Click to Download: Middle Market Private Equity M&A Activity – Q2 2020

Executive Summary

Transaction Volume Shrinks

Only 31 transactions were reported in Q2 2020, bringing the total reported transactions in 2020 to 113.

Size Premium

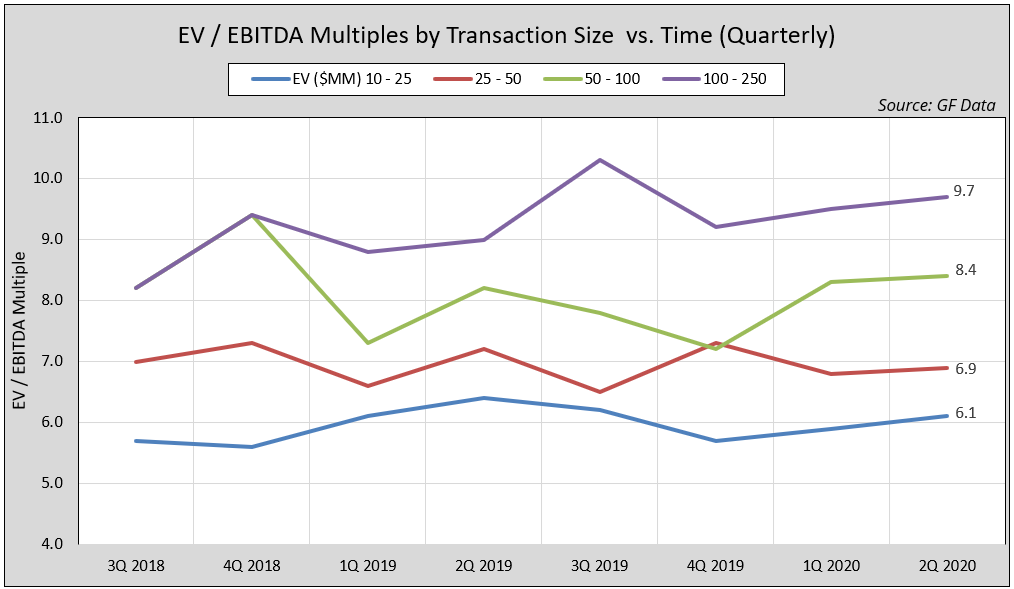

Size became an even greater pricing consideration for the middle market as transaction multiple variances widened for acquisition targets above and below $50 million.

Debt Usage Decline

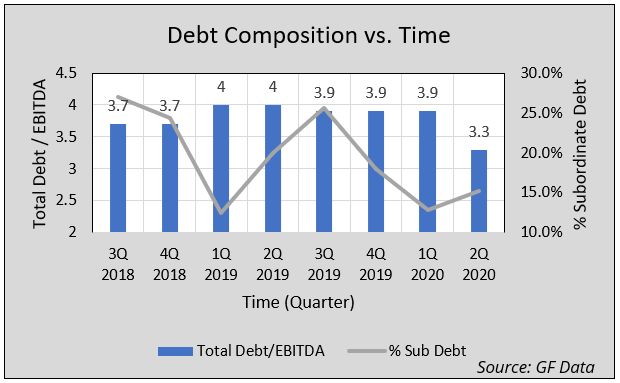

In Q2 2020, total debt to EBITDA fell to 3.3x from 3.9x the prior quarter. This 0.6x decline in total debt to EBITDA was attributed to a decline in senior debt to EBITDA, pushing the percentage of subordinate debt to total debt to 15.2%, up 2.4% from the previous quarter.

Media & Telecom Soars

In the first two quarters of 2020, transaction multiples for the media & telecom industry rose almost 30% to its highest level over the past five years. This was accompanied with substantial increases of transaction multiples in the distribution and manufacturing industries.

Based on our review of GF Data’s latest M&A Report, the reported results for Q2 2020 display a sizable decrease in completed deals, having about 40% of the completed deal volume compared with Q1 2020 and Q2 2019. As the first quarter fully submerged in the COVID-19 pandemic, Q2 2020’s results reveal interesting consequences. Despite the simple average enterprise value (EV) to EBITDA multiple remaining at 7.4x from Q1 2020, total debt dropped to 3.3x, down from the 3.7x – 4.0x range over the previous several of years. The percentage of subordinate (sub) debt to total debt averaged only 14.0% in 2020. This is down from the 2019 average of 19%.

In the first quarter of 2020, average EV/EBITDA transaction multiples increased for the larger companies in the $50 – 250 million enterprise value range and decreased for the smaller companies in the $10 – 50 million range. The increased market uncertainty likely caused a premium to be paid for the larger, and perceived safer, companies. Both smaller and larger companies’ multiples slightly increased in Q2 2020, maintaining the considerable spread in multiples between smaller and larger companies.

Industry Analysis

We analyzed industry average EV/EBITDA multiples of acquisition targets to gain a more in-depth understanding of how the market perceived industry risk and growth prospects as COVID-19 disrupted the marketplace during the second quarter. Approximately 80% of the reported deal volume comprises four industries: manufacturing, business services, health services, and distribution.

The average EV/EBITDA transaction multiple for health care services steeply declined to 7.0x in 2020 from 8.4x in 2019. The health care services industry has been negatively impacted in the short-run by the COVID-19 pandemic, as both practices and patients avoided preventative check-ups and elective treatments. To the contrary, the distribution industry average EV/EBITDA multiple increased to 8.5x, up from 7.0x in 2019. The distribution industry was valued extremely high in Q1 and Q2 2020 as consumer e-commerce presence and demand for deliver-to-door goods grew considerably. The manufacturing industry also increased to its highest average EV / EBITDA multiple over the past five years, up to 7.2x. The technology industry experienced a dip in its average EV/EBITDA valuation multiple to its lowest level since 2016. The retail industry average EV / EBITDA multiple was down from its 2019 high of 9.3x yet remained significantly higher at 8.9x than its 2018 average of 7.5x. The Media & Telecom industry average EV / EBITDA multiple soared to 9.0x in 2020 from its 2019 average of 7.0x. America’s dependence on robust internet connection and digital media and entertainment became even greater as much of the country began working from home and spending more leisure time at home in 2020. Business services industry average EV / EBITDA multiple remained approximately the same over the last five years.

For more information, contact:

The information presented here is not nor should it be treated as investment, financial, or tax advice and is not intended to be used to make investment decisions.

If you liked this blog you may enjoy reading some of our other blogs here.