Amar Gill is a Secretary General at Asian Corporate Governance Association and Kei Okamura is a Portfolio Manager at Neuberger Berman and ACGA Japan Working Group Chair. This post is based on an open letter by the Asian Corporate Governance Association (ACGA), prepared by Mr. Gill and Mr. Okamura, with support from Jane Moir.

The Asian Corporate Governance Association (ACGA) recently formed a working group of members and other interested investors to discuss the issue of Japanese companies’ so-called “strategic shareholdings” that include allegiant and cross-shareholdings. We are writing to share our thoughts and suggestions on this topic.

In recent years, Japanese companies have embarked on a number of landmark reforms to improve corporate value over the medium to long term, which global investors attribute as one of the key catalysts driving the Japanese stock market’s strong performance of late. Sound resource allocation by corporates is key to the revival of the Japanese economy and is expected to benefit all stakeholders including employees, customers and shareholders. ACGA and its undersigned members thus look forward to constructive discussions around this topic.

One of the most entrenched areas, however, is the so-called “strategic shareholdings” also known as “allegiant shareholdings”.[1] These often exist to form business relationships between group companies and their suppliers as well as customers and has often been criticized as an inefficient use of capital, an inhibitor of corporate reforms and at times a source of anti-competitive behaviour by businesses.[2] While there has been some divestments of strategic holdings by companies and more recently the reported guidance by Japan’s Financial Services Agency (FSA) to general insurance companies to provide plans to divest these shares, the progress on unwinding these investments has been slow, particularly outside of the financial sector.

Hence, ACGA and its undersigned members are issuing this letter to underscore the need to accelerate the further reduction of these shareholdings, which we believe in principle should be zero for most companies. In this letter, we provide key recommendations on divestment of strategic shareholdings in a manner that would advance governance practices and help companies achieve sustainable long-term growth. Please see pages 6-8 for our recommendations.

Background and historical context

Strategic shareholdings among Japanese companies proliferated amid the post-World War II redevelopment when firms faced two key events. First, during the 1945 to 1952 Allied occupation, the industrial conglomerates, also known as Zaibatsu, were dismantled. Stocks held by group families and companies were expropriated and redistributed to the general public, thus dramatically increasing individual shareholders participation in Japan’s equity market.[3] This, however, caused alarm among company management that viewed the new shareholder base could interfere with the running of their businesses. Second, the economic recession that ensued following the 1953 Korean War created difficult business conditions for many firms; management thus sought financial support to help shoreup weak balance sheets.

The combination of management concern over control and the need for capital allowed Japanese banks to expand their domestic lending business by acquiring shares of key clients and deepening capital ties in exchange for banking relationships.[4] Today’s strategic shareholdings can be seen as resulting from these circumstances. These capital tie-ups continued to expand especially among the so-called Keiretsu industrial and commerce groups that spearheaded Japan’s rapid economic growth into the late 1980s.[5]

Following the bursting of the economic bubble in the early 1990s and over the so-called “Lost Decades” of deflation that followed, the material weaknesses of the interlocking capital alliances became apparent. Plummeting stock prices caused significant impairment losses especially in the financial sector.[6] Thus began the gradual unwinding process in the mid-1990s as businesses and banks started to sell-down their strategic holdings.[7] The action of various financial groups and certain other companies to initiate reducing their strategic investments is commendable, reducing the drag of these investments on governance and Return on Equity (ROE).

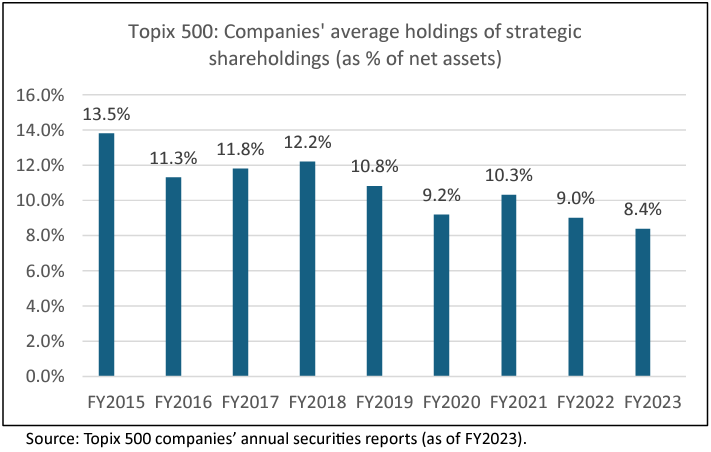

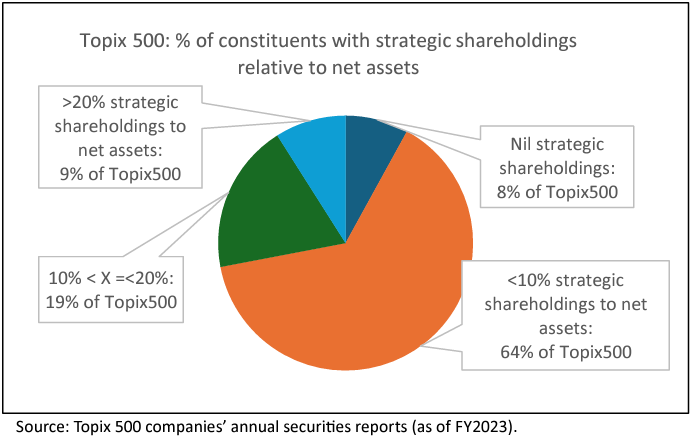

Although this trend has continued over the past 20 years, the pace of decline has been gradual. By the data from Topix 500 companies’ annual securities reports (Yukashoken Hokokusho, below “Yuho”), between fiscal year-end March 2015 to 2023, of the 500 biggest companies listed on the Topix index, the simple average of strategic shareholdings has declined from 13.5% to 8.4% of net asset value. However, as at the end of March 2023, 320 companies, or 64% of the Topix 500 constituents, had strategic shareholdings up to 10% of their net asset value while 140 companies, or 28% of constituents, had over 10% of their net asset value in strategic shareholdings.

Economic implications

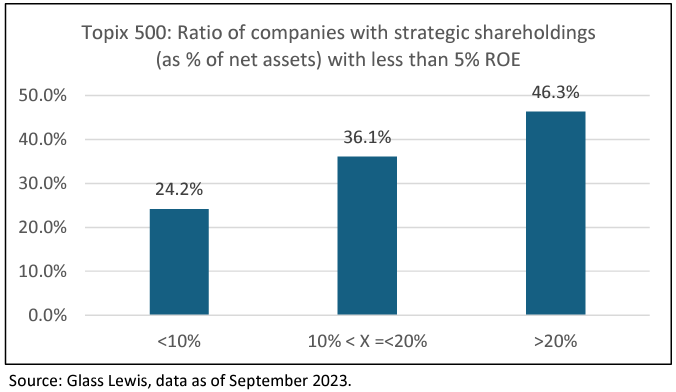

In our view, strategic shareholdings can have a detrimental impact on companies’ capital efficiency. According to Glass Lewis’ research, the proxy advisor firm found that the average 5-year ROE of Topix 500 listed companies fell as the ratio of strategic investments to net assets grew, which we believe is a result of the capital tied-up in strategic shareholdings weighing on the equity component of ROE and thus ultimately reducing the firms’ overall capital efficiency. It is worth noting that analysis conducted by the Tokyo Stock Exchange (TSE) found that the same group of Topix 500 companies had a disproportionately higher ratio of companies with ROE below 8% compared to global peers such as the US S&P500 and Europe’s STOXX600 members, indicating that this unique Japanese capital alliance structure may have contributed to inferior capital returns vis-à-vis global firms that do not generally have these structures.[8]

Governance concerns

Poor financial performance can persist for extended periods at companies that have a high level of strategic shareholders. These friendly shareholders may well have a tacit understanding that they will be aligned with management and vice-versa if there is a cross holding of shares. The result is that there can be a significant block of shareholding, represented by these strategic interests, that will generally not vote against management despite the poor performance. Moreover, when companies continue to see lackluster financial results, investors expect independent directors to play a mitigating role to help management address these issues to ultimately raise corporate value. However, if independent directors hail from the strategic investor, including individuals who have recently retired from the investor firm, this may lead to a conflict of interest between the strategic investor and other minority shareholders where the independent director may prioritize the commercial interest of the strategic investor over other minority shareholders

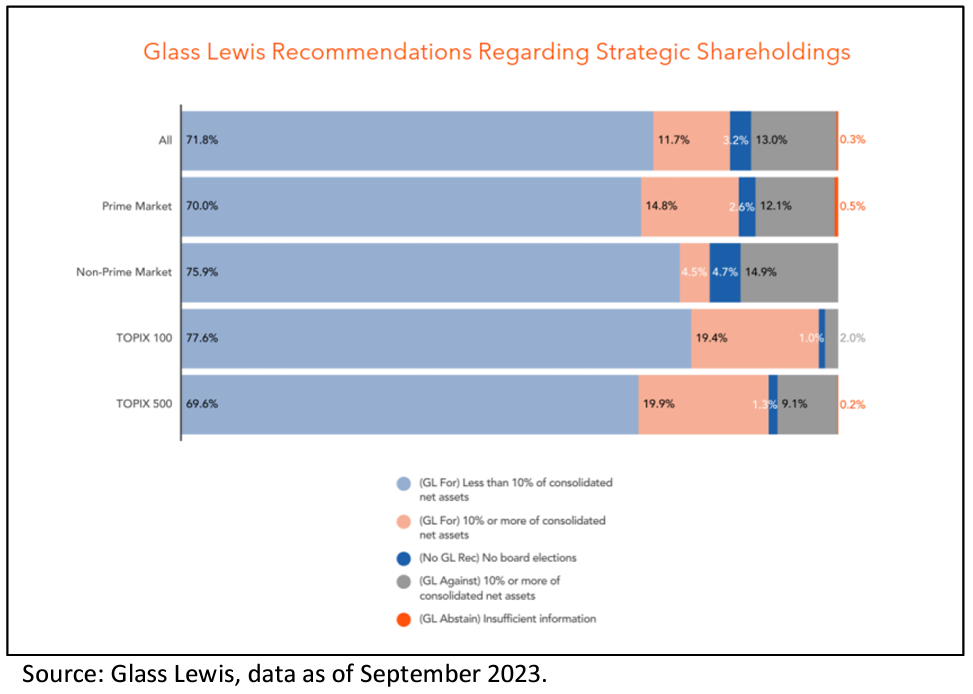

The questionable corporate governance of companies with strategic shareholdings not surprisingly leads to recommendations by proxy advisors to vote against election of directors, with investors voting similarly by their own policies. Last year, across the wider market of the Topix Prime Market of over 1,600 companies, Glass Lewis recommended voting action against the Chairman of the Board of 12.1% of companies and almost 15% of other companies in the non-Prime segments where they held strategic investments equivalent to 10% or more of consolidated net assets. Meanwhile Institutional Shareholder Services (ISS) set a higher threshold of strategic assets at 20% or more of net assets to trigger a recommendation to vote against top executives, usually the President or alternatively the Chairman of the company or a representative director.

Anti-competitive concerns of strategic shareholdings

Another concerning aspect of strategic shareholdings is the impact on competitive behaviour. Companies with strategic equity interests in their customers, and vice versa customers that have strategic equity holdings in their suppliers, are likely to favour these companies in their day-to-day business arrangements. Competitors are thus kept out of these contracts even if they may provide better terms.[9] This anti-competitive behaviour may be negative on shareholder value in not pursuing the best terms from the most efficient suppliers; it is also pernicious on progress of reforms in the relevant sectors and for the economy overall.

In the insurance sector, for instance, the FSA alleged price fixing between general insurance companies citing that the strategic shareholdings contributed to anti-competitive behaviour and ordered the companies to accelerate the unwinding of the holdings. To note, these four insurers are reported to hold 5,900 such investments equivalent to ¥6.5 trillion (US$43 billion, as of February 2024)[10]. Since then, the involved companies have published business improvement plans including targets to reduce the strategic investments to zero over the next several years.

These anti-competitive implications underscore that good corporate governance, including transparent shareholding structures, are essential to foster healthy competition in the relevant sectors and sustained economic growth for the country. Hence it is incumbent on regulators to continue to pursue the unwinding of these strategic shareholdings across the various sectors in the interest of economic efficiency.

Positive regulatory developments

Over the past decade Japanese regulators have addressed this issue through various initiatives such as the Corporate Governance Code that seeks companies to disclose policies on reducing these holdings and an assessment on the benefits and risks of maintaining these investments from a capital efficiency standpoint.[11]

New rules were introduced through a Cabinet Office Ordinance that became effective on 31 January 2019.[12] Strategic shareholding disclosures were enhanced in the Yuho for financial years ending on or after March 2019. These changes form the basis for the disclosure we see today, which increased the number of strategic shareholdings required to be disclosed from the largest 30 to the top 60. The Yuho complements the more qualitative disclosure required in the separate Corporate Governance Reports of companies as mandated by the Corporate Governance Code.

We believe such efforts, including the voting action by investors, have been instrumental in reducing these holdings. The latest “Shareownership Survey” from the Japan Exchange Group (JPX) for fiscal year to March 2023 shows the ownership share of financial institutions in other listed companies falling from a high of around 40% of market capitalisation in the mid-1980s to just 7% by the end of March 2023.[13]

ACGA and investor member recommendations

Given the concerns above, ACGA and the undersigned investors would like through this letter to make some recommendations for advancing the governance of companies with strategic investments. We believe these recommendations will help to improve governance and financial returns of the relevant companies and will be positive for the overall economy. Our recommendations are highlighted below.

1. Policy and implementation

ACGA recommends a general policy of no (zero percent) strategic share holdings. To achieve that end, companies that have strategic shareholdings should adhere to the Corporate Governance Code Principle 1.4[14] and set clear reduction targets appropriate for each company respectively. Reduction of strategic investments should not be through reclassifying these investments as “pure investments”. Indeed, unless a company is an investment holding company, we recommend as a policy that it should not have any company’s securities held as “pure investments”. Instead, the reduction of such investments should be done in the context of maximizing shareholder value and as part of a comprehensive effort to improve corporate governance and capital returns. In cases where the unwinding of strategic shareholdings could potentially impact the supply and demand dynamics of shares trading in the market, we urge companies to take appropriate measures to minimize the negative fallout to existing shareholders.

2. Governance

In keeping with Japan’s Corporate Governance Code Principle 1.4 on Cross Shareholdings, ACGA recommends the board of directors and audit board members play a stronger role in the oversight of strategic shareholdings so as to implement the Principles of the Code more effectively. In cases where a company holds significant strategic shareholdings (for example more than 5% of net assets),[15] we would encourage companies to establish a committee of independent directors and audit board members (Kansayaku) tasked with reviewing such shareholdings, the plans to divest and how reduction targets will be achieved, as well as the use of proceeds within a specific timeframe.

We also recommend that the internal audit department of an issuer be responsible for vetting all contracts and business relationships with investee companies to determine any explicit or implicit agreements between the parties that could give rise to an inference that these shares are being held for strategic purposes by the other party or could give rise to a conflict of interest by virtue of strategic shareholdings. Internal audit should report directly to the committee of independent directors and audit board members (Kansayaku) on this matter, and this committee should scrutinize whether these contracts have been conducted on an arms’ length basis and have followed the issuer’s tender process.

3.1 Disclosure on policy

ACGA recommends improved disclosure on the state of strategic shareholdings. In accordance with the Cabinet Office Ordinance on Disclosure of Corporate Affairs, we reiterate the need for listed companies to provide shareholders with specific and more detailed disclosure in the Yuho of the rationale for strategic shareholdings. Additional to the current requirements, we recommend issuers disclose the existence of any current and historical agreements, either explicit or implicit, with the investee company, to exercise its voting rights, confer a benefit or provide any other support to the investee company and its officers in exchange for investee company’s holding issuer’s shares. The exact nature of any such arrangement should be set out in full, including any vendor/purchaser relationship, services contract, or any other relationship (financial or otherwise), and should indicate its length of existence and how it benefits the company and its shareholders. There should be a declaration by the issuer that any holdings of an entity with which it has such a relationship do not give rise to any conflicts of interest, or potential conflicts of interest, or any inference of undue influence being exerted on the investee company and its officers. If there is no such agreement, or has not been any explicit or implicit, the issuer should be required to make a declaration to that effect in the Yuho in respect of each investment holding.

There should be a declaration by issuers to their shareholders who they know, or reasonably believe, to be holding their stock on a strategic basis, that any divestment by the counterpart would not be met by a loss of benefit or detriment to the shareholder. This would include the loss of any contract, business relationship or any explicit or implicit understanding between the parties. We recommend that this declaration by investee companies be required by the TSE to be provided in the Corporate Governance Report so that it can be made available to all shareholders by the next reporting period.

3.2 Disclosure on governance

ACGA recommends company boards should provide disclosure on how they oversee the strategic shareholding investments, how they raise awareness within business units of appropriate policies in relation to investee companies, and to frame board discussions of strategic investments in context of ROE, return on invested capital (ROIC) and weighted average cost of capital (WACC), and how these factors are represented in key performance indicators (KPIs) of senior management of investor companies and their compensation. This disclosure should be made in relation to the TSE’s March 2023 announced “Action on Cost of Capital-Conscious Management and Other Requests”.

In accordance with the Corporate Governance Code Principle 1.4, companies should have a voting policy and disclose how they vote their strategic shareholdings, including disclosure at the individual investee company and resolution level with the rationale for the vote. This is similar to the required disclosure for institutional shareholders and is good practice for transparency on how the fiduciary responsibility as a shareholder is being exercised. We encourage companies, while they have strategic share holdings, to adopt the relevant provisions of the Stewardship Code and to state this in their Corporate Governance Report. We recommend that the TSE consider to incorporate this into the Corporate Governance Code.

Companies that have sound reasons to maintain strategic shareholdings which they do not plan to reduce should be encouraged to sign the Stewardship Code, just as institutional shareholders do. The Stewardship Code should apply to all relevant shareholders who have a fiduciary responsibility: the vote of the strategic investors is as relevant, if not more so, than voting of institutional shareholders most of whom have much smaller investments in the companies. The engagement efforts and voting action of investors may be less effective if the larger strategic investors in the companies vote aligned to management, do not exercise their fiduciary responsibility and are not required to make similar disclosures as institutional investors. Regulators may thus consider extending the Stewardship Code to companies that have strategic investments as well.

We reiterate that full and transparent disclosures on strategic shareholders is crucial for all shareholders to determine if the board has exercised its oversight role appropriately and thus should be disclosed prior to the AGM to guide shareholders in their decisions on key proposals including the election of board members.

3.3 Disclosure on capital management

ACGA recommends companies undertaking divestment of their strategic investments should articulate their plans for the proceeds from these divestments. We would encourage companies to make this disclosure as part of its Action Plan in response to the TSE’s cost of capital guidelines. Unless a divesting company has good use for the proceeds for specific investments that generate ROE and ROIC higher than WACC, companies should generally return proceeds of divestments to shareholders in the form of special dividends and/or share repurchases when appropriate. Indeed, having these investments with low returns on the balance sheet shift to holding cash from their divestments would not lead to material improvement in ROE. Companies should thus avoid substantial increases in cash and/or financial securities resulting from these divestments.

We trust this letter and our recommendations will prove constructive in helping to enhance governance practices and shareholder value in corporate Japan. ACGA and the undersigned members look forward to discussing these issues further with you.

Endnotes

1In this open letter, we will refer to “strategic investments” in reference to allegiant and cross-shareholdings among companies.(go back)

2“Opinion Summaries Received from Investors in Response to Listed Company Corporate Governance Questionnaire for Investor”, Tokyo Stock Exchange, August 26th, 2008, <https://www.jpx.co.jp/english/equities/improvements/general/tvdivq0000004iib-att/opinions_summary.pdf>.(go back)

3Mark Scher, “Bank-firm Cross-shareholding in Japan: What is it, why does it matter, is it winding down?”, DESA Discussion Paper, February 2001, <https://www.un.org/esa/desa/papers/2001/esa01dp15.pdf>(go back)

4Chisato Haganuma, “Reduction of strategic investments in focus” (translated title), Mitsubishi UFJ Trust Bank, March 2021, <https://www.tr.mufg.jp/houjin/jutaku/pdf/u202103_1.pdf>(go back)

5Mark Scher, “Bank-firm Cross-shareholding in Japan: What is it, why does it matter, is it winding down?”, DESA Discussion Paper, February 2001, <https://www.un.org/esa/desa/papers/2001/esa01dp15.pdf>(go back)

6Federal Reserve Bank of San Francisco, “Japan’s cross-shareholding legacy: the financial impact on banks”, Country Analysis Unit, Asia Focus, August 2009, <https://www.frbsf.org/banking/wp-content/uploads/sites/5/August-2009-JapansCross-Shareholding-Legacy-the-Financial-Impact-on-Banks-august-09-FINAL.pdf>(go back)

7Ibid.(go back)

8”TSE’s Recent Initiatives on Corporate Governance”, Tokyo Stock Exchange, April 2023, <https://www.fsa.go.jp/en/refer/councils/follow-up/material/20230419-03.pdf>.(go back)

9Mark Scher, “Bank-firm Cross-shareholding in Japan: What is it, why does it matter, is it winding down?”, DESA Discussion Paper, February 2001, <https://www.un.org/esa/desa/papers/2001/esa01dp15.pdf>(go back)

10Sora Kitajima and Takanobu Aimatsu, “Japan tells casualty insurers to unwind cross-holdings amid scandal”, Nikkei Asia Review, February 10th, 2024, <https://asia.nikkei.com/Business/Insurance/Japan-tells-casualty-insurers-to-unwind-crossholdings-amid-scandal>(go back)

11Japan’s Corporate Governance Code Principle 1.4: Cross Shareholdings. “When companies hold shares of other listed companies as cross-shareholdings, they should disclose their policy with respect to doing so, including their policies regarding the reduction of cross-shareholdings. In addition, the board should annually assess whether or not to hold each individual cross-shareholding, specifically examining whether the purpose is appropriate and whether the benefits and risks from each holding cover the company’s cost of capital. The results of this assessment should be disclosed. Companies should establish and disclose specific standards with respect to the voting rights as to their cross-shareholdings, and vote in accordance with the standards.” (Japan’s Corporate Governance Code, Tokyo Stock Exchange, June 11th, 2021 (revised))(go back)

12“Corporate Governance Overview 2019”, KPMG, November 2019, <https://assets.kpmg.com/content/dam/kpmg/jp/pdf/2020/jp-en-corporate-governance-overview-2019.pdf>(go back)

13“2022 Shareownership Survey”, Tokyo Stock Exchange, <https://www.jpx.co.jp/english/markets/statisticsequities/examination/p6b22i00000024gs-att/e-bunpu2022.pdf>(go back)

14Japan’s Corporate Governance Code, Tokyo Stock Exchange, June 11th, 2021 (revised), < https://www.jpx.co.jp/english/news/1020/b5b4pj0000046kxj-att/b5b4pj0000046l0c.pdf>(go back)

15We have derived strategic investments at 5% of net assets as an appropriate threshold as the Topix 500 constituents’ median ratio of strategic investments to net assets is 5.4% (as of end-March 2023)(go back)

Print

Print