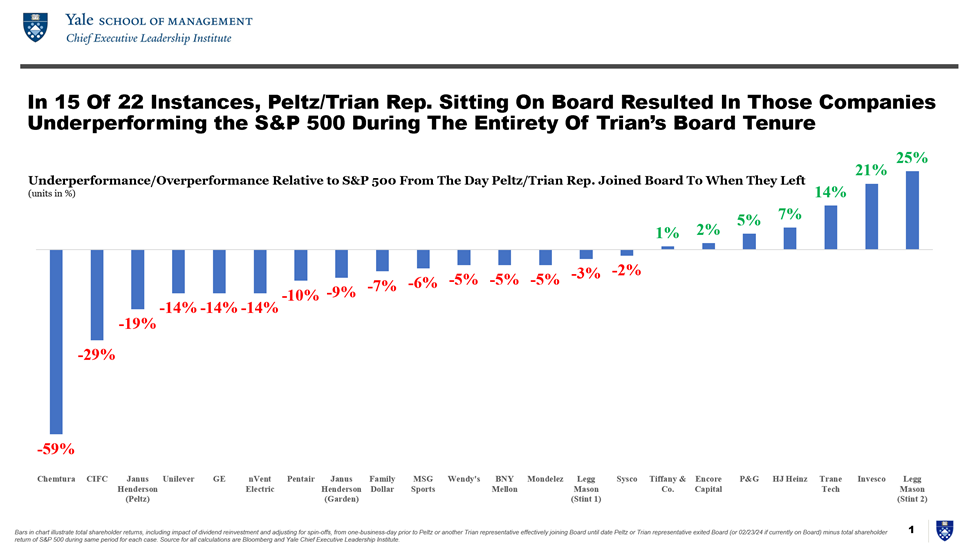

And if you measure Peltz’s performance just by when he was on the board, from when Peltz or a Trian partner joined the board to when they leave, there is no question that the companies Trian have been involved with have actually underperformed the S&P by -6% annually, on average. As we were the first to reveal many months ago, with others such as Disney subsequently corroborating our analysis, across 22 total instances where Peltz or a Trian representative sat on a board, 15 of those instances resulted in those companies underperforming the S&P 500 during the entirety of Trian’s board tenure.

No wonder Trian is losing investors so dramatically. Assets under management at Trian are down ~40%, from over $12.5 billion in 2015 to less than $8 billion today, excluding the value of Ike Perlmutter’s $2 billion+ in Disney shares contributed to Trian, with major investors like California State Teachers’ Retirement System and New York State Common Retirement Fund fully withdrawing from Trian while Trian shutters several of its funds.

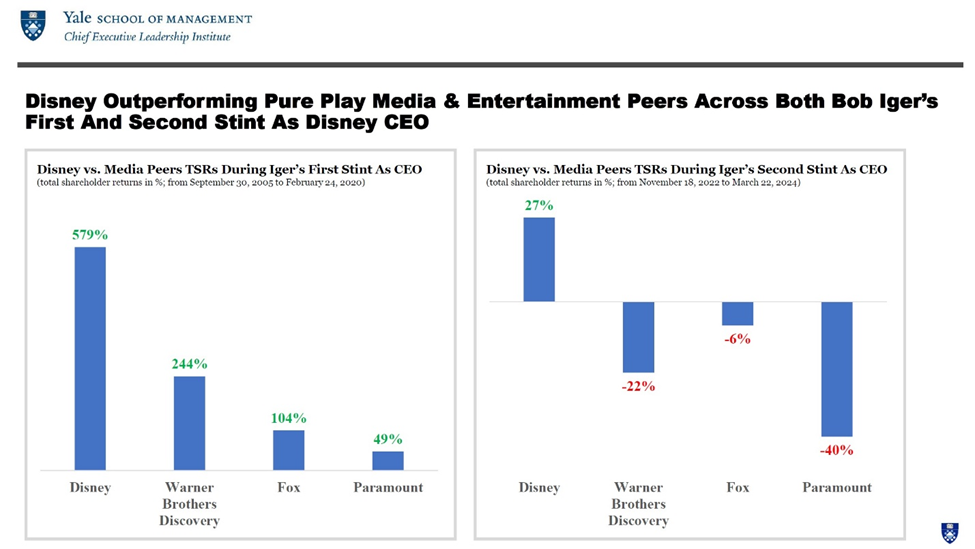

On the other hand, Peltz attacks Iger for supposedly underperforming the S&P 500 himself – though he miscalculates Iger’s track record by inexplicably including in his calculations the years during which Peltz pal Bob Chapek was CEO, even though Iger was not responsible for Chapek’s major strategic missteps, going too far on streaming by cannibalizing the rest of the company to fill Disney+ with more content than any subscribers wanted. If Iger’s returns are correctly calculated, we see that Disney has not only outperformed the S&P 500 but even more impressively, significantly outperformed all of its pure play media & entertainment peers during both of Iger’s stints as CEO. Disney’s 579% total shareholder returns during Bob Iger’s first term as CEO, from 2005 to 2020, far outpaced that of rivals such as Warner Brothers’ 244%, Fox’s 104%, and Paramount’s 49%; while since Iger returned as CEO in November 2022, Disney’s 25% total shareholder returns have far outpaced all of its rivals who are in the red, with Warner Brothers Discovery’s -21%, Fox’s -7%, and Paramount’s -40% returns. Perhaps the only quibble that could be made is that had Iger purchased Time Warner from its legendary CEO Jeff Bewkes in lieu of buying Fox, Disney would be even better off today, as Time Warner was the top media performer for ten years prior its eventual acquisition.

In fact, Iger’s performance during his second run as CEO already far exceeds those of peers who returned to the CEO job after a successful first run, a breed which I classify as returning “Generals”. Starbucks stock was down nearly 50% a year after Howard Schultz returned to Starbucks in 2008, but after three years had returned 63%. Similarly, after Michael Dell returned to Dell in 2007, the stock fell 17.3% a year into his tenure before multiplying by several times over the next decade. Even the celebrated Steve Jobs went sideways after returning to Apple in 1997, taking three years to pull off Apple’s stunning stock rebound of 403%.

Iger is surrounded by a dream team of top talent comprising some of the brightest rising stars in media, including Disney Entertainment Co-Chairs Dana Walden and Alan Bergman; Parks Chair Josh D’Amaro, and ESPN Chair Jimmy Pitaro, not to mention widely revered new CFO Hugh Johnston who joined from PepsiCo.

Clearly, the evidence shows which of Nelson Peltz and Bob Iger is the genuine wizard of the magic kingdom and which is the illusionist. While Peltz has a long history of value destruction, Iger’s nearly two decades as Disney CEO has been marked by nearly unparalleled value creation. The choice facing Disney shareholders as the April 3rd Annual Meeting beckons could not be more stark. No wonder even other activist investors – such as the savvy, constructive, highly regarded Mason Morfit of ValueAct – have endorsed Disney, even though ISS bizarrely blames Disney for not bringing Morfit onto the board, an argument which Morfit himself has not made before.

While it is true that some media monarchs cling to power past their peak – few would disagree that six or seven decades of Sumner Redstone or Rupert Murdoch were too long – clearly, the facts suggest Bob Iger deserves to complete his second decade at the helm of Disney. Indeed, two decades was the ideal term of office for many corporate giants, such as the renowned Reuben Mark of Colgate, who produced the highest stock returns in American industry over those 20 years not unlike Iger. Iger’s track record is unrivaled by any current media and entertainment business leader, and his plans for turning around Disney are already reaping massive rewards. The facts clearly suggest Bob Iger is nothing less than the Wizard of the Magic Kingdom.

Print

Print