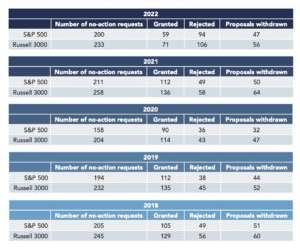

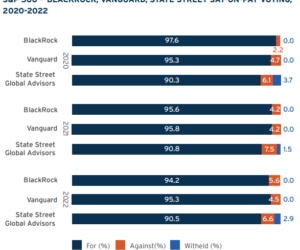

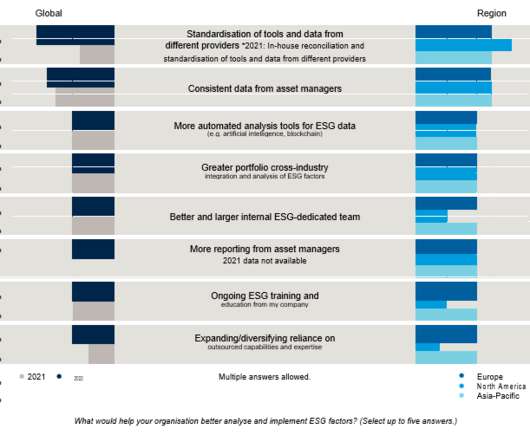

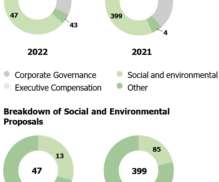

Shareholder Voting Trends (2018-2022)

Harvard Corporate Governance

NOVEMBER 5, 2022

on Saturday, November 5, 2022 Editor's Note: Matteo Tonello is Managing Director of ESG Research at The Conference Board, Inc. Posted by Matteo Tonello, The Conference Board, Inc., Related research from the Program on Corporate Governance includes Social Responsibility Resolutions (discussed on the Forum here ) by Scott Hirst.

Let's personalize your content